A Note Beforehand

Before we begin, it’s important to note that planning for your estate can have numerous advantages independent of any tax consequences. As with many financial aspects, it is important to choose strategies, products or services that work for your overall situation rather than making decisions primarily or exclusively on tax consequences. While this aspect is certainly important and should not be ignored as a large part of a comprehensive strategy, there are many good decisions that come without tax benefits and many bad financial decisions that may have certain tax advantages. Make sure that the tail doesn’t wag the dog and that your decisions make sense considering all your objectives.

Common Fees

There are several fees that could be associated with your estate plan, but are those estate planning fees deductible? Most common are the charges paid to attorneys to draft, review and update estate related documents such as wills, trusts, powers of attorney, healthcare proxies, and other documents. These can be paid as the documents are drafted and other services provided or on a retainer basis for those who seek ongoing services.

Effects of Tax Reform

The tax legislation taking effect in 2018 has affected several aspects of estate planning, including if estate planning is tax deductible. Previously most taxpayers deducted their estate planning fees as an itemized deduction as a “miscellaneous expense.” These deductions (which also included tax preparation fees and unreimbursed employee expenses) have been eliminated in the tax reform for tax years 2018 to 2025.

For the tax implication on estates and trusts, consult your own tax and estate planning professionals. Comments here relate to personal income tax returns.

Although this may disappoint some who were hoping to deduct these expenses on their personal income tax return, there are a few reasons why this may not have as great an effect on cost as it may seem. Even when estate planning fees were deductible, it was only for expenses related to the production of income, not for all estate planning fees in general. All miscellaneous expenses were also subject to a floor of 2% of Adjusted Gross Income or “AGI.” This means that to use the deduction, the total amount of miscellaneous expenses would have needed to be more than 2% of your total income after certain adjustments (retirement account contributions, for example) leading to AGI. You would have also needed to have total itemized deductions that exceed the standard deduction, which is why the loss of this deduction may affect even fewer taxpayers than would have otherwise been the case.

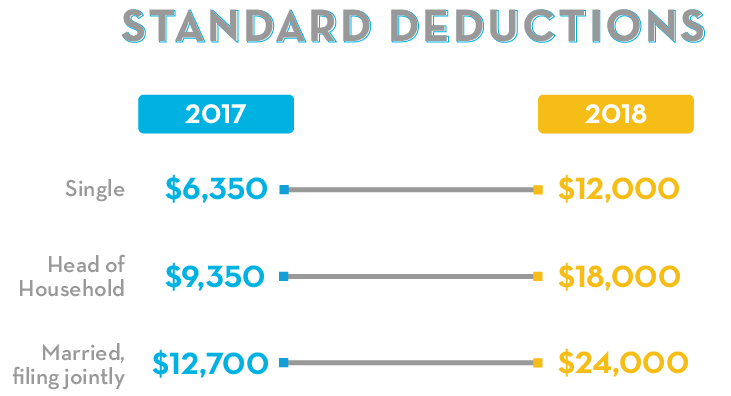

Although certain deductions have been reduced or eliminated by recent tax legislation, the standard deduction has also been increased. Compare the standard deduction for each filing status for 2017 and 2018 below:

Since a taxpayer can only use the standard deduction or itemize, there are likely fewer people that would have been affected by the loss of this deduction.

Although tax reform often has the goal of reducing taxes, simplification of the process is also a common goal. You may not have as many deductions, although your overall rates may lead to lower taxes paid in general. This is similar to what happened in the 1987 tax reform during the Reagan administration. Rates were lowered but certain deductions were eliminated. You could previously deduct not only your mortgage interest but income on consumer loans including credit card debt. That said, the benefits of estate planning could be enormous independent of tax-deductible fees.

Implications to Consider

Many types of estate planning strategies have tax implications. While the estate tax will also affect fewer people under tax reform, there are still monetary advantages to estate planning such as advanced charitable gifting strategies, many of which are tax-advantaged. Avoiding probate is also a significant cost benefit for many.

Speak with Professionals

As you can see, the topic of Estate Planning is complex and so are the tax implications. This may be an appropriate time to state the importance of making sure that you are working with quality professionals and that they are coordinated with one another on related issues. If your insurance agent offers a policy that is tax-advantaged, make sure your tax professional is aware of the implications. Your estate planning attorney, for example, may need to know when new investment accounts are opened or existing accounts transferred to weigh in on how beneficiaries should be listed or if certain accounts should be held in a trust rather than by an individual.

Many aspects of your financial life relate to one another. You may have specialists for tax issues, estate planning, insurance, retirement planning, investments and other areas. You may wish to consider working with a financial planner whose objective is, in part, to make sure these areas are coordinated well with one another, taking a big picture approach to your financial situation.