Ready for a quick Jeopardy pop quiz?

Question:

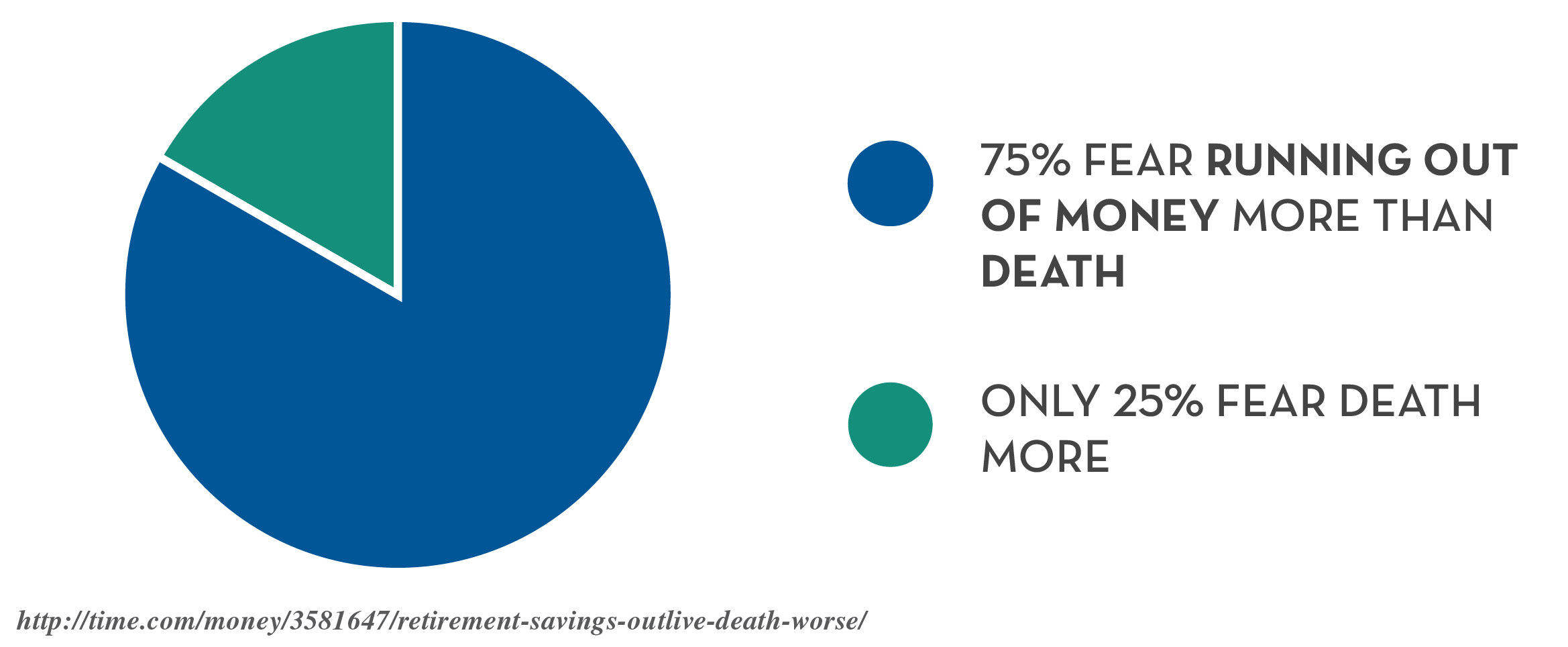

Studies have shown that three out of four Americans fear “this” more than death.

Answer:

What is “running out of money in retirement.1”

This statistic saddens me, but it also reinforces my belief that while money can’t buy happiness, not having money can make people miserable. So, what exactly can you do to improve the odds your golden years won’t involve having to hock the family silver?

Here are three tips aimed at minimizing your chances of running out of money in retirement.

1) Get a Financial Plan

For starters make sure to get a financial plan in place. Do this sooner rather than later. Retirement is like a long drive: there are several ways to get where you are going, but if you haven’t identified your destination in advance, chances are you might not like where you wind up.

When it comes to your financial plan, you should be as specific as possible. To continue the driving analogy, “Santa Barbara” is a clearer destination than “Central California,” but “915 Garden Street, Santa Barbara” is even more precise. The more detailed you are when defining your destination, the better odds you’ll get there.

2) WIN: Whip Inflation Now

Some of you may remember the 1970s, Gerald Ford inspired movement to “Whip Inflation Now.” Back then, of course, inflation was running rampant; subsequent decades have witnessed much lower levels of price increases. But nevertheless, once you have saved enough, perhaps the greatest threat to your retirement is inflation.

Historically, inflation in the U.S. has averaged around 3% annually. This may not sound like much, but over the course of thirty years, 3% annual increases mean that what used to cost a dollar now costs $2.43. To put it another way, if you currently live on $100,000 a year, thirty years from now you will need $243,000 annually just to live the same lifestyle.

While thirty years might sound like a long time, a 65-year-old couple has a 45% chance that one of them will live into their 90s.3

So, how can you combat inflation? One important step is to avoid becoming overly conservative with your investments.

To keep up with inflation and grow the purchasing power of your money, you need to own assets with higher expected returns. That doesn’t mean you should load up on penny stocks or start day trading your account. You shouldn’t completely abandon higher growth, higher volatility assets either. Adding bonds and other safe investments to your portfolio will protect against market volatility and provide income for your shorter-term needs. But stocks, real estate and other growth assets provide funds for later in retirement.

Ultimately, in retirement, as during your working years, a well-diversified mix of stocks, bonds and other asset classes makes sense for most people.

3) Turning Your Portfolio into a Paycheck

One of the key challenges in retirement is how best to distribute your assets. Think about it. All your life you have worked for a paycheck. In retirement, the goal is simply to recreate that paycheck from your investment portfolio.

This can involve tasks such as setting up monthly distributions, deciding which account to distribute from, maximizing the tax efficiency of your withdrawals, etc.

But perhaps the most important consideration when turning your portfolio into a paycheck is simply this: how much of your portfolio can you withdraw each year without running out of money?

There are a number of theories on this, and the short answer is, “It depends on your personal financial plan.” To keep things simple it’s fair to say that if you are planning to withdraw much more than 4% of your portfolio each year, you’re meaningfully increasing your odds of running out of money.

So, if you want to figure out if you have enough saved for retirement, here’s a good exercise:

Step 1: Calculate your annual spending

Step 2: Adjust that amount for inflation between now and the year you plan to retire. That will give you your spending for year one of your retirement

Step 3: Subtract any “other” income sources you’ll have coming in (Social Security, pension, employment, etc.)

Step 4: Whatever is left is the amount you will need to withdraw from your portfolio in the first year of retirement

Step 5: Divide that withdrawal amount by 4% – that will give you your “number,” which is the amount you should have in retirement savings

Step 6: Are you on track? Awesome! If not, at least now you have a clearer image of your ultimate destination and can begin to take corrective measures before it’s too late

Start Planning Today

There you have it; three simple tips aimed at making sure you don’t run out of money in retirement. Remember, it’s important to take action sooner, rather than later if you sense you might not be on track. Spending less, delaying retirement, getting a part-time job, or shifting your investments may all form part of the eventual solution, but the bottom line is that the sooner you implement corrective actions, the less draconian those steps need to be.

Running out of money is a scary proposition, but proper retirement planning and preparation can help allay those fears and set you on the right course.

Let’s end with one more Jeopardy quiz to remind you why you’re hoping to retire:

Question:

Studies have shown that nine out of ten retirees are “this.”

Answer:

What is “happy.2”

Sources:

1http://time.com/money/3581647/retirement-savings-outlive-death-worse/

2https://www.cbsnews.com/news/the-extraordinary-happiness-of-retirees/