As 2023 draws to a close, let’s step back and consider what dominated headlines in the last twelve months. Though markets and the economic backdrop remained volatile, 2023 was generally a better year than its predecessor. Inflation and the Fed continued to dominate headlines, though they often shared the news cycle with political developments at home and abroad.

Here’s a brief recap of some of what we focused on last year.

Inflation

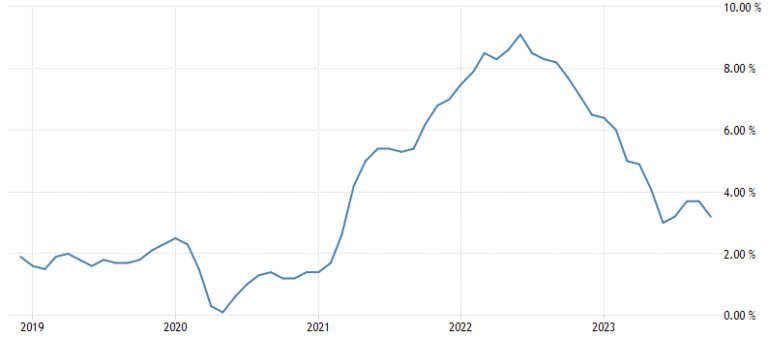

As it has for the past several years, inflation and its impacts dominated financial markets in 2023. Overall, the news was positive, as inflation readings moderated from 2022’s scorching levels.

Consumer Price Index (CPI) – 5 Years thru November 2023

Source: US Bureau of Labor Statistics.

While inflation has moderated over the past 18 months, levels remained stubbornly high for much of the year, and a late summer jump prompted a bout of market volatility. The “stickiness” of inflation led to concerns about monetary policy, and Federal Reserve Open Market Committee meetings were closely monitored, as were each and every pronouncement from a Fed official.

Interest Rates and the Fed

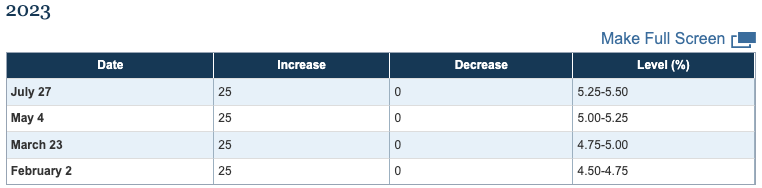

Speaking of the Federal Reserve, the Federal Open Market Committee (FOMC) increased interest rates at four of its meetings, eventually bringing the target Fed Funds rate to 5.25%-5.50%.

FOMC Rate Increases

Source: The Federal Reserve.

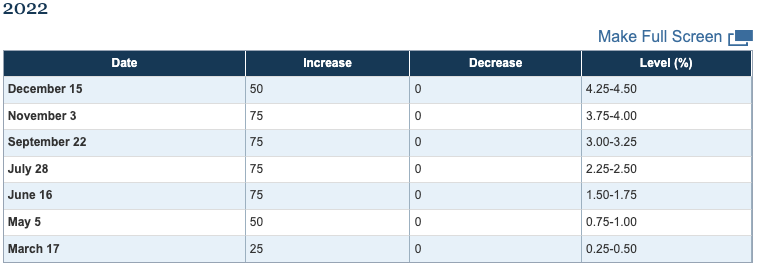

As the Fed tightened monetary policy more than generally expected, interest rates increased across the economy, leading to continued volatility in the bond market. However, the higher interest income bonds now offer helped offset price declines, and a Q4 rally in bond prices led to generally positive returns in the bond market.

The Magnificent 7

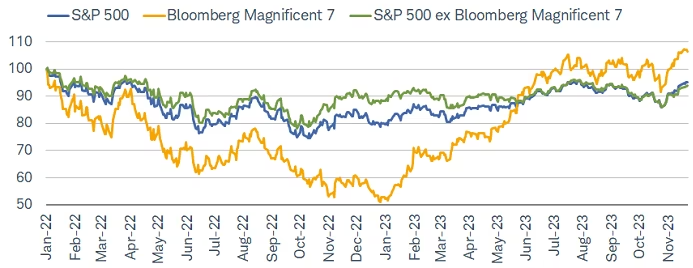

Stock markets generally moved higher in 2023, with the S&P 500 rallying more than 20% as of December 11th. That top line performance occurred despite market turmoil in the spring, as several bank failures prompted a mini-financial crisis. Markets soon recovered though, and indexes were mostly higher on the year.

One striking aspect of 2023’s market rally was the dominance of a small subset of companies. In particular, the “Magnificent 7” drove much of the market’s returns. These seven companies (Apple, Microsoft, Amazon, Meta, Nvidia, Alphabet, and Tesla) are among the largest companies in the world, so their stock price movements have a disproportionate impact on market indexes. While 2023 was a great year for these companies, it’s important to remember that stocks don’t move upwards in a straight line. In fact, these market leaders were actually last year’s laggards. The result is that an investor that bought these 7 companies, and one that bought the S&P 500 without these 7 stocks, both would have achieved approximately the same return over the past 2 years. However, the investor holding only these 7 stocks would have experienced a much bumpier ride.

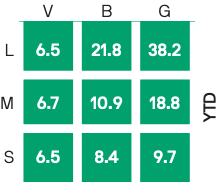

Different Types of Stocks

The stock market can be sliced and diced in a number of ways, but two of the most common are to classify stocks by:

- Small or Large

- Growth or Value

As market cycles fluctuate, sometimes larger companies (think McDonalds), outperform smaller companies (think Shake Shack.) The same is true with value stocks (think Proctor & Gamble) and growth stocks (think Amazon). While 2022 saw value outperform, 2023 saw a shift, as growth stocks (and particularly large growth) meaningfully outperformed less expensive stocks.

To a large degree this outperformance is a result of the Magnificent 7 we discussed above, because those companies fall into the “large” and “growth” categories. In 2022, these stocks did poorly, and which helped growth stocks underperform. That trend reversed in 2023.

While we don’t know what type of stocks will do best in 2024, it is important to note that historically value stocks have outperformed growth stocks, and small companies have outperformed large stocks. That historical precedence, combined with the somewhat stretched valuations of large growth companies, could mean that small and value companies are poised for a rally.

Political Turmoil at Home and Abroad

2023 was another year of geopolitical turmoil, both in the United States and overseas. In the US, Congress played a game of musical chairs with the debt ceiling last spring, threatening a debt default. That situation was rectified as cooler heads prevailed at the 11th hour. A similar story played out in the fall, as a government shutdown appeared imminent before a resolution was found. Overseas, the war in Ukraine continued, and instability in the Middle East escalated.

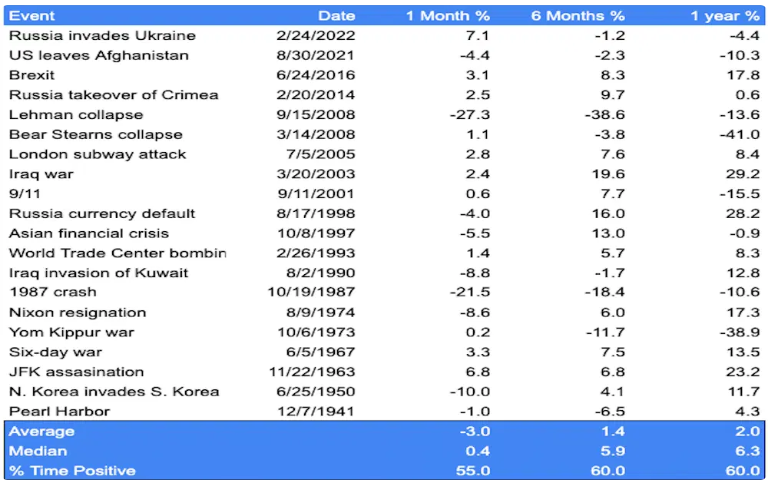

As a general principal, it is important to disassociate geopolitical developments from their market impact. The table below looks at a number of important geopolitical and macroeconomic events from the past eight decades, and the fact is that there is no real pattern to subsequent market performance.

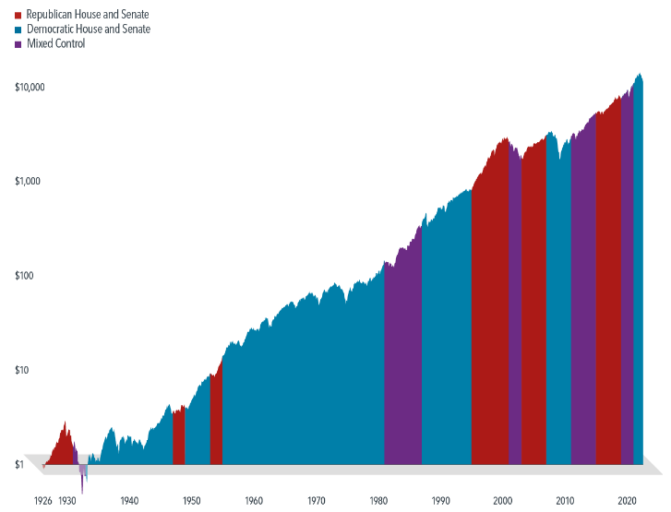

Finally, as we enter an election cycle in the United States, it is important to realize that markets have generally moved higher under both Republican and Democrat regimes.

Hypothetical Growth of $1 Invested in the S&P 500 Index & Party Control of Congress (January 1926 – June 2022)

The bottom line is that markets generally performed well in 2023, despite political and economic uncertainty. You’ll have to wait until we publish our 2024 outlook to see what we expect next year, but by way of preview, if you expect an end to uncertainty, you might want to be prepared to be disappointed.