2023 saw political strife, a regional bank crisis, Fed rate hikes, and worries about an economy that might be either too hot (inflation) or too cold (recession.) Yet despite it all, markets generally posted positive returns, with the S&P 500 ending 2023 up more than 25%, while the MSCI EAFE Index rose more than 18% and the Barclays Aggregate Bond Index was up more than 5.5%.

Now, as the calendar turns to 2024, investors are focused on many of the same issues as last year, while some new questions are also arising. Here’s a look at some of what we think will be on investor’s minds in the year ahead:

Question: Is the economy too hot, too cold, or just right?

Answer: Investors worry about both an economy that is too hot (prompting high inflation) or too cold (causing a recession.) Indeed, one of the main stories of 2023 was whether the Federal Reserve could reign in inflation without slowing the economy so much that it tips into recession. So far, the Fed seems to have engineered a “just right” economic slowdown, but market participants will continue to focus closely on this in the year ahead.

US Consumer Price Index (CPI) – 2014-2023

Question: Is the time finally right for bonds?

Answer: Following two consecutive years of losses, high quality bonds finally produced positive returns last year, with the Barclays Aggregate Index ending 2023 up approximately 5.50%. If inflation continues cooling and the Fed remains on pause (or lowers rates), the stage could be set for another positive year of bond returns, particularly given relatively attractive starting yields. Remember, income is a key component of bond returns, and yields currently sit near the top end of their multi-year range. Of course, investors will be watching closely for inflation that is stickier than expected or a less accommodative Fed, either of which could reverse the recent rally in bonds.

US Treasury Yield Curve

Question: Is the dollar in decline?

Answer: While we don’t know whether it will trend higher or lower in 2024, we do think the dollar will remain the world’s premier currency for the foreseeable future. Although the greenback softened in 2023, it remains near multi-year highs. Furthermore, there aren’t any logical candidates to take the dollar’s place, as every other potential contender has its own issues. For instance, what if a group of large emerging economies issues its own currency? This group, known as the BRICs, may launch a currency someday. But even if they do, would you rather own the U.S. Dollar, or a currency backed by China, Russia, Ethiopia, and Iran (among others)?

BRICS

Note: BRICS is an intergovernmental organization comprising Brazil, Russia, India, China, and South Africa. It was formed in 2010 by the addition of South Africa to its predecessor called BRIC. In August 2023, at the 15th BRICS Summit, South African President Cyril Ramaphosa announced that Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates had been invited to join the organization, however Argentina’s incoming government is expected to decline the invitation. Full membership is scheduled to take effect on 1 January 2024.

Question: Why don’t I just invest in U.S. tech stocks since they did so well in 2023?

Answer: Well for starters, just because something did well one year, it doesn’t necessarily mean that performance will continue. In fact, while U.S. tech stocks outperformed in 2023, the sector was a major laggard in 2022. Looking at performance over the past 24 months, tech and non-tech stocks have produced similar total returns, but tech has had much more volatility.

Mag7 From Drag to Dominance

Note: Data indexed to 100 (base value = 1/3/2022). An index number is a figure reflecting price or quantity compared with a base value. The base value always has an index number of 100. The index number is then expressed as 100 times the ratio to the base value. The Bloomberg Magnificent 7 Index is an equal-dollar weighted equity benchmark consisting of a fixed basket of 7 widely-traded companies (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, Tesla.) Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results.

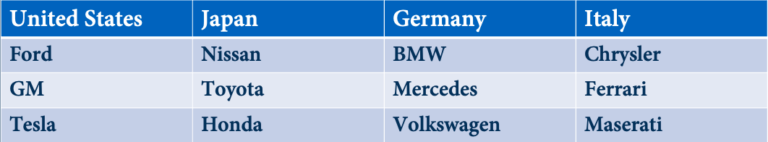

Question: Are some parts of the market cheaper than others?

Answer: Last year’s rally in large growth stocks (where Big Tech is concentrated) led to somewhat stretched valuations, at least according to historical norms. However, 2023’s relative underperformance of small and value companies (which had outperformed in 2022) means that they still feature attractive prices. Valuation alone doesn’t tell the full story of what will happen in the year ahead, but given recent market movements, it might make sense to review your overall portfolio allocation to identify what sectors of the market you are currently over or underweight.

Relative Prices Vary (Current P/E as % of 20-year avg. P/E)

Note: All calculations are cumulative total return, including dividends reinvested for the stated period. Since market peak represents period from 2/19/2020 to 9/30/2023. Since market low represents period from 3/23/2020 to 9/30/2023. Returns are cumulative returns, not annualized. For all time periods, total return is based on Russell style indices except for the large blend category, which is based on the S&P 500 Index. Past performance is not indicative of future returns. The price-to-earnings is a bottom-up calculation based on the most recent index price, divided by consensus estimates for earnings in the next 12 months (NTM) and is provided by FactSet Market Aggregates and J.P. Morgan Asset Management. Guide to the Markets – U.S. Standard & Poor’s, J.P. Morgan Asset Management.

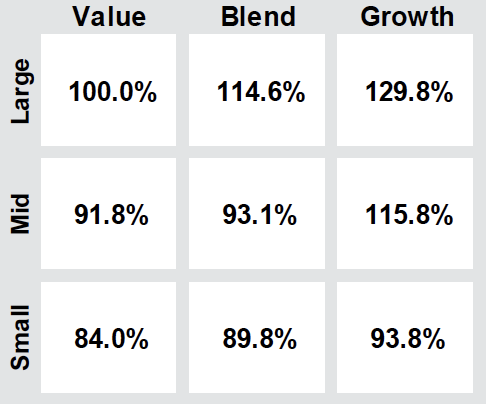

Question: Will international markets outperform the USA in 2023?

Answer: We don’t know what markets will do best next year, but following a long run of underperformance, international market performance has improved recently. This is not surprising, given attractive valuations in many global markets. Plus, U.S. and international stocks tend to rotate leadership across market cycles:

Cycles of Outperformance

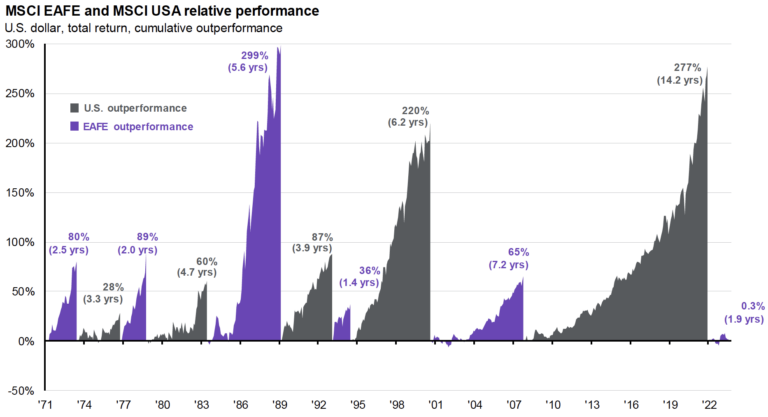

Question: But why would I even want to invest in foreign countries?

Answer: It is important to remember that ultimately, you invest in companies, not countries. For instance, if you wanted to invest in the auto industry, you could stick with the U.S. and buy Ford, GM, and Tesla. Or you could expand your investible universe to include Japan, and buy Nissan, Toyota, and Honda. Expanding further, by including Germany, you’d have access to BMW, Mercedes, and Volkswagen, and with Italy, you could buy Fiat Chrysler, Ferrari, and Maserati. So, the bottom line is that the world is full of great companies, and by investing globally you get to access all of them:

It’s About Companies, Not Markets

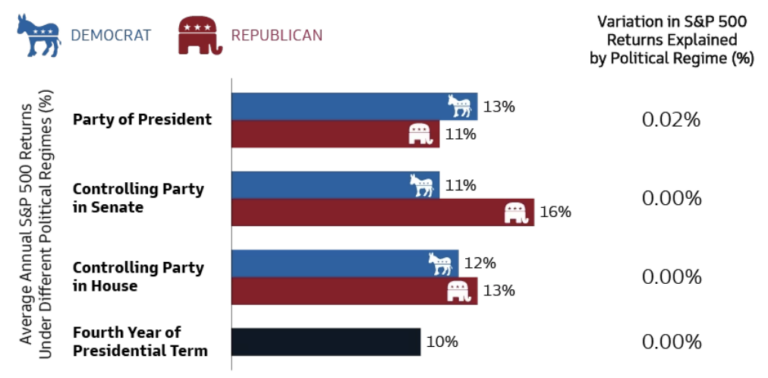

Question: Looking at the U.S., should I already be worrying about the election?

Answer: The outcome of the 2024 presidential and congressional elections will no doubt be important for a variety of reasons. However, you should be aware that markets have generally moved higher under the leadership of both Republicans and Democrats:

Another Election (1930-2022)

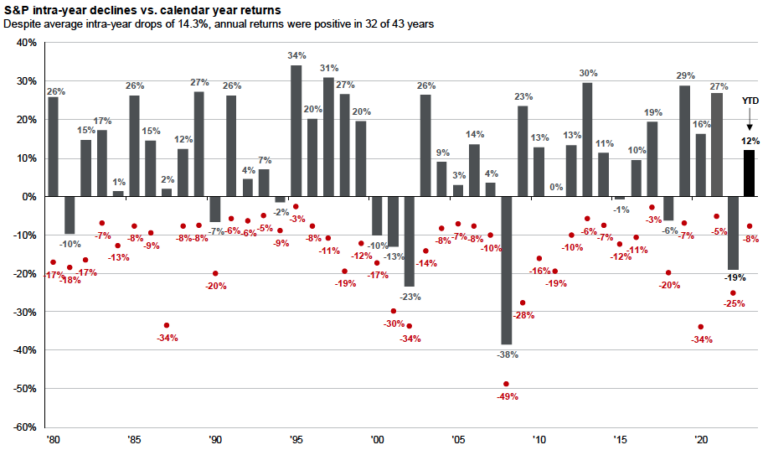

Question: Should I be worried about a stock market decline?

Answer: The reality is that the stock market falls at some point every year, despite the fact that market returns are positive approximately 70% of calendar years. So, volatility should be your expectation rather than a surprise. That is why you need to determine an appropriate asset allocation combining stocks with other asset classes. Then, when markets fluctuate, which they inevitably will, you’ll be prepared to stay the course and await an eventual market recovery:

Average Returns and Intra-Year Declines

Note: Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2022, over which time period the average annual return was 8.7%.

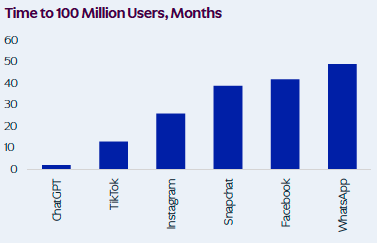

Question: Is AI taking over? If so, how should I invest in it?

Answer: Artificial Intelligence (AI) took the world by storm in 2023, driving the stock price of companies like Nvidia higher. Going forward, it seems clear that AI is going to play a significant role in many people’s personal and professional lives. However, just because an industry survives and thrives doesn’t mean that it’s easy to pick the winners. Consider the auto industry, which has clearly been successful over the last century or so. But according to Wikipedia, there have been approximately 3,000 car companies in the United States during that time, of which only a handful have survived. The Internet underwent a similar phenomenon in its early days, with many high-flying companies crashing and burning in the 1990s and early 2000s. The bottom line is that while it might be obvious to predict AI’s success, forecasting AI’s stock market winners might not be so easy:

AI Takes Over

So, there you have a small sampling of some of the questions we think investors will be asking in the year ahead. There will undoubtedly be others that spring up along the way, Donald Rumsfeld’s “unknown unknowns” if you will. But one thing is for sure, 2024 promises to be an interesting year!