Are annuity contracts a good fit for your retirement? As with so many financial decisions, the answer is, “it depends.” It depends on your age and your needs. Let’s dive into understanding annuity retirement pros and cons to help you decide if an annuity is the right solution for a portion of your retirement income.

What is an Annuity?

“Annuity” just means a series of payments. But when you hear about an annuity, you’re usually hearing about an annuity contract with an insurance company. And it’s important to understand what exactly annuities are: you purchase a contract from an insurance company that will, at some point in time, provide an income stream. That could either be as soon as you buy it, in the case of an immediate annuity or at some point later down the line, in the case of tax-deferred annuities. There are also different ways to calculate your account’s value. Depending on what type of contract you have, you’ll know how the value of your account, and maybe how the deferred payments will work over time.

Types of Annuities?

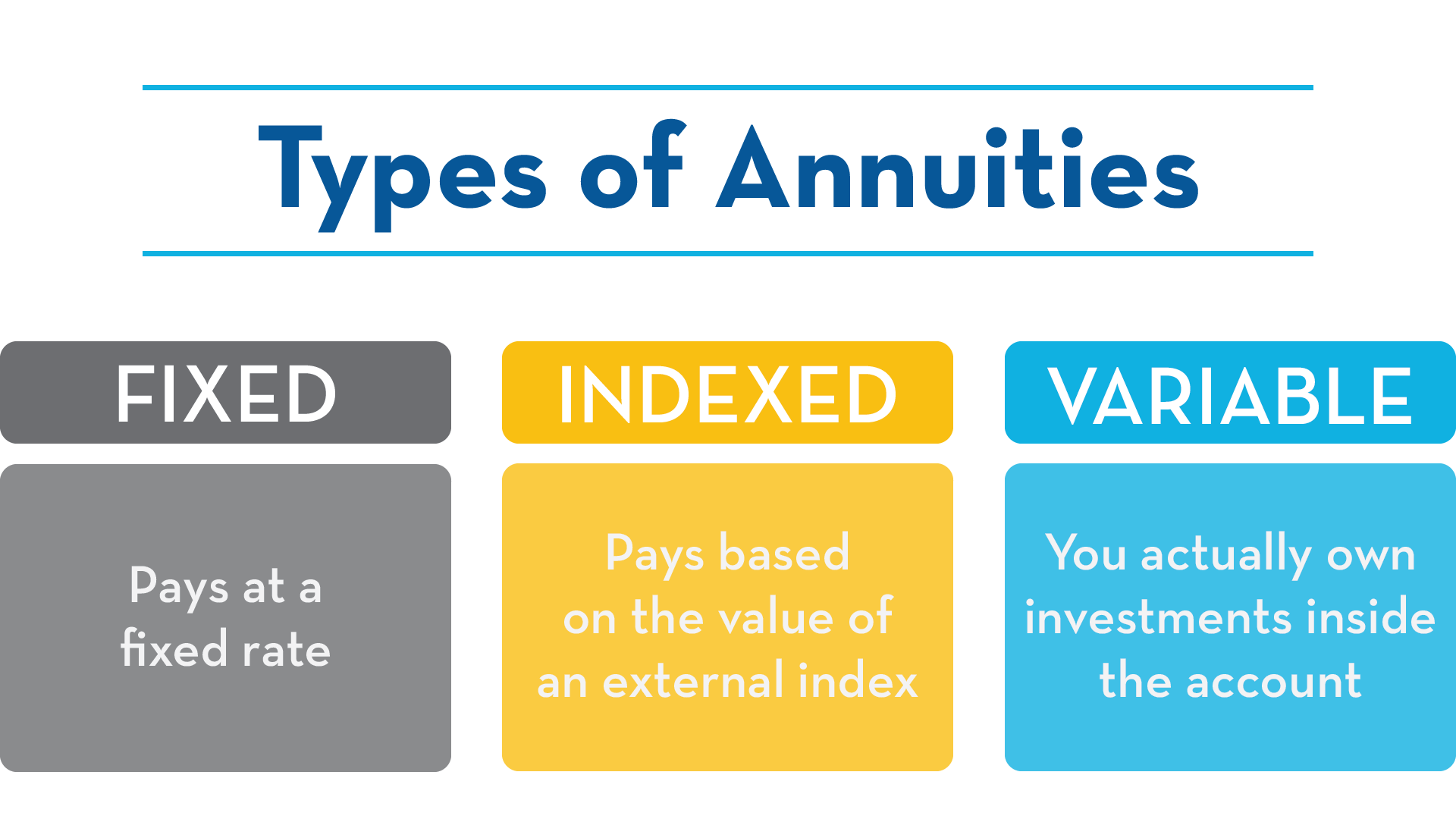

The 3 main types commonly seen are fixed annuity, fixed index annuity, and variable annuities:

• Fixed annuity: pays at a fixed rate.

• Fixed-Indexed Annuities: pays based on the value of an external index, like the S&P 500 stock market index. You don’t actually own what’s inside the account, it’s just determining the crediting method of the contract.

• Variable Contracts: you actually own investments inside the account.

All three of these annuity types function differently, and investors should make sure that you understand which type they are buying. Not only are there three different types of annuity contracts, but everybody’s experience might be different. We could buy the same annuity from the same insurance company and both have different experiences because we select different features. There also might be different payout amounts for different ages. Understand that this is a contract, rather than a commoditized item like an ounce of gold or a share of stock. Make sure you know exactly what you’re getting before adding an annuity to your retirement plan.

The Pros

Guarantees: One of the most attractive advantages of annuities, for many people, is the availability of guaranteed income. I’m going to tell you right up front: this is also a disadvantage. There are availabilities for guarantees in annuity contracts, but people frequently misunderstand them. It’s often related to the amount of income that you receive, or possibly the benefit that your beneficiaries may receive. It usually does not reflect the contract value, in the case of variable annuity contracts. We’ll talk about a little later on.

Riders: Another advantage of an annuity is a feature called riders, which are additional bells and whistles that the contract can provide that allow you to customize the account. One person that purchases an annuity contract might select a couple different riders, and the next person decides not to – their costs will be different because an income rider comes at a fee. So, don’t just go down the list and choose every single one, because you’ll end up with a very expensive contract. We’ll discuss that as a disadvantage as well.

Tax perks: One of the other advantages for people with non-qualified money – that means money outside of retirement accounts, just regular taxable money – are the tax features of annuity contracts. You get deferral of your growth, which means you do not pay taxes on the growth until you’re actually taking money from the account. Once that does happen, a certain amount of the money that you receive from the annuity contract will be considered growth or income, which you do pay taxes on, and the rest will be considered a return of your premium. You’re just getting your money back, and you don’t pay tax on that part. This can be an advantage when you’re receiving income from an annuity contract.

QLAC (Qualified Longevity Annuity Contract): Another very unique situation that can be an advantage for some is the QLAC account or Qualified Longevity Annuity Contract. If you have a lot of deferred money in traditional IRAs, for example, and you’re concerned that your Required Minimum Distributions may be higher than you would like them to be, which may negatively affect your tax situation. You may want to consider a QLAC contract. QLACs will not be subject to Required Minimum Distributions until you take the income at a later point in time. This is a unique, one-off situation, and this does not affect all annuity contracts. This is a specific situation that you should examine in full to see if it relates to you before purchasing a QLAC.

Hybrids: Another option which is kind of a one-off unique situation is the opportunity to purchase hybrid contracts, where one type of insurance product might be melded with another type of insurance product. For example, your annuity might have certain features related to long-term care or critical illness. This will vary substantially, depending on from which company you purchase the contract, and in which state you reside. The company might offer this feature on one of their annuity contracts, but they may not have approval for that particular contract feature in certain states. Be sure to do all of your research, and make sure that you understand the full market of opportunities before you make your selection due to that future.

Spousal Income: Another advantage of an annuity contract is it’s an efficient way to provide income for a spouse later on. If your spouse doesn’t have the inclination or desire to manage their account for income later in life, a one-and-done annuity solution that gets it out of the way might work for you. It might not provide the best return, but it could be an efficient and convenient way to ensure that a spouse has a survivor benefit after you pass.

Government Benefits: There is another important advantage that’s also a disadvantage, and that is using one of these contracts to ensure that you qualify for certain government benefits. Benefits vary substantially from state to state so we won’t cover them all, but some benefits that you may be attempting to qualify for include: wanting to know how much money you’re making and how much money you have. They might not count certain things, like the amount up to certain limits that you have in home equity or annuity contracts, for example. If this is the case, make sure that you’re not purchasing a contract just for that reason. It could end up doing more harm than good by being a bad fit as an investment or a potential source of retirement income later on. Make sure that if you are going down the path of purchasing something based on the availability of an external benefit, that you’re at least getting a decent product, and not buying something that is a bad fit just to receive that benefit. Again, please examine your own specific situation, because this is a very broad topic that will vary depending on what state you reside in.

The Cons

Fees: Annuity contracts can cost a lot. It’s up to you, depending on your situation, to decide whether you’re getting adequate value for the cost. There are commissions, mortality fees and expenses, adminitrative fees, annual maintenance costs, and possibly even transaction costs. There are a number of different fees that might be in any annuity contract that you should fully examine before making your decision. A detailed description of the charges contained in an annuity can be found in the prospectus.

Surrender Periods: This is a part of the larger, overall disadvantages of illiquidity and inflexibility. A surrender period is the amount of time that you need to own the contract before you can get out without paying a fee. You might have owned your annuity contract for three years and say “Hey, it’s been fun. I’d like to take my balance and go elsewhere.” But you might have to pay a fee to get out, which could erode a large portion of the gains you might have accumulated in the contract. Make sure you understand, before you get in, what timeframe requirements you’ll be responsible for meeting before purchasing that contract.

Guarantees: Remember that “Guarantees” was in the advantage section? It’s also here in the disadvantage section because they’re often misunderstood. Here’s a common misunderstanding of an annuity guarantee: you purchase, let’s say, a variable annuity contract. You put in $100,000. At some point down the road, the market isn’t doing great, and it’s down to $80,000. You heard the sales agent used the term “guarantee” at some point. You think to yourself, “I have a guarantee, I’m OK.” But you don’t usually have a guarantee that relates to your principal balance. Be sure that you understand what it is that your guarantees relate to in the contract, rather than assuming that they apply someplace that they do not.

Confusing: Annuity contracts are difficult to understand. They’re huge. They’re often over 20 or even 50 pages, in some circumstances. In addition to the actual application materials, the contracts have a lot of disclosures, your investment selections, and all the boilerplate text. It’s tempting to just glaze over this, but you want to read the entire contract, because remember: even if you get the exact same contract that your neighbor is raving about, that doesn’t necessarily mean that you’re choosing the same features, or that your payout is the same, based on your age. Or that other features haven’t changed since that contract was marketed, perhaps under a similar name from the same company. Make sure that you understand the full picture before making that decision to purchase the contract.

Low Returns: Coupled with the generally high fees is the potential for low returns. You might make more in a similar product elsewhere due to the fact that the high fees often will offset the returns that you have made. Look at the total picture, including the cost of ownership.

It’s Not a Swiss Army Knife: People tend to use annuities as a do-everything tool: you can use it for growth then, later on, you can use it for income, maybe you add some bells and whistles by adding riders to the account that do other things. However, this is not the only solution to every aspect of your financial life, even if it’s a good fit for you for a particular need. Make sure that the other financial aspects that you want to have in order are well served, by whatever means necessary. For example, don’t put your entire balance into an annuity that you’re intending to use for income, while not maintaining an emergency savings account in retirement. You might have an adequate income going forward, but what would you do for emergency expenses or one-off large lump sum expenses? Be sure that you’re taking this into account as it relates to your total financial needs.

To Summarize

As you can see, there are a lot of pros and cons of annuity retirement income. Only you can tell if it’s a good fit for you after you fully review all the pros and cons.

I’m going to leave you with a joke that’s old enough to vote: an economist is walking down the road, sees a friend of his, and the friend asks, “How’s your wife?” And the economist says, “Compared to what?” The reason this joke has been around so long is that it relates to almost every financial situation. You’re probably not saying to yourself, “I have this balance of money. I’m going to read this article. If I think that there are more advantages, I’m going to buy an annuity. If I think there are more disadvantages, I’m not going to buy an annuity.” You probably have a balance that you’re considering investing in some way, and you’re trying to find the best option. Even if you think an annuity contract that you’re examining is a good fit, that doesn’t mean it’s necessarily the best option for you. Depending on your objectives, there might be other products on the market that worth considering. Maybe they do a better job than the annuity contract. Maybe they do a good job at a lower expense. This is extremely important – if you do decide to buy an annuity contract, you’re going to have it for a long time.

For assistance deciding if an annuity contract is right for your specific retirement situation, contact us at Pure Financial Advisors.