The U.S. national debt is a hot topic, especially with the U.S. elections this year. Currently, the debt is nearing $35 trillion, which is over 120% of the country’s GDP and continues to rise rapidly. The amount almost sounds comical. It’s hard to comprehend such a large number in our minds. The government is spending as if the economy is in a recession, raising concerns about the impact on ordinary people, taxpayers, savers, and investors.

Total debt has risen to about 120% of U.S. GDP

Source: Charles Schwab, Deficits, Debt and Markets: Myths vs. Realities, June 2024.

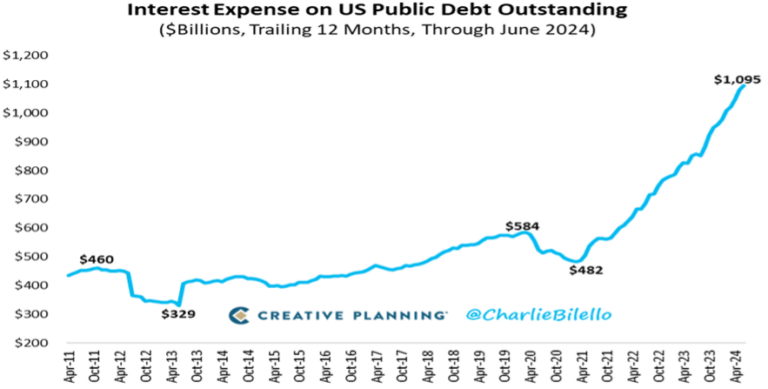

In the past four years, the national debt has surged by $11 trillion, equivalent to 40% of the U.S. economy’s GDP. To put this in perspective, it took 220 years for the U.S. to accumulate its first $11 trillion in debt. On average, the national debt has increased by $2.75 trillion annually.1 If the U.S. debt were an economy, its value would be comparable to the combined economies of China, Germany, Japan, India, and the UK. 2 At the current pace, the debt could reach $40 trillion by 2025, doubling in just eight years since 2017. The interest on the debt will soon be the largest expense item in the federal budget, surpassing Social Security and Medicare. These figures are staggering.

The Congressional Budget Office (CBO) predicts that the U.S. government will continue to run trillion-dollar deficits over the next decade, potentially adding $22.1 trillion to the debt between 2025 and 2034.3

We’re truly in uncharted territory. Should we be concerned? How might this affect our standard of living, our investments, our grandchildren’s future, and our country in general? What are the effects on the stock and bond markets? Is it all doom and gloom, or are there bright spots? Let’s answer all these questions, starting with what the national debt entails and how it arises.

The US National Debt – What is it? What does it stem from?

Federal debt is different from the “deficit.” The federal debt represents the accumulated total of all deficits incurred over the years by the government. Currently, it exceeds $34.5 trillion, which translates to more than $103,000 for every American. Back in 2021, this figure was $84,000 per person.4 The deficit occurs when government expenses, such as those for national defense, health care, education, and various programs, surpass its revenue from taxes and other sources.

Projected Growth in US Government Spending

Source: Charles Schwab, Deficits, Debt and Markets: Myths vs. Realities, June 2024.

When expenditures outstrip revenues, a deficit emerges. To bridge these budget gaps, the federal government issues debt in the form of Treasury securities. These securities are typically bought by investors like banks, investment funds, businesses, and individuals because they are generally seen as safe investments.

As consumers, when we spend more than we make, we take on debt. However, at some point the credit card companies and banks will cut us off like angry parents. But the federal government is not you or me. They are special. They can continue to issue debt and run deficits indefinitely. They also have the power to print their own currency. Whether that has consequences and comes back to bite us, is something we’ll talk about further down.

High and escalating deficits mean a larger portion of the federal budget is allocated to financing costs, which might squeeze out other expenditures. If it goes parabolic, this growth rate could become unsustainable over time. In addition, increased federal borrowing exerts upward pressure on interest rates.

Historically, and across various administrations, the U.S. government has typically spent more than its tax revenues, resulting in deficits. These deficits have been particularly large following recessions and crises. This is when tax receipts fall, and government spending ramps up to stabilize the economy.

The 2008 Global Financial Crisis and the 2020 pandemic led to massive deficits, which later decreased as the crises subsided. We can argue that the U.S. government’s borrowing ability and support for its citizens during crises helped prevent more severe and prolonged economic downturns. Or an argument can be made that it solved a short-term problem at the expense of exasperating a long-term problem.

Why Investors Should Care

The significance of any economic data depends on your time frame. For traders, the key concern is how it will affect markets today. For politicians, its importance lies in how it might influence public opinion for elections. However, for long-term investors, the crucial factor is how it will shape the economic and financial landscape for years to come. From this perspective, the ongoing crumbling of federal finances is a paramount issue.

The three major credit rating agencies have downgraded the U.S. federal government’s long-term debt. The country now has a worse credit rating than Microsoft Corp. (MSFT) and Johnson & Johnson (JNJ), despite the fact that neither company can physically print its own money.

Despite this, when it comes to the U.S. national debt, large figures don’t necessarily indicate an impending crisis or even a problem for investors. The nearly $20 trillion in new debt accumulated over the past 15 years might not be pushing us towards Armageddon. The reality of this debt for investors and Americans as a whole differs from what the public hears, which is why it’s important to understand the context.

For long-term investors, the rise in debt is significant precisely because they are focused on the long term. The biggest risk associated with federal debt isn’t excessive spending growth, insufficient tax revenues, or even rising interest costs. It’s the political system’s inability to address the issue in a serious manner.

A look at this year’s federal budget makes it clear that no real progress on the deficit can be made without either cutting spending on defense, Social Security, Medicare, Medicaid, raising taxes, or a combination of these measures. This is why investors should care and be prepared to position themselves in a way that protects them.

Reasons To Not Be Overly Concerned

Let’s talk about a few reasons we should take the national debt into proper context and not be as overly concerned as many would have us believe.

- GDP, which represents the annual total value produced, might not be the best metric for evaluating the sustainability of U.S. debt. The U.S. is an extremely wealthy nation, with total U.S. household net worth over $150 trillion5, nearly five times the national debt. From this perspective, the debt level might not seem as alarming. This is why the U.S is generally viewed positively by markets as a creditor.

- With more than $35 trillion in liabilities and over $57 trillion in assets6, the U.S. federal government possesses far more assets than many might realize. (Land, buildings, natural resources, etc.) Instead of gauging debt as a percentage of GDP, which mainly measures income, comparing debt to total assets presents a much more solvent picture.

- US debt has high demand. Treasuries are among the safest and most liquid assets globally, making it unlikely that investors will lose interest in U.S. debt. The federal government owns over 20% of U.S. debt, making it the largest single holder. Since this debt is essentially money the government owes itself, it doesn’t impact overall government finances. Over 40% of U.S. debt is held by U.S. savers, pensions, and financial institutions. Although more than 20% of U.S. debt is held internationally, it is not heavily concentrated in a single country7. The largest foreign investors include Japan and the U.K., where yields are lower than in the U.S.

- China’s exposure to U.S. debt has decreased without any negative effects. There is a belief that China could use U.S. debt as a weapon by quickly selling off its Treasury holdings, which might cause financial volatility and higher borrowing costs. This risk seems unlikely, as China has been reducing its Treasury holdings for years without causing issues in the U.S. debt market.

- Higher interest rates are only problematic if economic growth is sluggish. The cost of borrowing is the interest expense (%), while U.S. GDP growth (%) can be seen as the government’s “return” as long as the economic growth rate exceeds the borrowing cost, the U.S. can manage its debt. Currently, growth outpaces interest expenses.

- Historically, the level of U.S. debt hasn’t been correlated with stock or bond market performance. Despite the increasing supply of U.S. Treasury securities, demand remains strong enough to prevent a spike in interest rates, a trend expected to continue. Investors shouldn’t alter their long-term investment strategies based on the possibility of a debt crisis.

- Moreover, the U.S. dollar has been in a long-term bull market for over a decade. If foreign investors were avoiding U.S. Treasuries, the dollar would likely be weakening. The dollar has remained relatively strong as seen in the chart below.

The Dollar has Remained Relatively Strong

Source: Charles Schwab, Deficits, Debt and Markets: Myths vs. Realities, June 2024.

Reasons To Be Concerned

Now let’s evaluate a few reasons to see why the trajectory of the U.S national debt should concern us.

The US debt-to-GDP ratio is at ~120%, close to the all-time record of 126% from 2020. This ratio is also higher than during World War II when the United States was borrowing for the war with record budget deficits of 27% of GDP. Since the 1980s, the ratio has rapidly increased meaning that debt has increased much more quickly than the economy.

A standard observer would say they’ve been hearing about the national debt crisis for the past 15 years or so and nobody’s worse off. This is misleading. It’s already impacted millions of US citizens, mostly savers as well as US government bond investors. In addition, future potential problems may arise. Let’s look at a few of those.

- Higher yields: The need to finance annual deficits exceeding $2 trillion, combined with the Federal Reserve’s reduction of Treasury holdings, could limit any significant rally in long-term bond prices, keeping yields elevated. This could limit future investment that depends on borrowing as well potentially being negative for stock prices.

- Increased borrowing costs: As the federal deficit grows, so does the need to issue Treasury securities. While demand for Treasuries has remained robust, a continued increase in supply could lead to higher yields, increasing the government’s interest expenses.

- Crowding out effect: Higher interest costs could reduce government spending on important public investments that fuel economic growth, such as education, R&D, and infrastructure.

- Reduced business investment: Rising debt may lead to reduced business investment and slower economic growth, potentially limiting opportunities for investors in the private sector.

Long-term Risks and Considerations

While the immediate impact on investments may be limited, long-term investors should be aware of potential risks:

- Fiscal crisis: High debt levels could leave policymakers with less flexibility to deal with unexpected events or economic crises.

- Inflation risk: In an extreme scenario, the government might attempt to reduce the real value of debt through higher inflation, which could negatively impact both stocks and bonds. Higher inflation, or worse, hyperinflation would decimate people’s purchasing power, punishing savers, and could lead to national instability.

- Political issues: Another large risk may be the political system’s inability to address the debt issue maturely, potentially leading to market uncertainty. No politician wants to be seen as calling for cuts to spending on things like health care or Social Security, for fear they’d be voted out of office. Therefore, the proverbial can will continue to be kicked down the road.

The National Debt’s Potential Impact on the Economy & Markets

Investors must understand the implications of rising national debt for the economy and financial markets. Let’s go over a few of these.

- The federal funds rate and Treasury rates, particularly the 10-year Treasury, serve as benchmarks influencing long-term rates for mortgages and student loans for example. As debt claims more of their budgets, investors have less disposable income to invest.

- As Treasury yields increase, they exert more pressure on stock market valuations. Given the inherent risks of stocks, investors demand a premium over the risk-free rate offered by Treasuries. Therefore, this may induce selling pressure on stocks as a whole.

- High debt costs further strain investors by tightening consumer budgets, leading to reduced spending on goods and services and, consequently, lower company revenues.

- Higher interest rates can hinder business growth and depress stock prices. Companies face a double hit from rising rates: reduced consumer spending and competition with the U.S. government. Corporations will have to payer higher rates to attract investors to buy their corporate bonds.

- Higher interest expenses leave less capital for business reinvestment, curbing growth and long-term stock prices. The U.S. Treasury also feels the pressure; rising interest payments redirect federal revenues away from other valued government programs.

There’s a few potential solutions / approaches that the U.S may end up taking.

One approach could see the government and Federal Reserve driving inflation higher to lower debt relative to nominal GDP. (Print more dollars and the real value of the debt is inflated away.) However, this could increase interest rates, exacerbating debt issues and potentially harming the economy and currency.

Another route would be suppressing economic growth to maintain low inflation and interest rates, similar to Japan’s experience. This would negatively impact economic growth and the dollar, harming returns on U.S. stocks and bonds.

Finally, what if we grow our way out of it? Perhaps a massive new technological revolution (Artificial Intelligence?) results in enormous productivity growth and increased national wealth driving GDP much higher. Then, potentially combine this with common sense cuts to government spending. This could make the national debt manageable over time.

How Should You Position Yourself?

First off, don’t panic about the U.S. national debt. Focus on the factors YOU can control.

There are several strategies to mitigate the effect of escalating national debt on your investments. One approach is to invest in real assets like commodities or real estate, which help counteract inflation. Inflation is a problem because if the government decides to pay off its debt by printing more money, it devalues each dollar in circulation. Real assets, such as real estate and infrastructure, tend to retain their value better during a debt crisis.

Municipal bonds present another investment option, as state and local governments have borrowing limits that help manage their debt levels. These bonds are typically safer than corporate bonds and are often exempt from federal taxes. They may also be exempt from state and local taxes if you invest in bonds from your home state.

The equity market shouldn’t be entirely avoided either. The stock market tends to focus on short-term performance, so while debt is a long-term concern, it may not immediately affect stock market values.

Diversifying internationally can also be beneficial, particularly by investing in countries with substantial economic growth that can manage their debts.

It’s important to recognize that while the federal debt’s trajectory is a long-term risk, it may have minimal impact on investments in the short term. Investors shouldn’t drastically alter their long-term financial plans based solely on this issue. The historical lack of correlation between U.S. debt, deficits, and interest rates makes it hard to predict any potential impact on the economy or financial markets.

In summary, although the U.S. national debt poses heavy long-term challenges, it doesn’t require major changes to diversified investment portfolios in the short term. Nonetheless, long-term investors should remain cautious and consider incorporating a variety of assets, including real assets, international investments, stocks, alternative investments, and commodities, to hedge against potential future risks.

Sources:

-

Fiscal Data, “What is the National Debt,” https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/. Accessed in November 2024.

-

Peter G. Peterson Foundation, “The National Debt Is Now More than $35 Trillion. What Does That Mean?” July 2024, https://www.pgpf.org/infographic/the-national-debt-is-now-more-than-35-trillion-what-does-that-mean,

-

Peter G. Peterson Foundation, “Top 10 Reasons Why the National Debt Matters,” August 2024. https://www.pgpf.org/top-10-reasons-why-the-national-debt-matters

-

US News, “How the National Debt Affects Your Investments,” May 2024, https://money.usnews.com/investing/investing-101/articles/how-the-national-debt-affects-you

-

Fred Economic Data, Households; Net Worth, Level, https://fred.stlouisfed.org/series/BOGZ1FL192090005Q, Accessed in November 2024.

-

US Bureau of Economic Analysis (BEA), U.S. International Investment Position, 1st Quarter 2024 and Annual Update, https://www.bea.gov/news/2024/us-international-investment-position-1st-quarter-2024-and-annual-update, June 2024.

-

Peter G Peterson Foundation, The Federal Government Has Borrowed Trillions, But Who Owns All that Debt?, https://www.pgpf.org/blog/2024/08/the-federal-government-has-borrowed-trillions-but-who-owns-all-that-debt, August 2024.