We all understand there is risk in the world. Those of us who are investors are also aware that risk exists in our portfolio as well. Put simply, risk is the possibility of loss. When we think of loss as an investor, we often think of the principal value of what we own decreasing in value, but this type of risk (called market risk) is only one of many types of risks investors should consider along with the different types of risk management.

Other types of risk that are important considerations for any investor include but are not limited to:

- Longevity Risk

- Inflation Risk

- Sequence of Returns Risk

- Interest Rate Risk

- Liquidity Risk

- Market Risk

- Opportunity Risk

- Tax Risk

Fortunately, there are strategies available to manage each type of risk. By taking advantage of these strategies, you may be able to pursue returns that will help you meet your needs as an investor while limiting your exposure to several types of risk.

Types of Risk Management

Longevity Risk

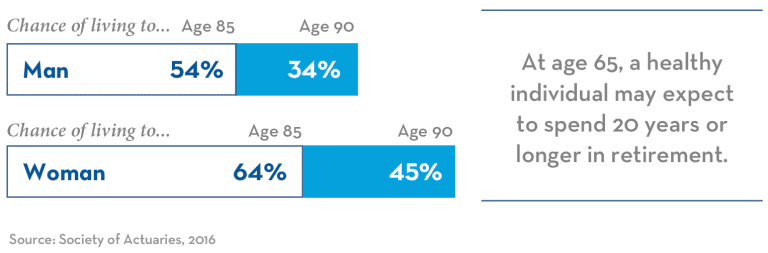

One of the greatest concerns investors have is that they will outlive their money. This is longevity risk in a nutshell. People are living longer and living healthier. That’s the good news. The bad news is that you should plan on funding a potentially longer retirement. You may have built a substantial balance during your working life, but will it provide the lifestyle you desire throughout your retirement? Longevity risk is a good place to start our conversation about risk for two reasons.

First, it clearly demonstrates that a discussion of investment risk is ultimately about people, not abstract returns. The desire to meet a personal goal such as replacing your paycheck in retirement becomes more important than abstract concerns such as the performance of your investments against a benchmark.

Second, longevity risk is interesting because it clearly demonstrates how different parties view the same risk. Insurance companies, for example, view increased longevity from the standpoint of being on the hook for paying benefits on certain types of contract (long-term care or annuities, for example) for a longer duration. This can increase the cost (or lower the benefits) of those products to consumers, making it even more important for them to attempt to ensure additional savings in retirement.

Investors can limit their longevity risk in many ways including, working longer, delaying social security for a higher benefit that may represent a greater percentage of retirement income and planning for a conservative portfolio withdrawal rate in retirement, generally no more than 4% for those retiring at a normal age.

Inflation Risk

Inflation is the increase in the cost of goods and services in an economy relative to the currency. When we experience inflation in the United States, the same number of dollars will buy less in the market that it did in the past.

You may not have thought much about inflation early in life. This is very common for a couple reasons, the most obvious of which is that when you are young you haven’t lived long enough to see inflation have a substantial material impact on the cost of everyday items. Think of inflation as the hour hand on an analog watch. You know it’s moving, but you can’t see the movement in real time – you can only recognize it has moved in retrospect.

You also become more concerned with inflation later in life because you’ve had an opportunity to build savings that can be affected negatively by inflation. When you are younger and have yet to build substantial savings, you may be indifferent to inflation. If you are in debt, you may benefit since inflation erodes the value of what you owe.

As an investor, you will need to be keenly aware of inflation risk and select asset classes and investment strategies with the potential to provide a “real rate of return” which is a return above the rate of inflation.

If inflation is 3%, for example, you haven’t really made progress in your portfolio by achieving a 3% return for the year. You’ve simply maintained your purchasing power which means the balance you have would buy the same goods and services it would have a year ago. To increase your wealth from a practical standpoint, you will need to achieve a rate above inflation, greater than 3% in this example.

This is particularly important to consider when evaluating low yielding asset classes such as cash or cash equivalent items including bank CDs, money market, and savings accounts. If you’re offered a rate below the rate of inflation, don’t confuse the numeric increase in your account value with progress that will allow you to purchase more with your money. This is not to say you should avoid those assets entirely but simply that you should evaluate the effects of inflation on your overall portfolio and include assets such as equities that can provide long-term returns above the rate of inflation.

Sequence of Returns Risk

Often investors focus on average returns. This can be the average of a portfolio allocation or their own experiences in the past. The challenge with a plan based on an average return is that even if it is achieved, there can be wide variation from year to year and the order in which returns occur can affect your investment experience.

Imagine you have a balance of one million dollars to invest. The first year you’re up ten percent and the following year you’re down ten percent. Your average annual return may be 0% but you’re not even. You would have $990,000 since the ten percent loss was experienced on a higher balance.

You can lessen your sequence of return risk by choosing a conservative withdrawal amount, also known as a sustainable distribution rate. For many retiring at a normal age, this is 4%. It will generally be well below your expected return for the portfolio. This will not only provide a cushion but also assist in combating the previously mentioned risk of inflation. In addition to selecting a conservative withdrawal rate, you can make sure to rebalance your portfolio periodically to make sure you are not exceeding the level of risk necessary to reach your goals. This is important since your most aggressive asset classes can potentially through appreciation represent a larger portion of your overall balance than they did in your initial allocation.

Interest Rate Risk

Changes in interest rates can affect your portfolio in many ways. When interest rates go up, for example, fixed income items such as bonds may no longer be as competitive and may decrease in value. Even equities may experience the effect of the changing interest rates on the overall economy or a specific business. Think of credit as the fuel that drives economic activity. Interest is the cost of credit. What happens to your driving habits when fuel costs go up?

You can protect yourself from interest rate risk by owning many different asset classes and choosing your fixed-income investments so that you have a variety of maturity dates among short, intermediate and long-term since longer maturities usually carry the greatest interest rate risk. This strategy also comes with a bonus in that it also helps with our next risk, liquidity risk.

Look Out For These Types of Retirement Risk [Watch Video]

Liquidity Risk

You may have checked the value of your home online recently and been excited to see the value, only to have your thoughts turn to the process of selling. How long will it take? How much will the commission be? What if it sits for too long after I’ve purchased the next property? This is a perfect example of liquidity risk, but it’s not confined to real estate only.

Many investments have lock-up periods or charges for early sale, often called “surrender charges” in annuity contracts. The non-monetary costs such as hassle and uncertainty can often be a large factor in considering some investments without a liquid market.

You can protect yourself from liquidity risk by limiting the amount of your portfolio that is difficult to liquidate or difficult to do so without incurring expenses. You don’t need access to your entire balance at all times, but you should easily be able to convert a portion to cash in a reasonable timeframe if necessary.

Market Risk

Market risk is what most investors imagine when they think of risk in general. It’s the possibility that the value of your investment can decrease. Fortunately, there are ways to limit your market risk. Avoid investing a sizable portion of your portfolio in a single asset. Investors often get “oneitis” and are so convinced in the merits of a single investment that they lose sight of the additional risk they take by owning too much of any single investment.

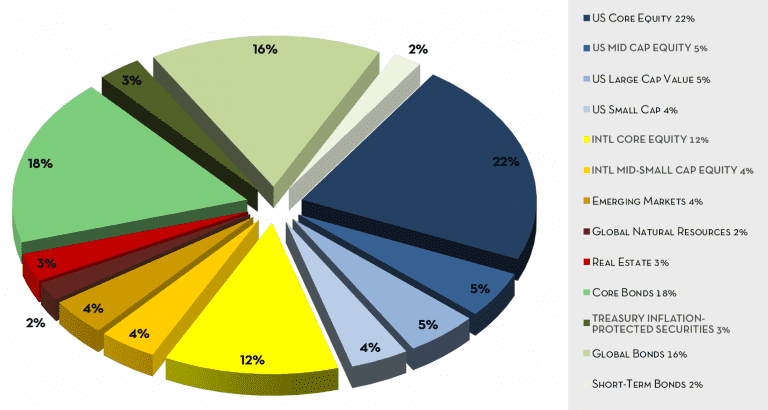

A Sample of a Diversified 60% Stocks / 40% Bonds Portfolio

Purchasing investments at various times or “averaging in” can reduce the risk associated with timing your investment. You will also want to consider diversifying among a variety of asset classes. Owning several different stocks may provide some diversity, but stocks, in general, may be affected by similar market forces and move in similar directions. If you use an electronic site to follow your quotes, how often is it all green or all red? When you have not just a variety of stocks but also items from other asset classes such as bonds, real estate, commodities or others, you will have returns that are less correlated to one another, meaning they do not move in the same direction or react similarly to the same market conditions.

Opportunity Risk

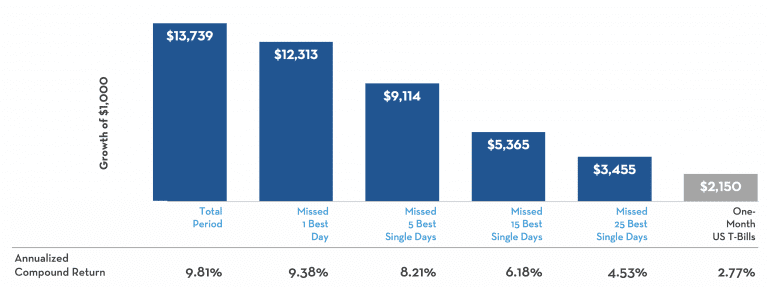

Opportunity risk is interesting because it is a type of risk people often assume unknowingly when they are attempting to avoid risk in general. Sitting on the sidelines or placing your money under the mattress can seem safe. You will, after all, preserve your principal balance. However, you are experiencing the opportunity cost of not receiving a return on the balance, which can be detrimental to your investment goals over extended periods of time.

Trying to time the market and “sit out” the downturns can do more harm than good for many investors. This is because by doing so you miss out on the possibility for upside that often happens specifically during a downturn. You may have heard the phrase that one should focus on the “time in the game” rather than “timing of the game.”

Reacting Can Hurt Your Performance:

Missing Only a Few Days of Strong Returns Can Drastically Impact Overall Performance

Performance of the S&P 500 Index, 1990–2017

Opportunity risk is also frequently coupled with inflation risk. It’s not just that you’re preserving your balance only while missing out on an additional return. The balance you preserve is worth less over time due to inflation. Standing still is going backward when you consider what you can purchase with your money. In our discussion of inflation risk, we pointed out that you need a return at least equal to the rate of inflation before you have a “real rate of return” above it. Sitting on the sidelines and looking for the ideal time to jump back in can prevent this from happening.

A strategy to limit opportunity risk is to have an emergency fund that will cover three to six months of emergency expenses but not more. The specific amount within that range can be decided based on how many earners are in the household and the stability of the jobs, but having an emergency fund will prevent you from needing to pay a fee, commission or tax bill to get out of an investment and prevent needing to sell at a less than ideal time. You understand you’re not going to get a large return from money in a savings account or similar vehicle, but you make the tradeoff for liquidity. It’s unlikely that you will need more than this amount in a brief period so having an emergency fund greater than a few months of expenses can lead to too much opportunity risk.

Tax Risk

Tax risk is a very important consideration for investors. You may have an excellent return on your investments, but it’s the amount you’re able to keep after tax that will most directly affect your lifestyle. There are several ways to contain tax risk and ensure you can keep the most amount of your money possible.

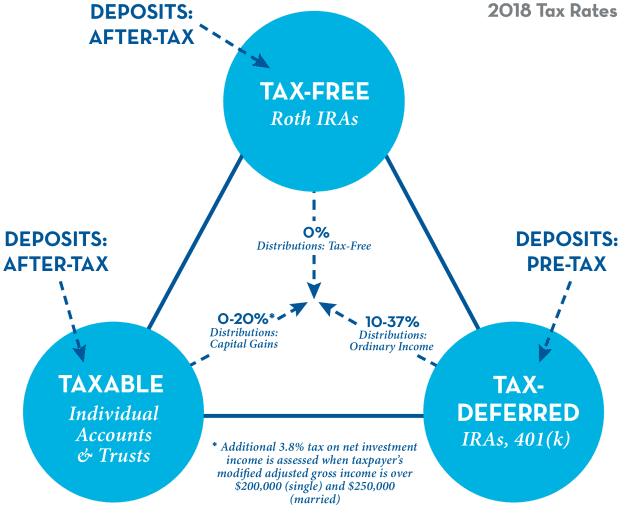

Invest in all available “pools” of money. Often investors have most of their savings in tax-deferred accounts such as their employer-sponsored retirement accounts. Tax-deferred accounts are only one of the three “pools” available to investors in the United States. You can also invest in tax-free accounts, such as your Roth IRA and taxable or “non-qualified” accounts, such as accounts in your name or jointly with a spouse that are not retirement accounts.

Having money in all three pools is called “tax diversification” and it’s one of the most powerful tools that investors can use to avoid tax risk. When you are finally spending your funds, you will have a variety of options to pull from depending on your tax situation at the time which can increase not only your after-tax return but also the flexibility of how you can use all accounts.

You’ll also want to consider the tax features of the investments themselves for those funds held in taxable accounts. For those in a high tax bracket, investments with a slightly lower return but favorable tax treatment may be a good overall choice. A common example of this would be to select the lower-yielding municipal bond instead of a higher yielding corporate option if the after-tax return is higher.

The timing of your investment sales may make a material impact. When items are held longer than one year, the more favorable investment rate, also known as the dividend and capital gain rate applies. This is more favorable than the ordinary income rate and can be as low as zero depending on other income received during the year. Some highly appreciated assets may be better passed through inheritance to your heirs to avoid capital gains entirely if you wish to leave a legacy in general. Giving these items to qualified charities during your life can have a similar effect by avoiding capital gains. For advanced strategies such, you’ll want to address your plans with your financial planner, tax professional, and potentially your estate planning attorney.

By focusing on risk management in addition to return, you can not only reach your financial goals but do so in a way that allows you to sleep at night and enjoy your returns.