More

Pure’s Tax Planner, Frank Haney, CPA, shares six smart tax strategies designed to help you feel more prepared for your tax filing. Transcript We all know that filing your tax return can be stressful, confusing, and a headache at best. So here are six smart strategies to make this filing year easier. 1. Tax Filing […]

Tax season is fast approaching and now is a great time to get started to be ahead of the curve. Pure’s Financial Planner, Nick Rose, CFP®, AIF®, will guide you through a simple checklist designed to navigate through tax strategies to help you retain more of your hard-earned dollars. FREE GUIDE | End of Year […]

Pure’s Senior Financial Planner, Richard Alexander, CFP®, AIF®, explains the difference between capital gains and dividends. Capital gains are profits from selling investments at a higher price, while dividends are income paid out by corporations to stockholders. FREE GUIDE | 10 Tips for Real Estate Investors Transcript Capital Gains vs Dividends. Both are sources of […]

Robert Gonzales, Pure Financial Tax Planner, focuses on a few key points of the changes to the 2023 tax code. FREE GUIDE | End of Year Tax Strategies Transcript Tax season is right around the corner and I’m here to let you know about the thousands of inflation adjustments the IRS has made for the […]

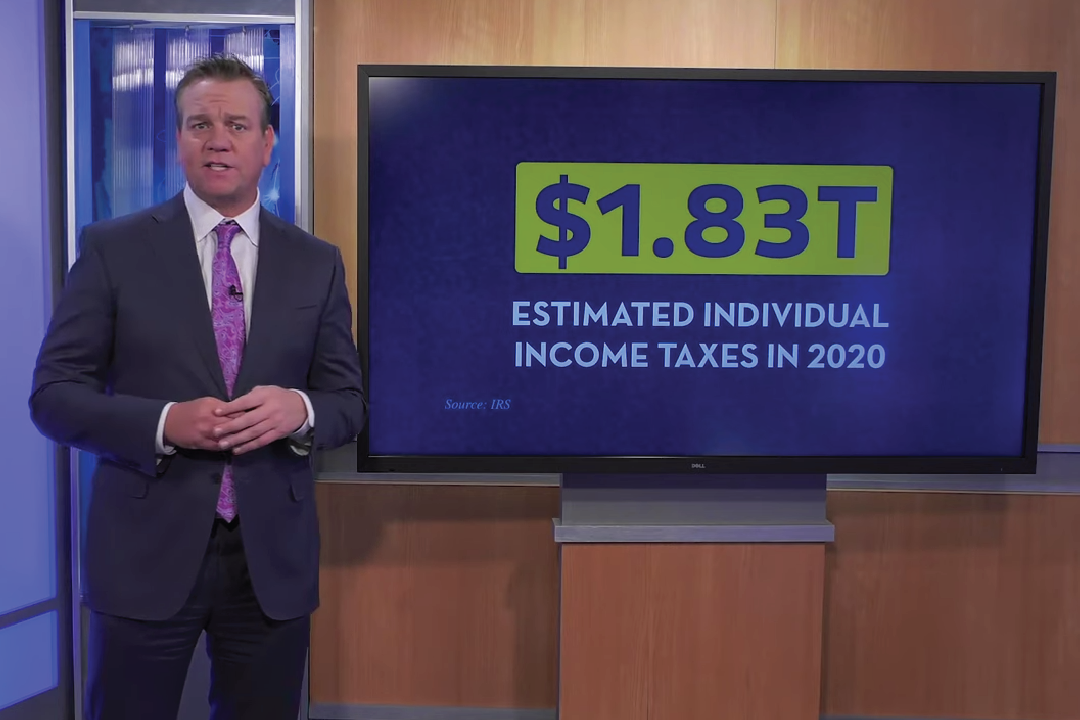

Like most everything else in 2020, taxes are a little different this year. It is essential that you understand the short-term and long-term rules and regulations that guide how much you will pay to Uncle Sam. Financial professionals Joe Anderson and Alan Clopine guide you through the ins-and-outs of the changes in the tax acts […]

Being self-employed has a lot of appeal, giving you the flexibility of your own calendar. However, for the self-employed business owners, there are some additional taxes you need to be aware of. It’s a Self Employment Tax and it consists of two parts Social Security Tax and Medicare Tax. Make sure to subscribe to our […]

New tax reform comes with the promise of lower taxes while it also eliminates key deductions. Will you benefit from the Tax Cuts and Jobs Act? Will it impact your retirement? Financial experts Joe Anderson, CFP® and Alan Clopine, CPA explore new strategies that can be used to significantly reduce your tax liability before and […]