More

Pure’s Senior Financial Advisor, Matt Balderson, CFP®, AIF®, shares realistic financial habits that inspire momentum, reduce financial blind spots, and build meaningful progress toward your goals in the new year and beyond. Transcript If your wallet had a fitness tracker, what would it say about your habits? As we step into 2026, many of us […]

Pure’s Senior Financial Advisor, Joe Schweiger, CFP®, AIF®, explores budgeting through a financially fit mindset, emphasizing consistency and practicality when building a resilient budget for the new year. Transcript January is the time for setting fitness goals, but if your finances stepped on the scale today, what shape would they be in? If you think […]

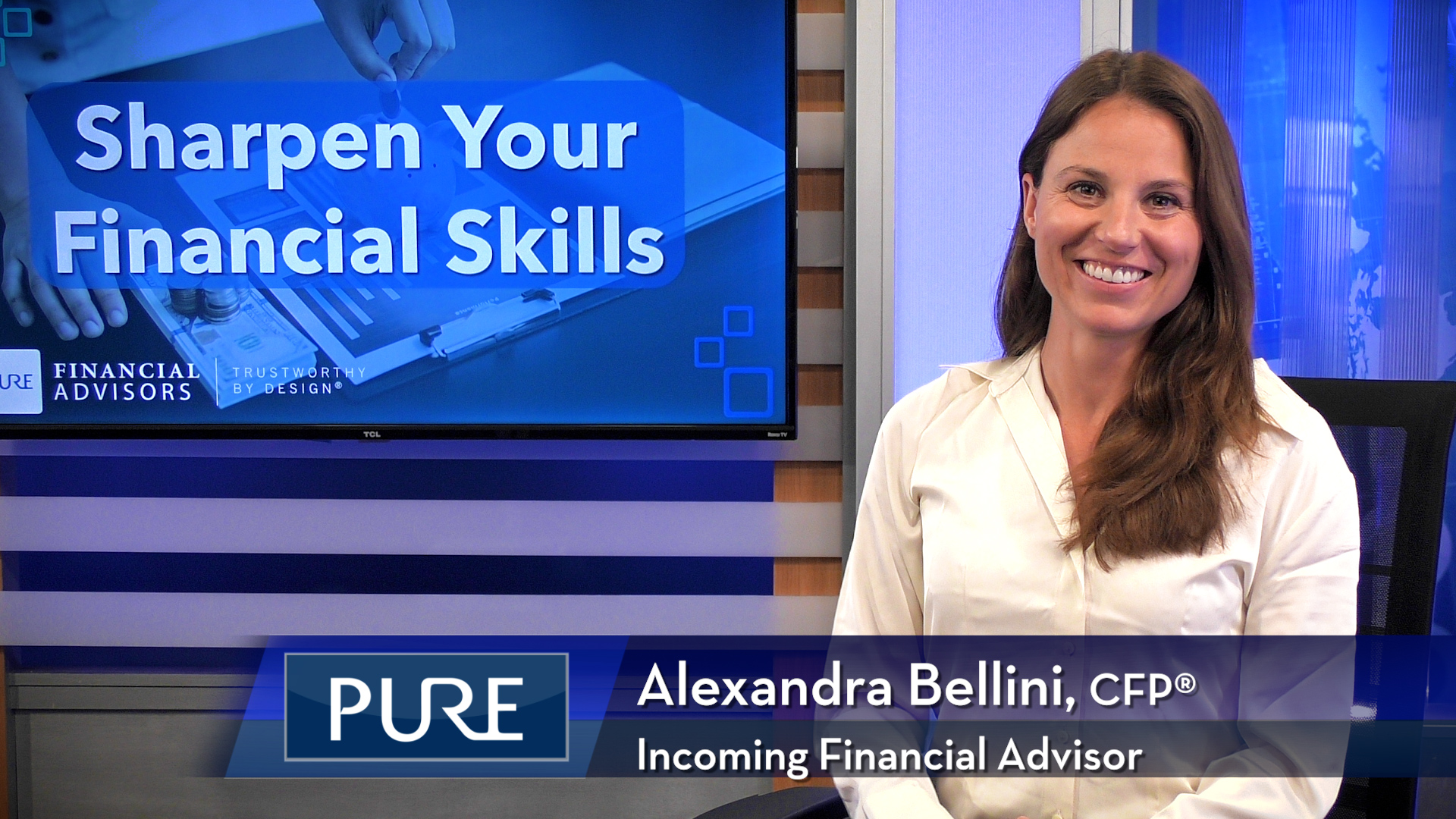

Financial education is vital at every stage of life, from early budgeting to retirement planning. No matter where you are on your financial journey, there’s always an opportunity to invest in your financial well-being. Pure’s Incoming Financial Advisor, Alexandra Bellini, CFP®, shares simple tips to enhance your financial literacy. She discusses: Creating a budget Saving […]

Interested in growing your money in a retirement account that is tax-free? Learn the ins and outs of Roth IRAs in this white paper. In this guide, you’ll learn… What exactly a Roth IRA is Eligibility requirements Contribution limits The difference between a Roth IRA and a Traditional IRA And more! Don’t wait to discover the difference compounding can […]

Have the years raced by without saving for retirement being a priority? You are in good company. Financial professionals Joe Anderson and Alan Clopine give you tips to fast track your retirement after 40. Planning for your retirement takes a different approach when you haven’t focused on it until the time horizon for retirement isn’t […]

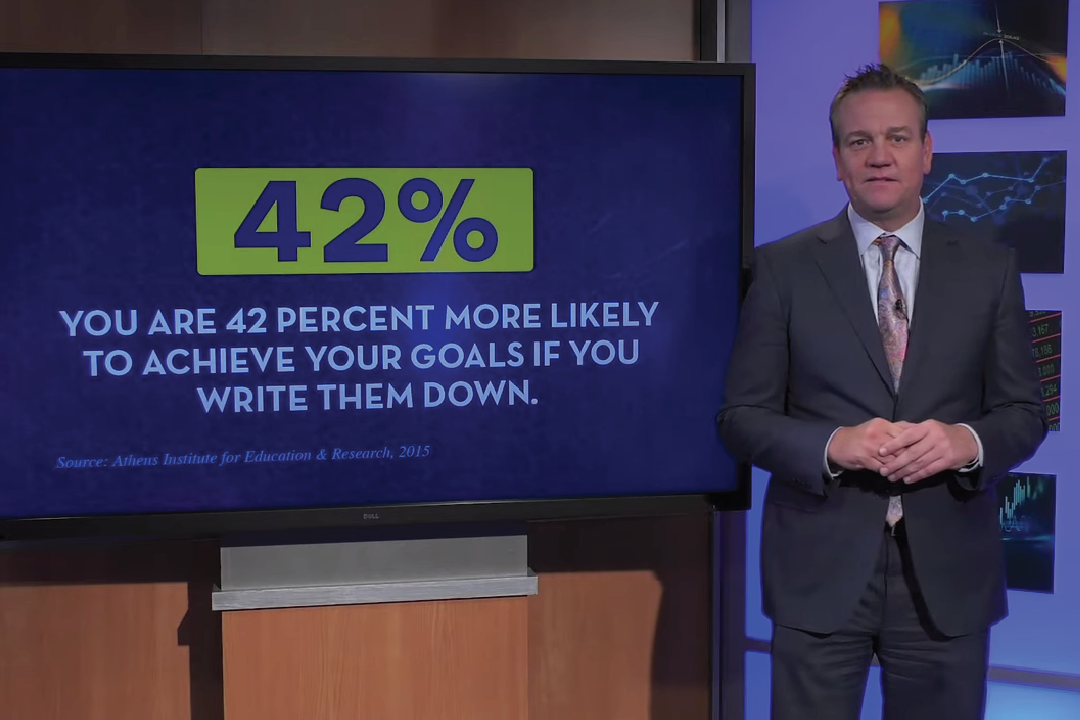

Starting to save money can be overwhelming, and many times, be a difficult step to take. By looking at the benefits of saving, the payoff can be substantial. It’s called the financial compound effect. Understanding how it works and putting it into effect for your financial plan can make a big difference during retirement. In […]

Are you ready for financial football? Where are you in the game? First and goal in the 4th quarter with no timeouts? Wherever you are, you can get a game plan for a winning season. Financial professionals Joe Anderson and Alan Clopine give you the tools to put a successful game plan in place that […]

Nick Loper of Side Hustle Nation shares just a few of the 250 ways he’s found that everyone from millennials to baby boomers can make more money and trim expenses in this new era of creative entrepreneurship and freelance work – from shuttling booze to making some bread teaching people to make bread. Plus, Joe […]

Save $85,000 annually: Jamila Souffrant from JourneyToLaunch.com explains how she can save $85,000 every year, and how you can save and invest more money too. Plus, 10 Financial Planning Tips for Young Investors, and the merits of buying company stock. And interest rates are on the rise – what does that mean for your bond […]

Broke Millennial’s 16 money tips and mind tricks on today’s Your Money, Your Wealth. Erin Lowry shares her mind tricks for more effective saving and her clever tips for paying down debt. Plus, working the tax brackets with Roth conversions, some crazy options that may or may not work when you’ve contributed too much to […]

Laura Adams, host of the Money Girl Podcast joins the show this week to give us eight ways to save serious cash, so we can avoid the holiday debt hangover. (Can’t guarantee that you can avoid working out, though.) She also lays out how to tackling debt and whether you should lease your car or not. Plus, the […]

The most dangerous factor that can blow up your retirement savings is you! Financial experts Joe Anderson and Alan Clopine describe the different types of investor behavioral bias that can cause us to make bad investment decisions. Special guest from Pure Financial, Matt Balderston explains how we are all susceptible to biases that can have a […]