The stock market has gone wild!

Or, more accurately, pockets of the stock market have gone crazy. Previously beaten-down companies like GameStop, AMC, and Blackberry have soared in 2021, accompanied by eye-popping gains and jaw-dropping volatility.

Why is it happening?

And what does it mean for your finances?

Read on to learn more.

LISTEN | SPECIAL YMYW PODCAST EPISODE 310a:

GameStop: Stocks Gone Wild! Should You Join the Day Trading Craze?

What’s happening?

Recent headlines have been dominated by news about a small handful of stocks that have seen their prices soar. But these moves haven’t been driven by the big Wall Street pros. Instead, it has been individual investors driving prices higher.

Much of the credit (or blame depending on your perspective) has been given to online trading forums and blogs, particularly on the Reddit social media site. Bands of day traders there have identified beaten-down stocks and then bought aggressively, driving prices higher. Many of the stocks they’ve targeted have been previously unloved or troubled companies, especially those that have been heavily “shorted” by hedge funds and other Wall Street pros.

Shorting a stock: Traders go short a stock when they believe its price will fall. They do this by borrowing shares they do not own and then selling those shares. At some point, they need to buy those shares back. If the price has fallen, they make money. But if the price has gone up, they need to pay more for the shares and lose money. Shorting stocks can be extremely risky because there is no limit as to how high a stock can go, so losses are theoretically unlimited.

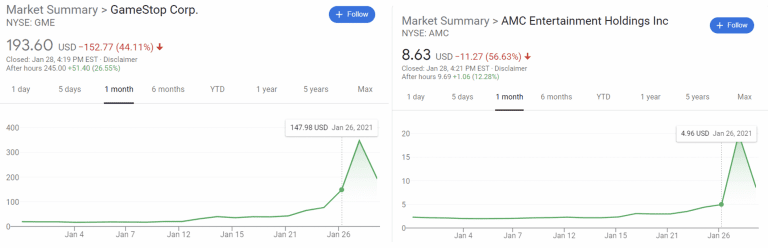

Several of these stocks have skyrocketed. For instance, GameStop has seen its share price, which began the year at $17, soar as high as $469 on January 28th. AMC, which has been fighting to stave off bankruptcy with theater attendance crippled by the pandemic, saw its price skyrocket from $2 at the start of 2021 to more than $20 a share less than four weeks later.

These huge increases have been ascribed to day traders, many of them posting on Reddit, buying stocks and options on these companies. Short selling hedge funds have then been forced to buy back their positions, contributing to further price increases.

Short Squeeze: A short squeeze occurs when other traders identify a stock that has been widely shorted. They then buy that stock to drive the price higher. The hope is that as the price goes up, people that have shorted it are forced to buy it back to cut their losses. This additional buying then creates upward momentum, and hopefully, a sharp spike in the share price.

Should you join the party?

It’s up to you to decide whether to buy a stock, but it is important to remember that anything that goes up sharply can also go down sharply. So, before getting involved in GameStop, AMC, or any other momentum stock, make sure you understand what you are signing up for.

Because, while you might get rich, you also could lose a lot of money. For instance, GameStop recently plummeted from $469 a share to $126 a share. What makes that 73% drop more incredible is that it happened in less than an hour and a half on Thursday January 28. AMC experienced a similarly sharp collapse, falling from $19.88 a share at Wednesday’s close to $7.51 less than 24 hours later (as of 11:30 Thursday.)

So, it bears repeating that if you decide to get involved in these stocks, you need to be prepared for very large price swings in both directions.

You’ll also want to keep track of evolving legal and regulatory changes. For instance, TD Ameritrade, Interactive Brokers, and Robinhood are among the firms that have placed restrictions on trading in certain stocks. Also, remember that it is illegal to intentionally manipulate stock prices and that the SEC often investigates unusual trading activity. So, it’s possible that government regulators will at least investigate some of the trading activity the Reddit crew has been involved in.

Is trading a game?

Beyond crazy movements in a handful of stocks, the bigger question to address is why these sorts of things are occurring in the first place. Observers have credited a couple of factors for the surge in retail trading activity.

For starters, COVID-19 means that many people have more time on their hands and less ways to fill that time. When stuck in the house some people are choosing to watch the stock market, rather than TV. Furthermore, stimulus checks and other government support, combined with curbs on many leisure activities, means that some people have excess funds they can put to work in the stock market. Computing power, the internet, and data availability all combine to arm these traders with tools that would have previously been unavailable to them.

The final factor is what has been referred to as the “gamification” of trading. Apps that simplify the trading process and contain bells and whistles celebrating the placing of orders have contributed to the sense that trading is a video game. On the one hand, making investing appealing to newbies is a good thing, and increased access to tools and information can help people meet their financial goals. But on the other hand, recent speculation in some of these stocks bears little resemblance to “investing,” and it seems likely that at least some of these new market participants don’t fully understand what they are doing or the risks they may be taking.

Are you trading or investing?

There is a fundamental difference between trading and investing. Trading relies on sentiment and your view of how others will value something in the future. Investing relies on numbers, and a judgment of the value of cash flows now and in the future. Neither activity is inherently good or bad; what matters is that you know which one you are engaged in and act accordingly.

On Wall Street, people say that in the short run the market is a voting machine, but in the long run, it’s a weighing machine. What that means is that in the short-run market sentiment and emotion can move markets, but over time it’s a company’s fundamental performance that determines its worth.

In the first days of 2021, some market participants voted, and AMC, GameStop, and a handful of other stocks were clear winners. But more time is needed for the marketplace to weigh in on a final judgment as to the true value of these companies. Your job as investors is to determine that value and make sure your portfolio can survive if your judgment is wrong.

Alternatively, you can choose not to play games with GameStop and its ilk and instead focus on time-tested, tried, and true financial and investment principles.

The choice is yours.

Neither the information presented, nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Investments and/or investment strategies involve risk including the possible loss of principal. There is no assurance that any investment strategy will achieve its objectives.