Factor investing is a strategic approach that involves finding securities based on specific attributes such as value, quality, momentum, size, and minimum volatility. These factors, which are well-documented by researchers, are essential tools for investors seeking to outperform the market. Decades of research have revealed the sets of characteristics that explain differences in expected returns. Over extended investment horizons, utilizing these factors led to consistently surpassing general market performance. Like traditional index funds, factor investing is transparent and rules-based, designed to specifically identify companies with factor-specific characteristics for which to gain exposure.

These factor strategies have now become accessible to a broader audience, thanks to exchange-traded funds (ETFs) and mutual funds. Leveraging these, investors can construct efficient, cost-effective portfolios, with the aim of achieving a return in-excess of the general stock market.

Factor investing aims to achieve a couple key objectives:

- Enhanced Diversification: By targeting broad, persistent drivers of returns, factor investing enhances portfolio diversification. Unlike traditional diversification, which can falter if securities move in lockstep with the overall market, factor-based diversification mitigates those risks.

- Above-Market Returns: Factors represent compensated risks, forming the bedrock of a security’s return profile. Similar to the equity risk premium associated with stock investments, factors also offer a premium over the long-term, with returns exceeding the general market.

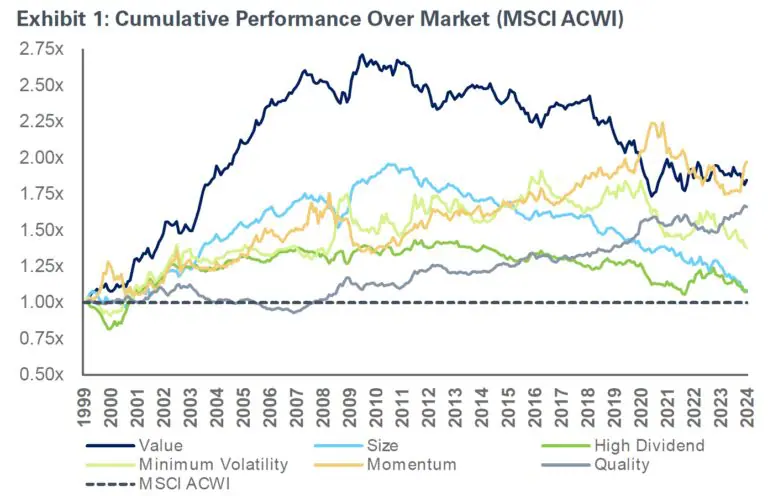

See the below chart which displays how the various factors have outperformed the general market over the long run.

Cumulative Performance Over Market

Now, let’s start digging into more detail of what each of these factors mean.

The Various Types of Investing Factors

There are five main factors — value, quality, momentum, size, and minimum volatility — that tend to be consistent over time and have a strong economic reasoning behind them.

Value:

Value factor investing seeks to capture superior returns from stocks priced below their intrinsic value. Commonly tracked through metrics like price-to-book, price-to-earnings, dividends, and free cash flow, it involves investing in stocks that are more “affordable” compared to their peers. The lower these price ratios, the more attractive a stock is, according to value factor investing. Historical research, including a 1992 study by Fama and French, supports the idea that lower-cost stocks tend to yield higher returns. When evaluating stocks, investors can identify value by considering metrics such as forward earnings or cash flow or book value relative to current price.

Size:

Historically, portfolios comprised of small-cap stocks have consistently delivered superior returns compared to those composed solely of large-cap stocks. (We use market capitalization to determine size of a company). Consider allocating investments to smaller, more agile companies. These smaller firms, despite having fewer resources than their larger counterparts, often outperform. Their ability to swiftly adapt and identify new investment prospects in the marketplace due to their size could explain their historical outperformance. But it might also be explained that smaller companies are by definition “riskier”, so they must deliver better performance to compensate for being riskier.

Momentum:

Stocks with a history of strong performance often continue to deliver robust returns, according to some research and observation. Momentum factor strategies focus on relative returns over a three-month to one-year period, investing in outperforming stocks while reducing exposure to underperforming ones. These strategies capitalize on stock trends, and the phenomenon of investors piling into stocks that have recently done well. This may cause certain stocks to continue their moves higher due to the crowd effect.

Quality:

Quality factor stock investing is characterized by factors such as low debt, consistent earnings & asset growth, and high returns on capital. Investors can assess quality stocks using common financial metrics like return on equity, the debt-to-equity ratio, and earnings consistency / growth. Quality-focused strategies seek out stocks with high capital efficiency and superior financials compared to their peers. These types of companies have been shown to outperform stocks that don’t have these qualities over the long run.

Lower Volatility:

Based on research, stocks with low volatility tend to yield better risk-adjusted returns compared to highly volatile stocks. When constructing a portfolio, consider investing in stocks that as a group exhibit lower volatility than the broader market. Volatility, which represents risk, has a persistent nature. Investors can leverage this insight by analyzing volatilities and correlations to create a portfolio with reduced expected volatility. As opposed to the other four factors, the primary aim of the minimum volatility factor is not necessarily to boost returns but rather to mitigate overall risk.

Conclusion:

Factor investing primarily aims to capture the premiums linked to specific risks, resulting in long-term excess returns. It blends elements from both passive and active management. (See the exhibit below.) Similar to traditional index funds, factor investing operates transparently and adheres to predefined rules. It systematically identifies companies with specific factor characteristics, whether that’s small cap, value, momentum, low volatility, or quality factors.

Passive Factor Allocations Combine Attractive Elements of Both Traditional Passive and Active Mandates

Think of factors as active concepts implemented passively. By combining the advantages of active and passive investing, factor strategies seek better risk-adjusted returns. Keep in mind that factors inherently carry risk, and generating returns requires embracing that risk. Thus, some downward volatility should be anticipated, and factor strategies may underperform the general market for certain periods of time.

Investors should recognize that, on average, all factors have historically yielded long-term excess returns. While factor investing isn’t a quick path to wealth, patient and disciplined investors tend to benefit. Integrating factor investing into your long-term strategy can enhance diversification. A multi-factor portfolio, spanning various factors, reduces risk and boosts returns over time, reducing individual factor-related risks.