More Educational Videos

Purefinancial

When cooking up your favorite Italian dish, the most common ingredient is pasta, and there are 350 different types. But what about your retirement recipe? The most important ingredient is the retirement plan itself, with 14 different types. So what are the best ingredients for your Recipe for Retirement? In this episode, Joe Anderson, CFP® […]

Stocks and bonds, 401(k)s and IRAs – how investment savvy are you? Less than half of Americans have a solid understanding of basic investing terms and concepts. It can be difficult to grow your wealth if you don’t know what tools and strategies are available, much less know how to use them to develop a […]

Are you neglecting one of the most precious assets that you have? When it comes to individual retirement accounts or IRAs, many people have a practice of “fund it and forget it”. But there are strategizes you can implement to help maximize the money it generates. The “Dynamic Duo” of financial planning, Joe Anderson, CFP®, […]

What exactly are dollar-cost averaging and reverse dollar-cost averaging? Joe and Big Al explain as they answer questions about paying Medicare premiums with HSA funds, and ETFs vs mutual funds when dollar-cost averaging into small-cap value funds. Plus, why would you want to reduce the stock allocation in your emergency fund, and should a stable value fund be part of your portfolio? Is it possible to “re-identify” an inherited IRA as a spousal IRA to change the RMD calculation? Is the section 162 executive bonus plan just whole life insurance? And finally, Joe’s past comes back to haunt him with 9 cats, a neurotic beagle, and 200 IRAs.

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

The psychology of retirement: what if you’ve saved enough and you’re financially ready to retire, but you’re paralyzed by the idea of no longer earning and saving? Plus, a Roth conversion strategy when your income is too high to contribute to Roth. How to know if it pays for you to convert and how much, and should you contribute to a rollover IRA before or after leaving a job? Finally, should you purchase long-term care insurance, or self-insure?

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

With a Qualified Charitable Distribution you can donate directly to charity from your IRA. Watch to learn the rules and tax benefits. Watch the full episode, Re-energize Your IRA Make sure to subscribe to our channel for more helpful tips and the latest episodes of “Your Money, Your Wealth.”

The SECURE ActR changed the age at which you must begin taking required Minimum Distributions (RMDs) from your retirement accounts to age 72. With COVID-19 the CARES Act waived the RMD requirement for 2020, but now the requirement is back. Watch and learn how you’re penalized if you don’t take an RMD. Watch the full […]

It’s one thing to have a nice balance in your retirement accounts. But when it’s time to withdraw from your accounts in retirement, you need to consider the taxes you will pay. Learn how to avoid a ticking tax. time bomb when it comes to IRA and 401(k) balances. Wouldn’t it be nice if some […]

Started late on saving for retirement? You can catch up! At age 50, max out your combined IRA and 401k contribution of $33,000 with an employer match of $4,000 at a 7% return – in 10 years you could have $511,00 for retirement, and in 20 years $1,517,000! Watch the full episode, Re-energize Your IRA […]

What investments are available for an IRA? Traditional IRAs & Roth IRAs: Stocks & Bonds, Mutual Funds & ETFs Self-Directed IRAs: Real Estate, Crypto Currencies, Gold Watch the full episode, Re-energize Your IRA Make sure to subscribe to our channel for more helpful tips and the latest episodes of “Your Money, Your Wealth.”

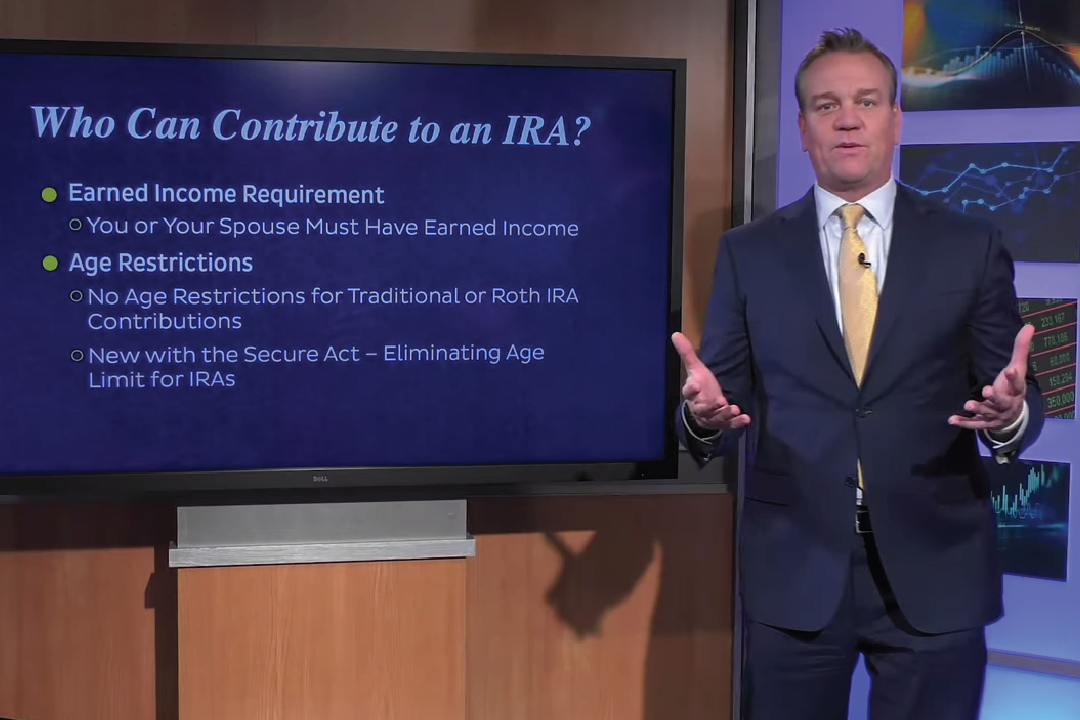

With the SECURE Act and CARES Act, the IRA rules have changed. Let’s start with what is now current law: Who Can Contribute to an IRA? Earned Income Requirement: You or Your Spouse Must Have Earned Income Age Restrictions: No Age Restrictions for Traditional or Roth IRA Contributions, New with the Secure Act – Eliminating […]

Are you blindly depositing money into your retirement accounts, but have no idea how to make the most of your investments? Financial professionals Joe Anderson and Alan Clopine take you through the steps to reenergize your IRA. From Roth IRA backdoor door conversions to qualified charitable distribution or QCD, they’ll guide you through the steps […]

Nate Ritchison, CFP® explains how the Roth IRA and traditional IRA retirement savings accounts differ when it comes to tax treatment and required minimum distributions. NEW IN 2020: The age to begin required minimum distributions (RMDs) has changed from 70½ to 72. Transcription: “The question I often get when I meet with clients is, “what’s […]

What’s a safe withdrawal rate from your investment portfolio when that money has to last 50 or 60 years because you’re part of the FIRE (financial independence/retire early) movement? Karsten Jeske, Ph.D., CFA, aka “Big Ern” from EarlyRetirementNow.com shares his experiences. Plus, will listener Paul reach $5M by retirement? Can monthly payments from an IRA […]

Tanja Hester (OurNextLife.com, award-winning financial independence blog) talks about her new book, Work Optional: Retire Early the Non-Penny-Pinching Way. Joe and Big Al answer questions about whether kids will inherit a Roth IRA tax-free, the rules around a traditional IRA transer, investing in a Vanguard target date fund, and where to safely invest for growth. […]