More Episodes

When it comes to taxes, planning ahead is key, it’s a year-round commitment that ties into your retirement vision. Pure’s Financial Advisor, Ryan Miiller, CFP®, AIF®, analyzes the newest tax updates for 2024 and show you how they fit into your personal financial journey. FREE GUIDE | 2024 Tax Planning Guide Transcript For the first […]

It’s a voice message extravaganza as Joe and Big Al talk about tax gain harvesting on Dante in New York’s daughter’s custodial account, and the tax impacts of Leon in Chicago investing in his brokerage account. The fellas also spitball on whether Michelle in San Diego, en route to San Francisco, should buy or rent in her 60s, the mega backdoor Roth and the pro rata rule for Sean and his cichlids in Winter Springs, Florida, and whether Jason in NOLA can do the backdoor after recharacterizing his contribution. Plus, should Kevin in Ohio make like the Steve Miller Band and “take the (pension) money and run”? Can Scott in Colorado make like Johnny Paycheck and “take his job and shove it” when it’s time for the rule of 55? And should Suzi and Peter consider long-term care insurance and protecting their assets with an irrevocable trust?

Do you know the difference between tax deductions and tax credits? Pure’s Financial Planner, Peter Stokes, CFP®, AIF® discusses how both options can cut down your tax bill, but in different ways. Tax deductions work to reduce taxable income, while tax credits directly impact the taxes that you owe. Learn more about: Tax credits for […]

When in retirement, your priority will likely shift from earning on investments to safeguarding and preserving your savings. Pure’s Financial Planner, Annie Chen, CFP®, AIF®, points out potential withdrawal trapdoors you may stumble into during retirement. FREE GUIDE | Withdrawal Strategy Guide Transcript Once you’ve transitioned into retirement, it’s less about what you can earn […]

Are you wrestling with your taxes and getting body slammed? Taxes are often not part of many people’s financial plan, an oversight that can cost you tens of thousands of dollars if it isn’t. Taxes can knock you out – you have to know the moves to keep away from a TKO. Most people are ready to […]

What comes to mind when you think of your taxes? Do you feel pain in your stomach? Financial professionals Joe Anderson and Alan Clopine want to empower you to maximize your return by using strategic tax planning. They take a look at the changes in tax law and give you some tools and strategies to […]

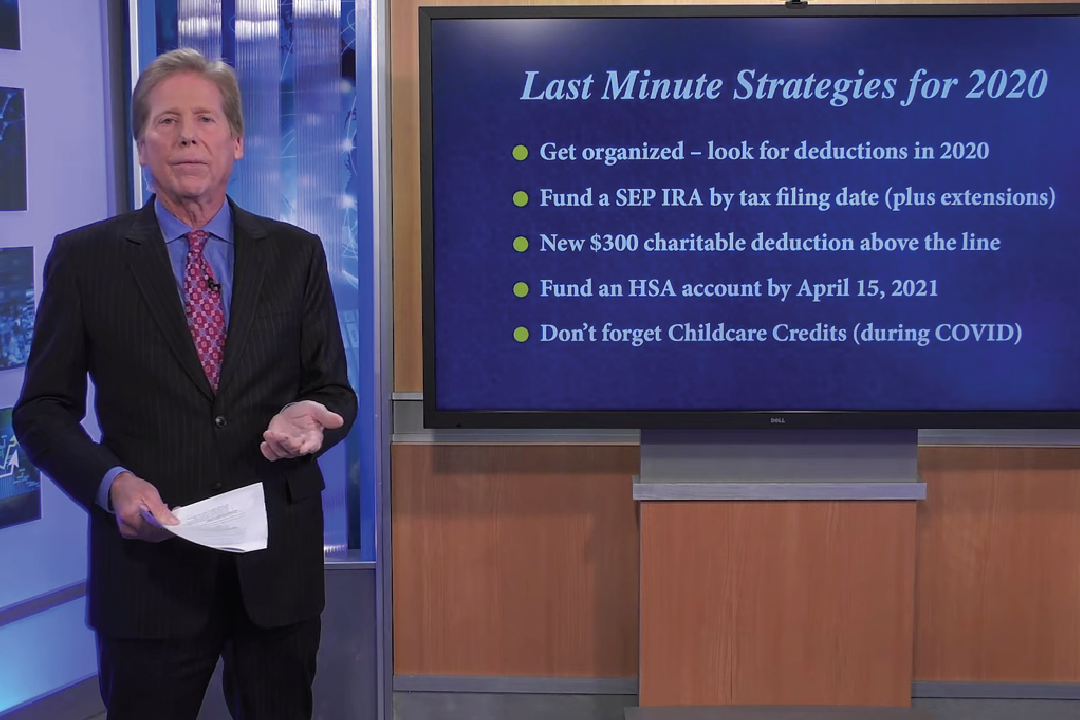

Stimulus checks, CRD’s, and changes in RMD’s – if there is ever a year that you could make mistakes on your taxes, this is it. Last tax year, 747 billion dollars worth of tax deductions were claimed, but many more were missed. Financial professionals Joe Anderson and Alan Clopine want to help you avoid costly […]

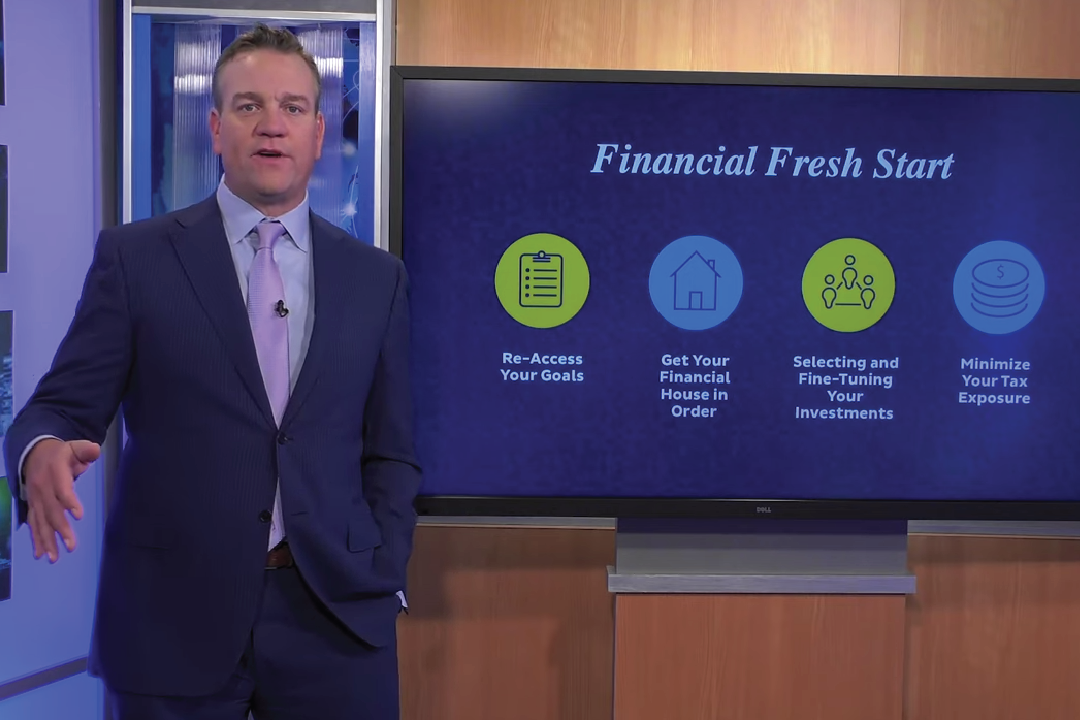

Nothing like a world-wide pandemic to get you ready for a Financial Fresh Start in the new calendar year. While 2020, certainly came with challenges, it also highlighted how important having a plan in place is for your sense of security now and into the future. Financial professionals Joe Anderson and Alan Clopine provide the […]

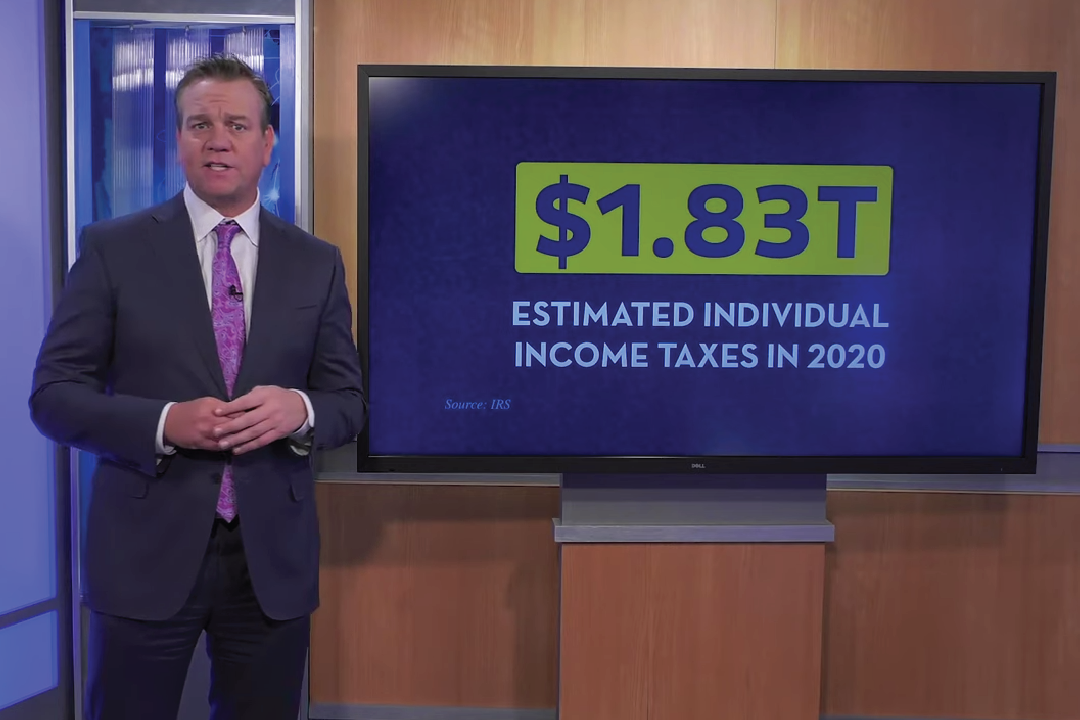

Like most everything else in 2020, taxes are a little different this year. It is essential that you understand the short-term and long-term rules and regulations that guide how much you will pay to Uncle Sam. Financial professionals Joe Anderson and Alan Clopine guide you through the ins-and-outs of the changes in the tax acts […]

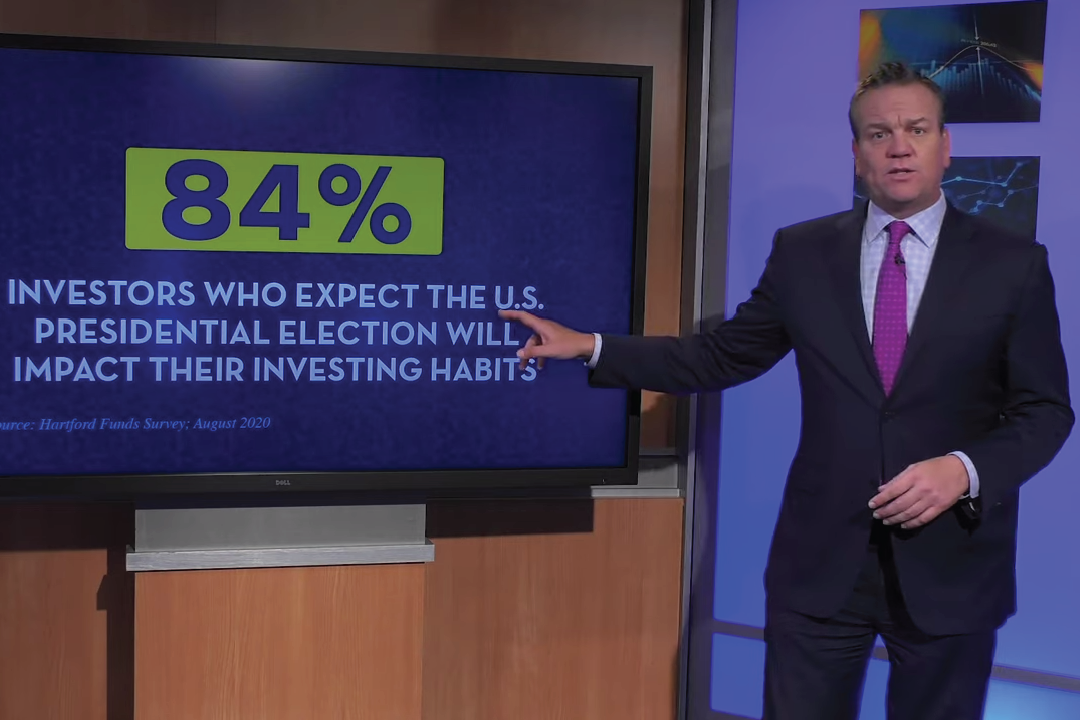

The U.S. Presidential campaigns are full of threats claiming that if one side or the other wins, the market will dip or surge. Does the party of the person who becomes the commander-in-chief really drive the market in one direction or the other? Financial professionals Joe Anderson and Alan Clopine take a historical look at […]

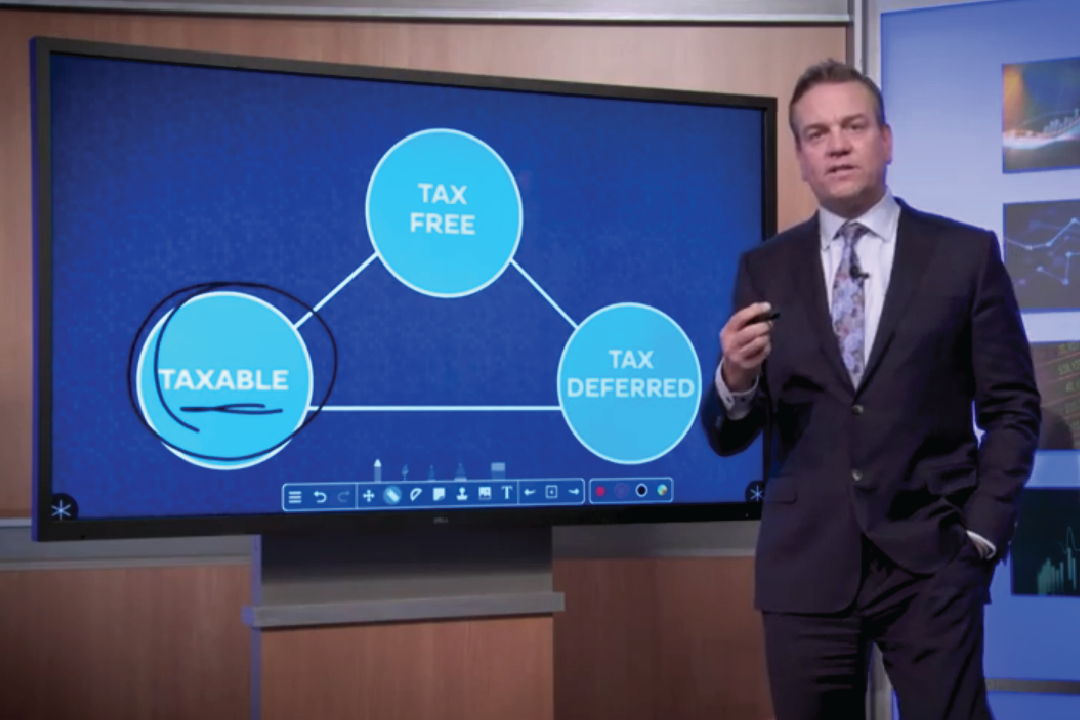

Taking control of your taxes in retirement can help put more disposable income back in your wallet rather than giving it to the taxman. You can’t control the stock market or how long your job may be available to work, but you can have an impact on how much you pay in taxes. Financial professionals […]

Are you planning on selling a business or expect to have a big boost in your income? We asked financial professionals Joe Anderson and Alan Clopine about tax strategies to help keep more of what you earn. From tax-loss harvesting to a donor-advised fund, the duo gives you tips on ways to limit your tax […]

Saving money on your tax bill can be easier if you own a business. If you are an employee, you may feel like there is almost nothing you can do. But help is on the way! Financial professionals Joe Anderson and Alan Clopine explore the tools and strategies you can use to keep more of […]

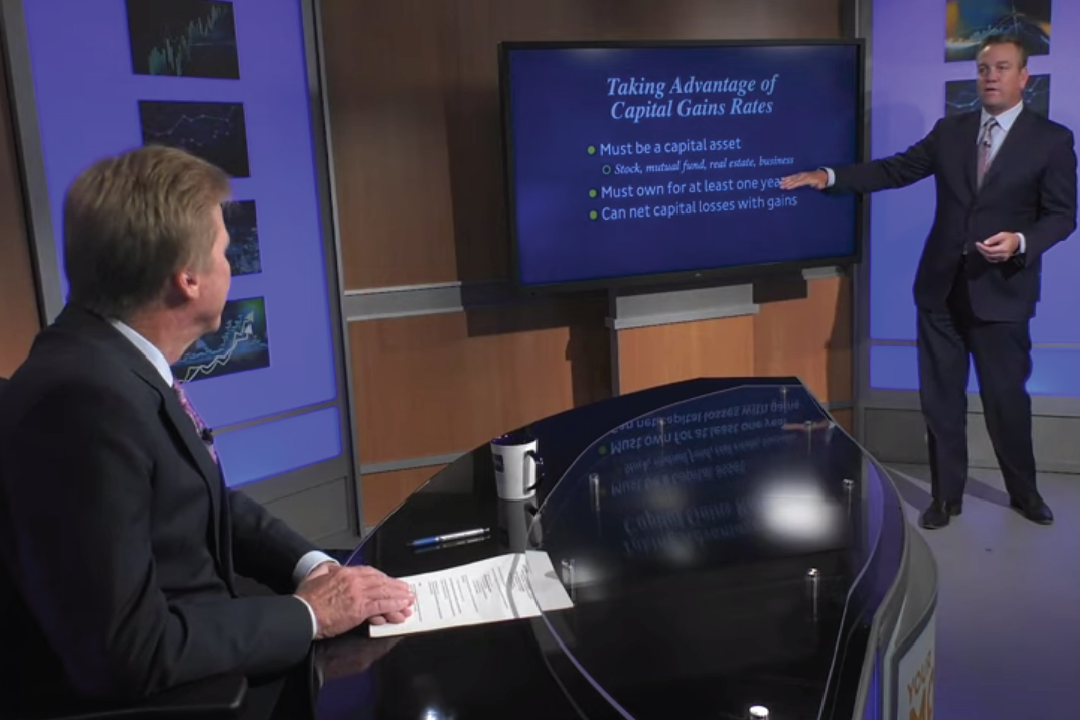

Capital gains can be unwelcome words when you meet with your accountant at the end of the year. However, there are strategies you can use to help lower the amount of taxes you pay even when you cash in profitable stocks. Financial professionals Joe Anderson and Alan Clopine explain the benefits of tax gain harvesting […]

Are you using the available tools and strategies to reduce your tax bill? Many admit they don’t even know if a donor-advised fund or a SEP IRA are options for their personal tax planning. Financial professionals Joe Anderson and Alan Clopine take a look at income tax and charitable strategies that can make a big […]