More

At Pure, our finance white papers cover a wide range of topics involving the financial and investment industry as a whole. These educational guides are written by experienced professionals that have extensive knowledge on these topics. Whether you are looking to learn the very basics of finance or want to dive deep into tax planning, we have something for you. These financial services white papers can also help you develop a proper financial, retirement, or estate strategy to help you secure a bright future. Make financial planning easier by educating yourself with our wealth management white papers.

Retirement savings and available tax breaks have changed substantially with the SECURE 2.0 Act of 2022. It’s part of the $1.7 trillion omnibus budget bill that became law in December 2022, and it contains about 100 different provisions that may affect you. Amanda Cook, CPA, Tax Planning Manager at Pure Financial Advisors, provides a very […]

The Setting Every Community Up for Retirement Enhancement Act, or the SECURE Act, was included in a bill passed by Congress in December 2019, becoming effective on January 1, 2020. At the end of 2022, President Biden signed a $1.7 trillion bill into law. The Secure Act 2.0 comes with a lot of retirement and […]

Will the Senate pass the SECURE Act 2.0, and will it require a Roth option for retirement savings? Plus, “pandemic unemployment” from the CARES Act and the earned income tax credit. Next, are you eligible to make Roth contributions, and should you contribute only to Roth for retirement? Then, the pros and cons of consolidating retirement accounts, and some early retirement spitball analyses. When you plan to retire early, should you invest in dividend-paying stocks or real estate? And finally, is the bucket investing strategy really that complicated?

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

Question: I’m 46 and I want to start doing Roth conversions. Should I wait until I retire to avoid paying higher taxes or are there issues with putting it off? Watch the full episode, SECURE Act Savvy Make sure to subscribe to our channel for more helpful tips and the latest episodes of “Your Money, […]

Question: I’d like to retire next year at age 56, but I’m concerned that the tax penalty will eat away at my retirement account. Any suggestions? Watch the full episode, SECURE Act Savvy Make sure to subscribe to our channel for more helpful tips and the latest episodes of “Your Money, Your Wealth.”

Probably the biggest change in the SECURE Act was the repeal of the Stretch IRA. This provision used to allow your non-spousal beneficiaries (such as your kids or other beneficiaries that are not your spouse) to stretch their required minimum distributions over their lifetimes. Beginning in 2020, a beneficiary IRA must be depleted within 10 […]

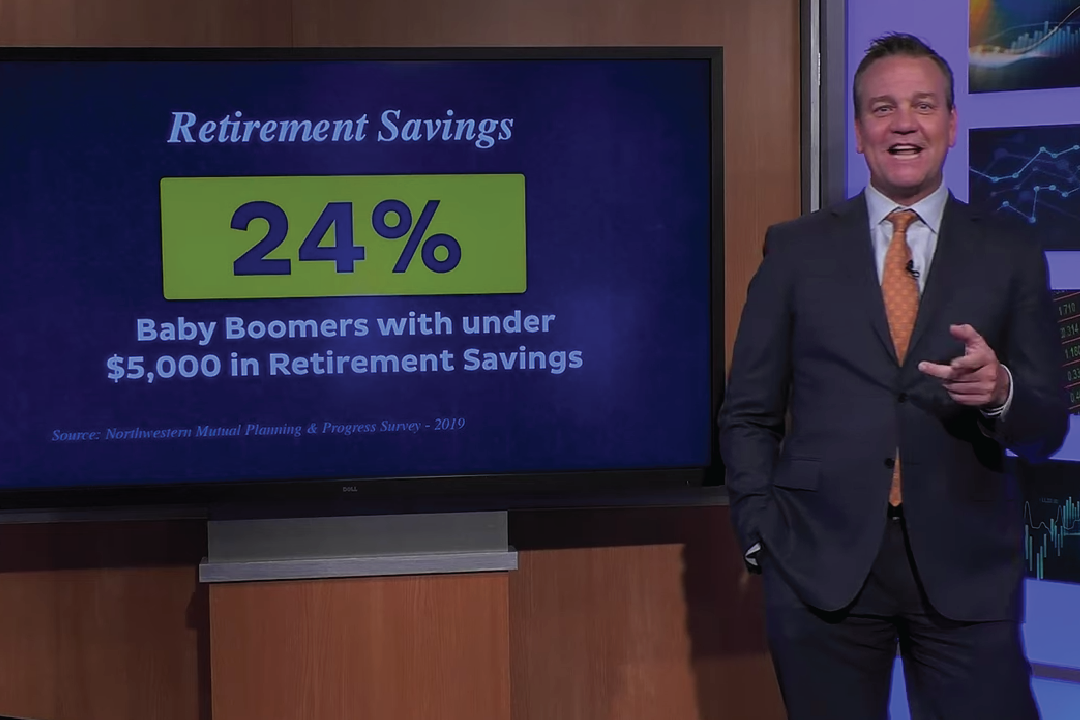

Congress passed the largest retirement savings reform in more than a decade in December of 2019 when they passed the SECURE Act, the Setting Every Community Up For Retirement Enhancement Act. The Pension Protection Act in 2006 was the last major change. What do the SECURE Act changes mean for you, your ability to save […]

What might a Joe Biden presidency mean for your taxes? Learn about Biden’s proposed changes to the current tax laws, and how the provisions from Donald Trump’s CARES Act Coronavirus stimulus package and the SECURE Act affect your taxes and retirement planning. On August 26, 2020, Joe Anderson, CFP®, Big Al Clopine, CPA, and YMYW […]

Congress passed the largest retirement savings reform in more than a decade when they passed the Secure Act also known as the Setting Every Community Up For Retirement Enhancement Act. Do you know what the Secure Act means for you and your retirement? Financial professionals Joe Anderson and Alan Clopine help you to become Secure […]

Joe and Big Al tackle your SECURE Act retirement planning questions: how minors can distribute inherited IRAs, whether a trust should be your IRA beneficiary, and what effect the new law has on required minimum distributions, or RMDs, and qualified charitable distributions, or QCDs. Plus, the fellas get schooled by YMYW listeners on their Thrift […]

How does the SECURE Act affect your retirement plans? Alan Clopine, CPA of Pure Financial Advisors explains some of the key changes to retirement savings effective January 1, 2020, including required minimum distributions (RMD), IRA contributions, annuities, and changes to the stretch IRA provision. Transcript: Hot off the press, the SECURE Act: Setting Every Community […]

The Setting Every Community Up for Retirement Enhancement Act, or the SECURE Act, was included in a bill passed by Congress in December 2019. This legislation is effective as of January 1, 2020. This guide will lay out how the SECURE Act will affect your retirement plans. In this guide, you will learn the changes […]