More

TJ in Louisiana has been sitting on the sidelines, but now it’s time to get into the market. Should he dollar cost average, or just go all in? Does Margaret in CA’s idea of selling a stock at a loss and buying a put option on that stock that expires after the 30-day waiting period work as a tax loss harvesting strategy? When is it worth it for Brian in Charlotte, NC to diversify beyond a basic three-fund portfolio? Should Christine in San Diego convert her variable annuity to a fixed indexed annuity? How should Dean in Columbus, GA invest inherited retirement money? Are Jen and John in CA on track for retirement, and how should they fund their home remodel? Are there any negative consequences for Steve in PA if he finds a new financial advisor just a few months after hiring his current advisor? The fellas also talk through how Chris can give money to charity from his required minimum distributions (RMDs), and finally, Terry calls in with a follow-up question about whether a solo 401(k) is an option to avoid unrelated business income tax (UBIT).

How is Kimberly’s strategy for reducing her retirement taxes by doing Roth conversions and qualified charitable distributions? Is Patrick’s tax loss harvesting transaction a wash sale? At what marginal tax rate should Brian stop making Roth 401(k) contributions? Joe and Big Al are back this week to answer these questions. Plus, spitballing on the importance of international stock in John in Seattle’s diversified investment portfolio, David and Terri’s Roth conversion and I bond strategy, Blake’s severance package, and the impact of a new home purchase on John in DC’s retirement spending.

Linda is retired and financially independent. Her advisor suggests she have a separately managed account, specifically for tax loss harvesting. Joe and Big Al spitball on how to save as much tax as possible on retirement withdrawals. Plus, Brian wants to know if it ever makes sense to put IRA money into a brokerage account, rather than doing Roth conversions, so the fellas explain the benefits of tax gain harvesting. Also, why is Robert and Jane’s financial advisor constantly trading in Jane’s professionally managed account? Pete wants to know if flat-fee financial advisors are worth their fee, and Daniel needs financial guidance for his 34-year-old daughter. He’s also considering a free assessment, but he doesn’t really know what he’s getting himself into, so Joe and Al explain.

There are aspects of your retirement planning that you can’t control, but are you controlling the controllable – like your taxes in retirement? The White House estimates that our collective individual income tax will add up to $2.3 trillion this year! How much of that will you be paying? Learn from Joe Anderson, CFP®, and […]

Is it better to pay tax on $5 million than on $1 million, or is that crazy talk? Also, an asset location strategy to lower RMDs and taxes but still maintain portfolio growth, and an argument against Roth IRAs. Is it a valid one? Plus, what counts as contributions if you withdraw from your Roth IRA after 5 years? Why not pay the tax on a Roth conversion out of your IRA? Roth conversions vs. the medical insurance ACA subsidy, and what? Joe, arrogant?!

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

Joe & Big Al discuss various strategies to protect your portfolio from a stock market crash: stop losses, put options, collars, non-correlated alternative investments, and tax-managed buy-and-hold. Also: how should you measure financial advisor performance? How does tax-loss harvesting work? Are health savings accounts (HSA) tax-free? Is alternative minimum tax (AMT) a concern when moving Roth to an annuity? And our first “Dear Joe” question, in the Derails: how do you get your mother-in-law to stop smoking in your car without starting a fight?

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

Does it matter if you put retirement savings in the older spouse’s accounts first? Does Marion have a good VTSAX to VTWAX tax-loss harvesting and portfolio rebalancing strategy? Plus, Joe and Big Al help you make sense of fees – both from your financial advisor and on exchange-traded funds, or ETFs. Big Al will provide […]

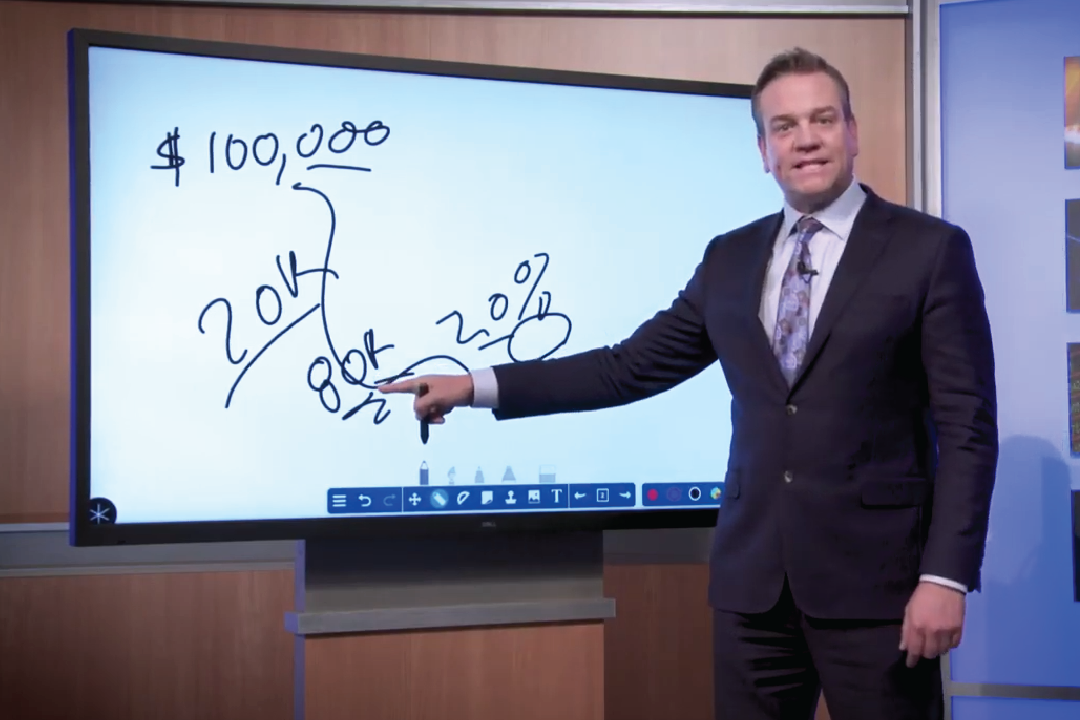

Tired of writing a big check to Uncle Sam? You can help take the sting out of your tax bill by using financial planning tools and strategies. Financial professionals Joe Anderson and Alan Clopine discuss how tax-loss harvesting can help create tax savings. They caution against counting on antiques or rare coins to fund your […]

Looking for ways to save money on your taxes? While losing money on an investment may not seem like the ideal plan for your retirement savings, the loss may be used in a strategy to maximize your bottom line. Financial professionals Joe Anderson and Alan Clopine walk you through the concept of tax loss harvesting […]

Want to learn how to earn tax-free income in retirement? Taking the sting out of your tax bill can be as easy as using a simple strategy called tax loss harvesting. Financial professionals Joe Anderson and Alan Clopine explain how creating a tax loss can actually increase your bottom line. Click here to watch the […]