More

Purefinancial

Can Clark Kent’s dad in Hutchinson, Kansas retire at age 50? Will Devin in South Carolina be fat and happy or cutting calories if he retires at 59 and a half? Can Scott Magic in Idaho retire to a good and simple life at age 60? Gina and her wife are 52 and 58. Can they retire in four years, and how much should they be putting in their Roth accounts? Plus, Frenchie in Maine needs a spitball on a Roth conversion strategy with Canadian retirement funds, and Andi shares what she knows about target date funds.

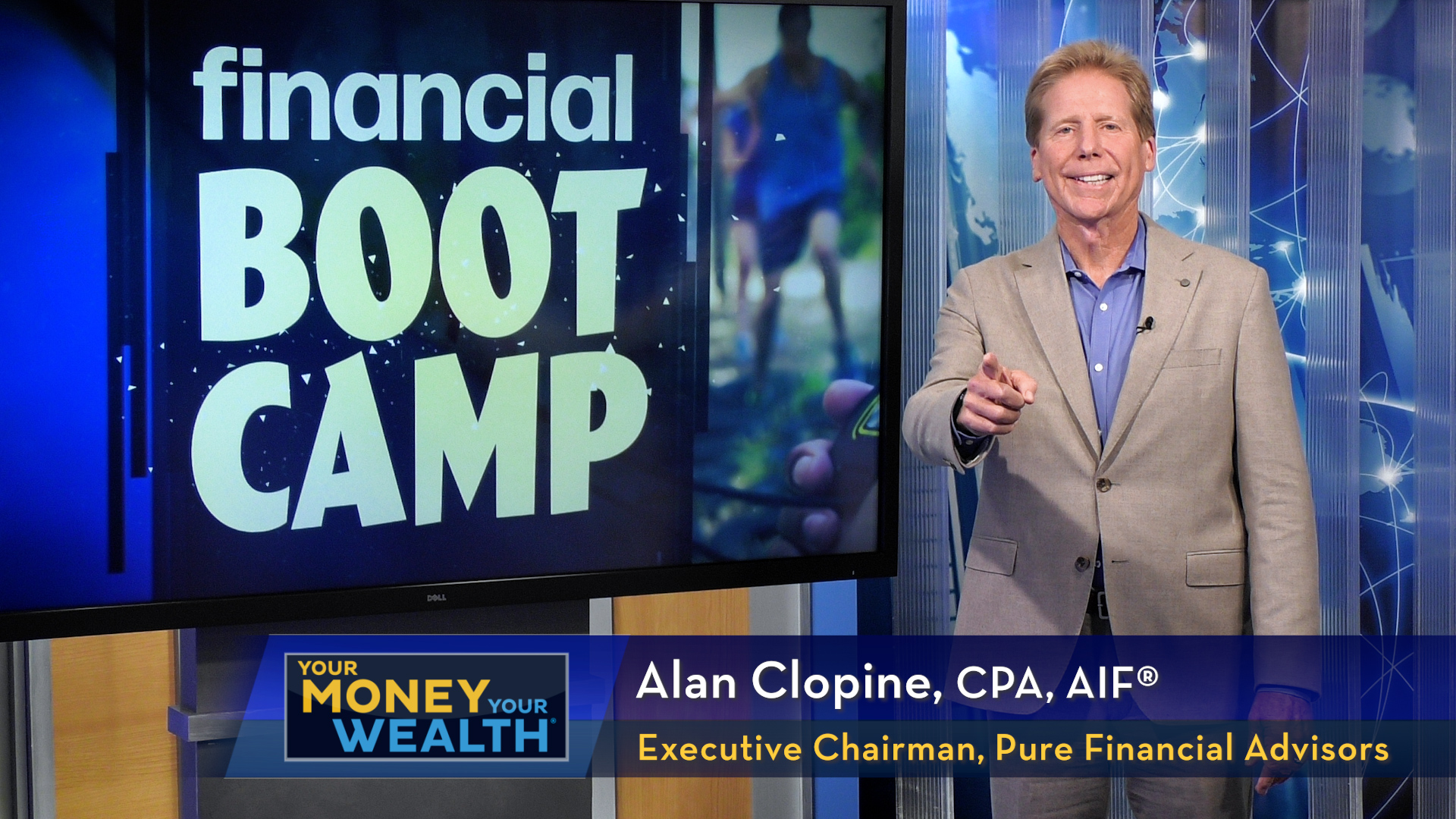

Stocks and bonds, 401(k)s and IRAs – how investment savvy are you? Less than half of Americans have a solid understanding of basic investing terms and concepts. It can be difficult to grow your wealth if you don’t know what tools and strategies are available, much less know how to use them to develop a […]

Can your investment portfolio be over diversified? How do dividends and net unrealized appreciation (NUA) work? How will ownership inequality in the stock market impact future returns for most investors? What do Joe & Big Al think of target date funds? Plus, the YMYW podcast is now on video! Watch the fellas spitball on annuities, bonds, long-term treasuries, risk tolerance, the buckets of money investing strategy and the latest on the Roth provisions in the Build Back Better Act. Show notes, video clips, free resources, Ask Joe & Al On Air: https://bizlink.to/ymyw-352

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

Tanja Hester (OurNextLife.com, award-winning financial independence blog) talks about her new book, Work Optional: Retire Early the Non-Penny-Pinching Way. Joe and Big Al answer questions about whether kids will inherit a Roth IRA tax-free, the rules around a traditional IRA transer, investing in a Vanguard target date fund, and where to safely invest for growth. […]