More

Purefinancial

What is private credit and where does it fit in your investment portfolio? At age 60, Hope is tired of working and she’s hoping to retire in 2-3 years. Should she factor home equity into her retirement spending plan with a reverse mortgage? Which mortgage option for a Houston dream home is best for Nisa in San Jose’s early retirement goals Plus, Wayne in Phoenix needs to know how the section 121 tax exclusion works on a vacation home, and Jack and Jill in the UAE have questions about tax gain harvesting and the foreign earned income exclusion. Finally, are Joe and Big Al off their strategy game? A Spotify listener takes the fellas to task about the Affordable Care Act subsidy discussed in episode 472, and challenges their spitball for Duke and Daisy’s retirement spending plan in episode 475.

Home equity may be the biggest asset you own. Many people prefer not to include their home as part of their cash flow plan in retirement, but we’re living longer and retirement is getting more expensive! In this episode of YMYW TV, Joe Anderson, CFP® and Big Al Clopine, CPA explore ways to use your […]

Joe and Big Al attempt to clearly and succinctly explain modified adjusted income for Medicare and IRMAA, and the pro-rata and aggregation rules for Roth conversions. Will a combat zone TSP transfer be subject to those rules? Plus, joint tenants with rights of survivorship vs. transfer on death for a brokerage account, reducing taxes on the sale of a timeshare, how much to spend on home improvements, and using a reverse mortgage instead of long-term care insurance. And wait ’til you hear the fellas’ thoughts on the best way to pay the least amount of tax when you cash out your retirement savings to buy gold and silver.

The pros, cons, and mistakes of rental real estate investing, how to eliminate mortgage payments and create monthly income with a reverse mortgage, and potential side hustles and passive income streams in retirement, presented by Alan Clopine, CPA, of Pure Financial Advisors and Your Money, Your Wealth®. Transcript: Andi: Alternative retirement income sources, real estate […]

If you’re thinking of paying off your mortgage, Joe and Big Al can help you walk through your investing and tax strategy first. Plus, after maxing out your retirement accounts and health savings account (HSA) and owning rental real estate, how else should you save for retirement? (Hint: brokerage account.) As a self-employed small business […]

Cameron Huddleston discusses her book, Mom and Dad, We Need to Talk: How to Have Essential Conversations With Your Parents About Their Finances. But first, we talk glide path: should you invest more aggressively through retirement? Which assets should you spend before you take Social Security? What should your portfolio withdrawal strategy be if you don’t […]

Your Roth IRA questions answered: when should you do a Roth conversion? Should you wait until you’re in retirement to convert? What kind of income is it? How do you convert slowly so the tax bite doesn’t hurt so much? How long do you have to work before you can contribute to a Roth IRA? […]

An entire episode dedicated to money questions that run the gamut: from Roth conversions and the Mega Backdoor Roth strategy to IULs to insure future income, reverse mortgages in recession, divorce and retirement accounts, and much more. Listen to the podcast on YouTube: Subscribe to the YMYW podcast Subscribe to the YMYW podcast newsletter FOLLOW […]

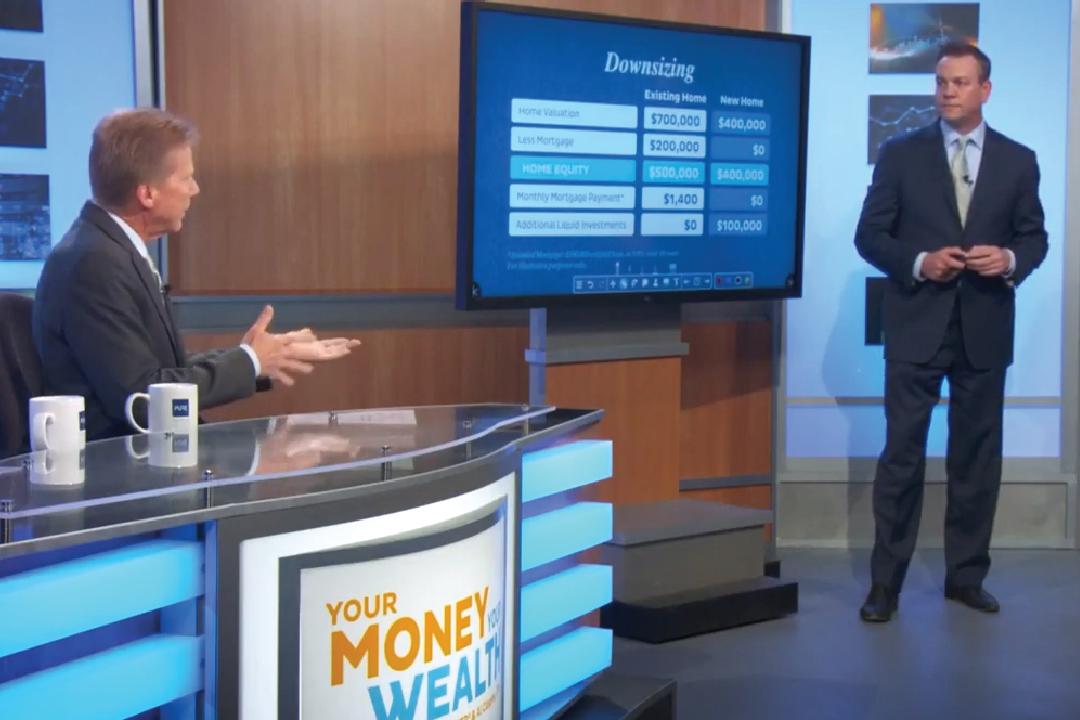

Chances are your home is your biggest investment. How can you make the most of your home in retirement? Financial professionals Joe Anderson and Alan Clopine discuss the benefits of downsizing and dispel the myths about reverse mortgages. Transcript: Joe: Real estate is a very interesting asset class, and a lot of us already own […]

Plenty of risks threaten retirement, and today we focus on managing risks from longevity, inflation, sequence of returns, taxes, interest rates, and lost opportunity. Plus, Professor Jamie Hopkins from The American College and the New York Life Center for Retirement Income talks about how our risky investor behavior needs Rewirement (which happens to be the title of […]

Dr. Wade Pfau of RetirementResearcher.com returns to Your Money, Your Wealth® to share some incredible reverse mortgage strategies that can supercharge your retirement when executed correctly. He also updates us on the new rules for reverse mortgages since the 2018 tax law has changed, explains why they have traditionally gotten such bad press, and how […]

Are you getting close to retirement but aren’t sure if you will have enough of an income stream to enjoy your time in retirement? Financial Experts Joe and Al explore ways to produce more income with the largest asset many retirees own: their home. American College Professor, Wade Pfau, takes a look at the pros […]

Meir Statman, professor of finance at Santa Clara University and author of Finance For Normal People: How Investors and Markets Behave tells Joe and Big Al how smart people can avoid doing stupid things when it comes to investing. Also, are you house rich but cash poor as you approach retirement? The fellas have some strategies for making […]