More

What should Martin do about his outrageously fee-heavy 403(b) plan? Should EF hedge his pre-tax non-qualified 415 excess plan? What should Max do with his old TIAA plan, and what are the pros and cons of a cash balance plan for self-employed people like Brent Money? Plus, Mike needs Joe and Big Al’s spitball on the highly compensated employee rule and excess 401(k) contributions, and the fellas explain how employee stock purchase plans are taxed for Big Cheese Bob the Tomato.

Have you ever had a water leak in your sprinkler system or your pipes and it was so small you didn’t even notice – at least until you got your bill? And then you are shocked – how could the bill be so big for a leak so small you didn’t even notice it? The […]

On your road to retirement have you stayed focused on the magic number you needed in your retirement account that you calculated years ago? Many retirees admit to having serious blind spots when they look at their retirement plans. It may seem basic, but one of the best things you can do is put a plan […]

True/False Question: It’s best to stop contributing to my employer’s retirement plan during a recession and wait until the market recovers. Watch the full episode, Stress-Test Your Retirement Plan Make sure to subscribe to our channel for more helpful tips and the latest episodes of “Your Money, Your Wealth.”

Baby boomers are reinventing what it means to be retired. Today retirement is often about keeping active, emotional fulfillment and more and more about working in a new Gig Economy. Whether you’re looking to supplement your income or just want a job to keep your stimulated, financial professionals Joe Anderson and Alan Clopine break down […]

Thinking of starting your own business after you retire? It is a growing trend in this Gig Economy. More retirees are getting a side job or starting the business of their dreams. Financial professionals Joe Anderson and Alan Clopine discuss what you need to know about limiting your tax exposure when you get a side […]

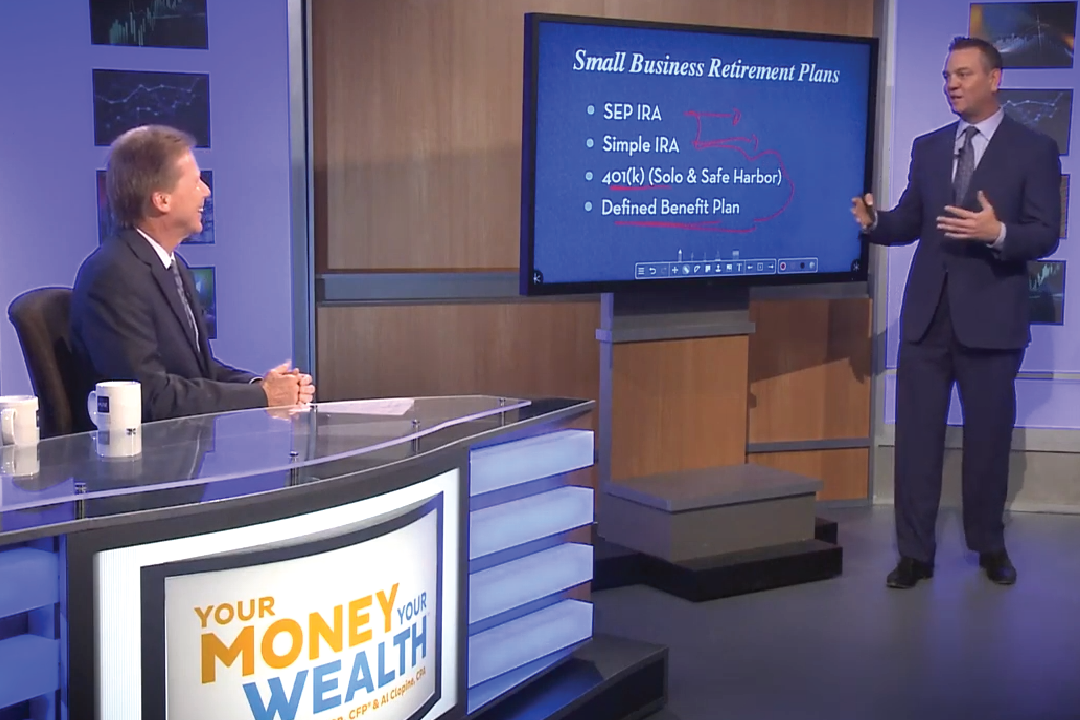

Starting your own business in retirement can mean having retirement plans available to you that were not available before you joined the Gig Economy. Financial professionals Joe Anderson and Alan Clopine explain the tax benefits from various retirement plans ranging from a defined benefit plan to a SEP IRA. Click here to watch the full […]

Do you enjoy tinkering with your car or making home repairs by watching do-it-yourself shows? Then you may be a good candidate for DIY or do-it-yourself retirement planning. Everyone needs a financial plan for retirement but not everyone needs a professional financial planner. Financial professionals Joe Anderson and Alan Clopine help you explore if you […]

Are you self-employed? Do you know the top plans you should be using to generate more retirement income? Pure Financial Advisors Financial Planner Allison Alley, CFP® outlines the best retirement plan options for the self-employed. Transcript: We often get the question asking us, “what’s the best retirement plan if I’m self-employed?” Well, that’s hard to say. […]