More Posts

Part 3: Real Estate Investment Trusts (REITs) This article is the third in a series looking at the pros and cons of various income-producing vehicles. But before we dive in, we’ll begin with an important caveat: Here at Pure Financial Advisors, we believe that for most individuals, the income alternatives we’ll be discussing are best […]

Part 2: Rental Real Estate This article is the second in a series looking at the pros and cons of various income-producing vehicles to help you determine whether they belong in your portfolio mix. But before we dive in, we’ll begin with an important caveat: Here at Pure Financial Advisors, we believe that for most […]

Want to take the sting out of your tax bill? Real estate can be a valuable investment tool and a mechanism for lowering the amount of taxes you pay. Trying to decide if a 1031 exchange or a charitable trust is the best tool for you to use can be overwhelming and confusing. Financial professionals […]

Financial professionals Joe Anderson and Alan Clopine are getting real about real estate. The duo breaks down the pros and cons of buying real estate with your retirement accounts. From tax consequences to the possible impact on your required minimum distributions they discuss the top considerations if you are considering buying real estate with a […]

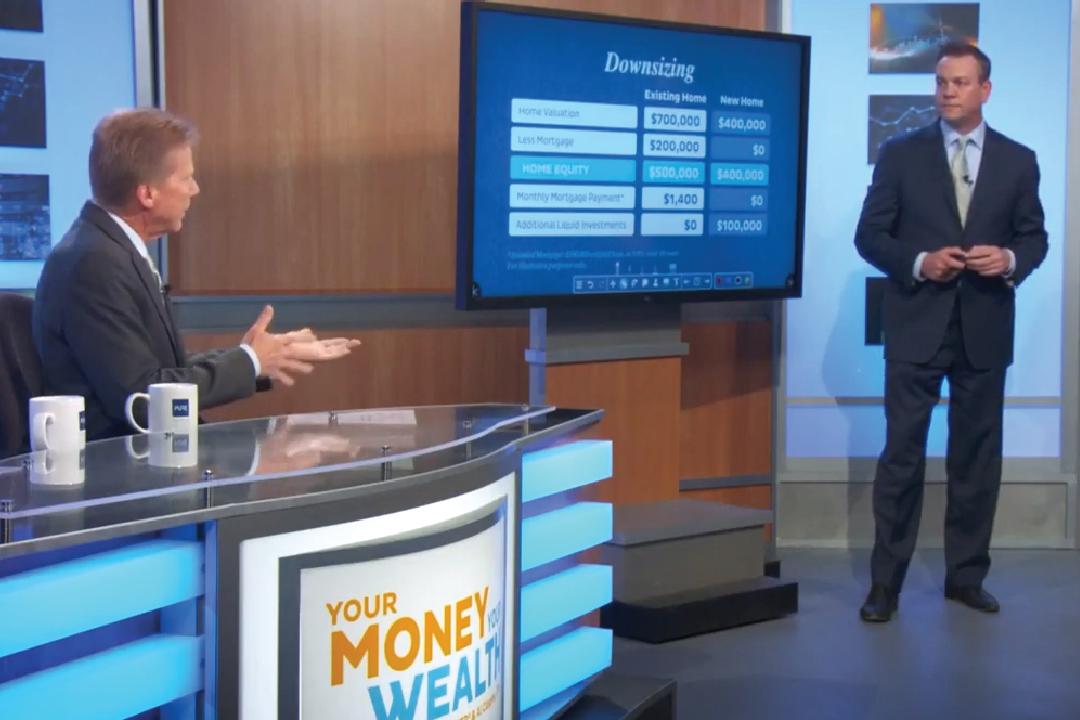

Chances are your home is your biggest investment. How can you make the most of your home in retirement? Financial professionals Joe Anderson and Alan Clopine discuss the benefits of downsizing and dispel the myths about reverse mortgages. Transcript: Joe: Real estate is a very interesting asset class, and a lot of us already own […]