More

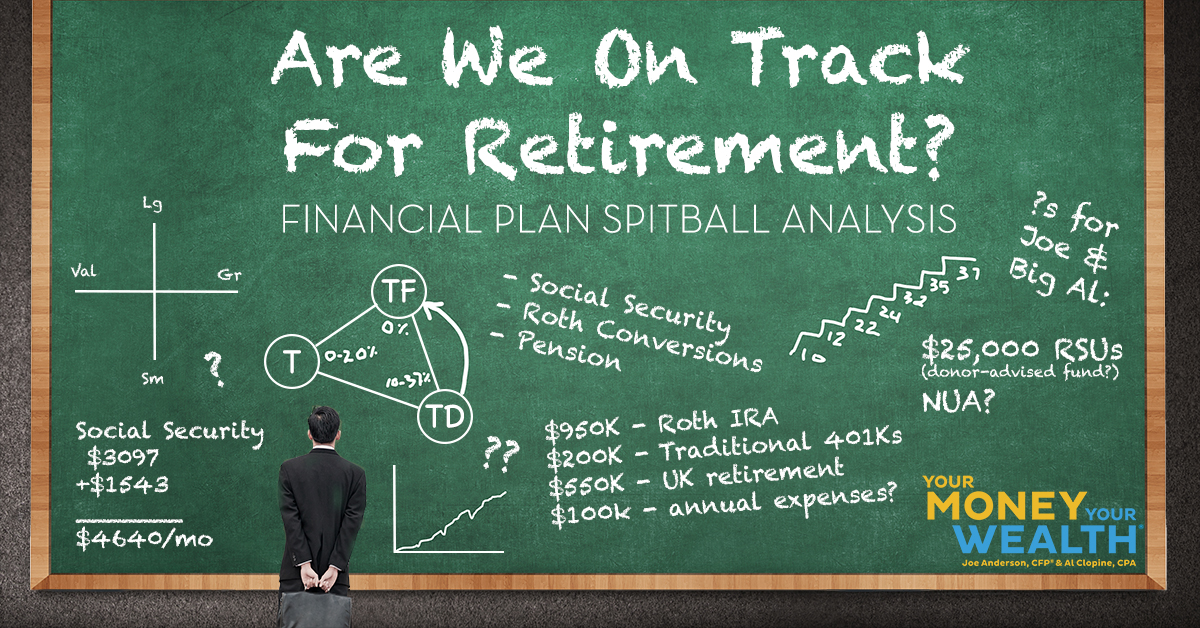

Purefinancial

It’s a common question: should you pay off your mortgage when you have extra cash, or invest for retirement? Joe and Big Al spitball on how Ms. Moneybags and her wife-to-be should use their upcoming windfall. Plus, what should Bob’s asset allocation be as he nears retirement? Should Harley and Harlene do Roth conversions after tax rates increase, and should they take advantage of net unrealized appreciation (NUA) on Harlene’s company stock? Pete needs a 13-year retirement plan sanity check, Lauren wants to know if she can retire early or at least go part-time, and Michael and Carol want the fellas to spitball whether they’re on track for retirement.