More Posts

Are you among the 49% of retirees making the same mistake that quietly costs thousands every single year? The good news is, it can be fixed with a little clarity and some thoughtful planning. Find out what that mistake is and how to avoid draining your portfolio faster than you planned, as Joe Anderson, CFP® […]

Mark Salisbury, PhD, CEO & Co-Founder of TuitionFit, alongside Pure’s Principal, Marc Horner, CFP®, shares insights on how families can approach the college tuition process with confidence and make smarter decisions. Outline 0:00 Introduction & Overview 2:09 Education as a Pathway 4:22 College Pricing & Discounts 5:45 The College Selection Process 8:40 Starting with Price 13:43 Negotiation Strategies 22:06 Public vs Private […]

No matter what stage of life you’re in, certain milestones can indicate meaningful financial changes to consider. Pure’s Principal, Marc Horner, CFP®, shows us how financial planning evolves across those milestones and why adjusting your plan along the way matters. Transcript Financial planning isn’t about predicting every detail of your future. It’s about […]

Pure’s Financial Advisor, Blaine Thiederman, CFP®, breaks down the true cost of long-term care and why planning early can help protect your independence, your future, and your peace of mind. Transcript When people think about long-term care, they often picture something far off in the future or something that only happens to other families. But […]

Pure’s Senior Financial Advisor, Joe Schweiger, CFP®, AIF®, explores budgeting through a financially fit mindset, emphasizing consistency and practicality when building a resilient budget for the new year. Transcript January is the time for setting fitness goals, but if your finances stepped on the scale today, what shape would they be in? If you think […]

When it comes to setting up your adult children for long-term success, a vital cornerstone is providing them with critical financial knowledge. Pure’s Principal, Marc Horner, CFP®, shares practical ways you can prepare your children to build a solid financial foundation. Transcript As a financial planner, a common question I hear from parents is: ‘How […]

Pure’s Senior Financial Advisor, Michael Chipperfield, CFP®, AIF®, provides six critical considerations for growing families who want to establish a stronger financial foundation. Transcript Here’s a jaw-dropping stat: it now costs over $300,000 on average to raise a child in the U.S. over 18 years.1 If you’re just becoming a parent or expecting, you’re entering […]

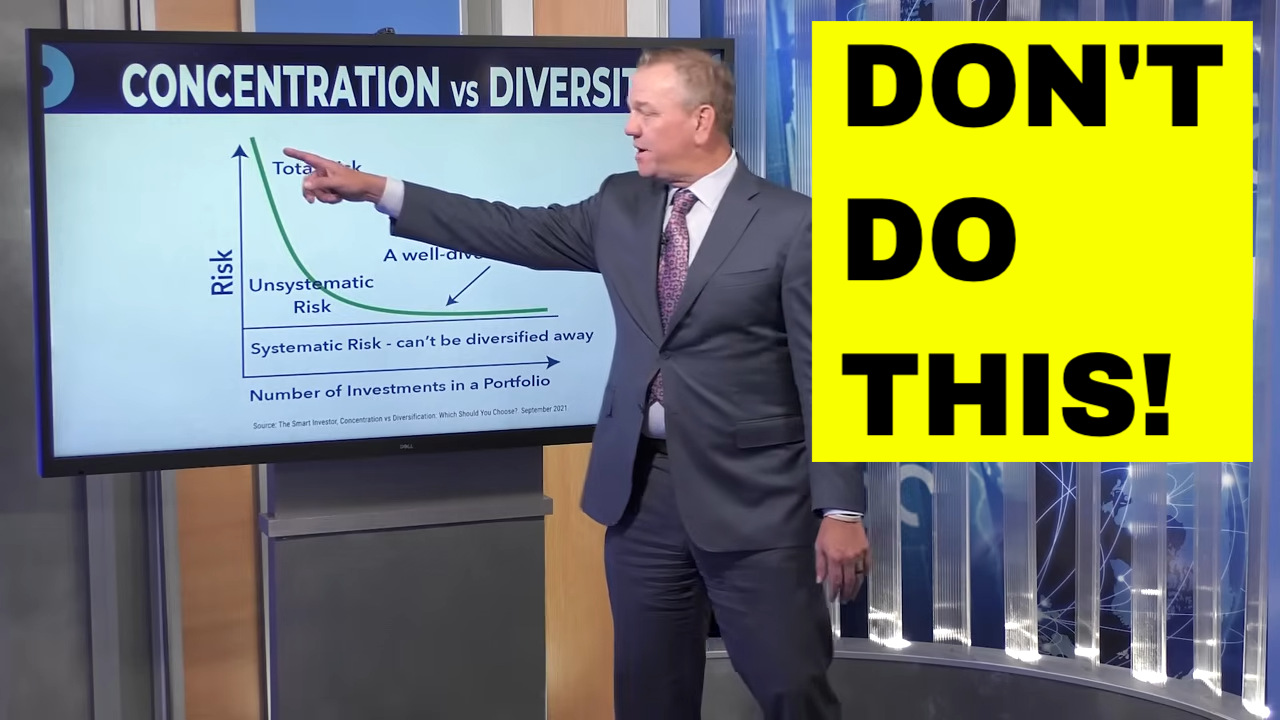

You’ve heard the phrase, “if it sounds too good to be true, it probably is”? Not everything you see online is good advice, especially when it comes to personal finance tips from self-proclaimed “finfluencers”. Joe Anderson, CFP®, and Big Al Clopine, CPA, expose what’s hype, what’s harmful, and how to protect your retirement from bad […]

Want to pay zero tax on your retirement income? Joe Anderson, CFP® and Big Al Clopine, CPA lay out how to make it happen with smart planning and the right mix of income sources. Discover the secrets to a tax-free retirement! Joe and Big Al dive deep into tax planning and Roth conversion strategies, smart […]

Are your emotions sabotaging your financial success? Find out how to fix your relationship with money for good! Joe Anderson, CFP®, and Big Al Clopine, CPA, show you how the emotions of investing can impact your portfolio, and how your money personality might be keeping you broke. Learn the investing biases and investing mistakes to […]

Joe and Big Al spitball on how to avoid screwing up the timing of your Roth conversions: Barrie from New York is 62 and single, and she’s been diligently converting pre-tax money each year for lifetime tax-free Roth growth. Should she continue after she retires next year? “Jerry and Elaine” want to retire in the next six years and still leave the kids an inheritance. When should they start Roth conversions? Alex in Pennsylvania is a 31-year-old software engineer. Should he convert his IRA to Roth all at once? Plus, how can he transition into a career as a financial planner? A clarification from one of our YouTube viewers on the age plus 20 rule of thumb for retirement contributions is very un-clarified for Joe, and the fellas let Lisa in San Diego know whether she can use her rental real estate income to fund a Roth 401(k).

Think you’re ready to retire? Joe Anderson, CFP® and Big Al Clopine, CPA reveal six powerful signs that show whether you truly have enough to quit working—and what steps you can take now to secure the retirement you’ve always imagined. Calculate your FREE Financial Blueprint Important Points: 00:00 – Intro: The #1 Question About […]