More Posts

The holiday season is a great time to focus on giving back, so have you considered strategies to maximize the impact of your charitable donations? Pure’s Senior Financial Advisor, Allison Alley, CFP®, AIF®, shares six practical steps to help you plan your giving to ensure your contributions make a meaningful difference to the causes and […]

Updated for 2025: ‘Tis the season to give and get back! Americans give billions of dollars to charitable organizations throughout the year. While most of us know that you can get a tax deduction from giving, do you know how to maximize that tax deduction? In this guide, you’ll learn how to maximize your tax […]

If you give a gift, the IRS will forgive a tax! Put away your checkbook – Joe Anderson, CFP® and special guest Allison Alley, CFP® show you six secrets to getting bigger tax savings from your donations to charity, including organizations like 501(c)(3) non-profits, churches, and schools. Tax-Smart Charitable Giving: Financial Goals Charitable Giving Strategies […]

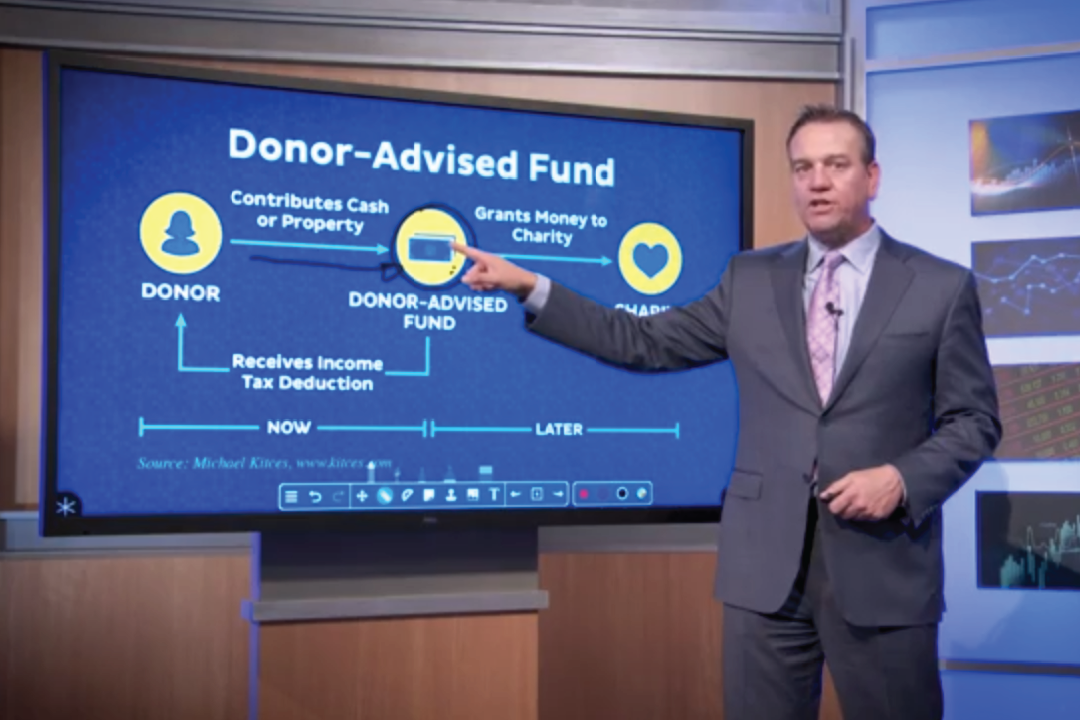

Johnson Andrews, CFP®, AIF®, Financial Planner, Irvine, covers three tax saving strategies: Employer Match 401k plans: The Triple Bonus Charitable Giving: Donor Advised Fund & QCD’s Start Your Own Gig Business: Tons of Deductions. FREE GUIDE | 2023 Tax Planning Guide Transcript 1. Employer Match 401k Plans In a traditional plan, when you contribute a […]

‘Tis the season to give and to get back. Americans give billions of dollars to 501(c)(3) non-profit charitable organizations throughout the year. While most of us know that you can get a tax deduction for giving, do you know how to maximize that tax deduction? In this webinar, Alan Clopine, CPA, Chief Financial Officer and […]

From Thanksgiving to New Years Day, people are generally in a festive and giving mood. In fact, about 30% of all donations to non-profit organizations happen in the month of December. Pure’s Senior Financial Planner, Hillel Katzeff, CFP®, covers some best practices for you to give to charity. FREE GUIDE | Charitable Giving: Steps on […]

Senior Financial Planner, Brian Sauter, CFP®, AIF®, reviews three strategies for charitable giving and how to maximize your tax deductions. FREE GUIDE | Charitable Giving: Steps on Informed Giving Transcript There are several ways that you can donate to charity. You can use cash or check, appreciated stock or real estate, clothing, household items, vehicles […]

‘Tis the season to give and to get back! Alan Clopine, CPA lists many ways to maximize your tax deductions when giving to charity by using donor-advised funds, bunching donations, qualified charitable distributions, charitable remainder trust, charitable gift annuity, gifting appreciated stock, and much more. DOWNLOAD | 2021 TAX PLANNING CHECKLIST Subscribe to our YouTube […]

Donor-Advised Funds – The gift that gives back! William Hodapp, CFP®, CPA, AIF® explains how you can support your favorite charity, get a tax deduction, and potentially grow your contribution to benefit charities even more. DOWNLOAD | TAX PLANNING CHECKLIST Subscribe to our YouTube channel. IMPORTANT DISCLOSURES: • Investment Advisory and Financial Planning Services are […]

Asset location: how to position assets to pay less tax without sacrificing investment growth? Should young folks contribute all of their retirement savings to Roth accounts? Also, conversations (not advice) on a self-employed defined benefit plan vs. pass-through profits, gifting tuition for education, making Roth conversions with a special needs child in mind, a correction on inherited Roth IRAs, and plenty of entertaining listener comments and Derails.

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

No one likes to think about life after they are gone, but it can you give some valuable peace of mind to know that your loved ones are taken care of after your days on this planet have ended. We asked financial professionals Joe Anderson and Alan Clopine how to utilize a stretch IRA and […]

There are so many non-profit causes worthy of your charitable gifts. You can donate to charity from your investments rather than writing a check! In this video, Kyle Stacey, CFP® outlines 3 planned giving strategies that will save you money on taxes, allowing you to stretch your donations to charity even further. Transcript: So today […]

Danielle Kunkle Roberts of BoomerBenefits.com on Medicare basics, parts A to D, signing up, common mistakes, Medigap vs. Medicare Advantage, recent improvements to Medicare, and the future: will Medicare For All or Medicare At 50 become reality? Plus, Joe and Big Al answer your money questions: are health insurance premiums deductible? And when do you […]

A qualified charitable distribution, or QCD, is a distribution you can make from your IRA directly to a charity if you are eligible for required minimum distributions. In this video, Matt Balderston, CFP® from Pure Financial Advisors outlines the rules and limits for this type of charitable giving. Transcription: Today we’re going to be talking […]

Do you have some extra money this holiday season and want to give to charity? What if you could make that gift stretch a little further and ease your tax burden? Financial experts Joe Anderson and Alan Clopine breakdown different strategies to help make giving to charity a little easier. From analyzing your overall needs […]