Joe & Big Al discuss various strategies to protect your portfolio from a stock market crash: stop losses, put options, collars, non-correlated alternative investments, and tax-managed buy-and-hold. Also: how should you measure financial advisor performance? How does tax-loss harvesting work? Are health savings accounts (HSA) tax-free? Is alternative minimum tax (AMT) a concern when moving Roth to an annuity? And our first “Dear Joe” question, in the Derails: how do you get your mother-in-law to stop smoking in your car without starting a fight?

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

Show Notes

- (01:06) Should I Use Stop Losses, Puts, Options, Collars to Protect Stocks Against a Market Crash? (Steve, San Diego)

- (07:51) What’s the Safest Short-Term Note I Can Invest in to Earn 7% Yield? (Matt)

- (09:57) How Do You Measure CERTIFIED FINANCIAL PLANNER™ Professional Performance? (Pat, Houston, TX)

- (18:54) Is HSA Tax-Free or Not? (John, Abilene, TX)

- (21:50) How Does Tax Loss Harvesting Work? (Will)

- (28:01) Roth Contribution Strategy with DROP and Pension (Mike, Columbus, OH)

- (33:06) Do We Have to Worry About Alternative Minimum Tax When Moving Roth Funds to an Annuity? (George, Charlotte, NC)

- (34:30) How Pacino/McConaughey Movie Two for the Money is Like Investing Behavior

- (39:10) Derails: Al Clopine Vs. Mike Schmidt. Dear Joe: How Do I Get My Mother-in-Law Not to Smoke in My Car? (John, Abilene, TX)

Free resources:

Big ERN, Karsten Jeske: EarlyRetirementNow.com

What is a Fiduciary? Why is Fiduciary Duty Important?

What to Expect from a Financial Advisor:

YMYW S. 6 E. 10: Don’t Let the Taxman Ruin Your Retirement (Tax Loss Harvesting and Other Strategies):

Listen to today’s podcast episode on YouTube:

Transcription

Today on Your Money, Your Wealth® podcast 329, Joe and Big Al talk about the different methods investors use to protect their investments from a potential stock market crash and earn the best possible yield: from put options and option collars, to non-correlated alternative investments, to an aggressively tax-managed buy-and-hold strategy allocated to meet your goals and risk tolerance. Plus, how do you measure the performance of your financial advisor? How does tax-loss harvesting work? What’s the tax status of health savings accounts? The fellas also discuss a Roth contribution strategy with a DROP plan and a pension, and whether alternative minimum tax is a concern when moving Roth funds to an annuity. And you’ll want to stay with us through the Derails for our first “Dear Joe” non-financial question: How can John in Abilene Get his mother in law not to smoke in his car without starting a fight? If you’ve got a money question, random life question, comment or story, click Ask Joe and Al On Air at YourMoneyYourWealth.com. I’m producer Andi Last, and here are the hosts of Your Money, Your Wealth®, Joe Anderson, CFP® and Big Al Clopine, CPA.

Should I Use Stop Losses, Puts, Options, Collars to Protect Stocks Against a Market Crash? (Steve, San Diego)

Joe: We got Steve writes in from San Diego. “Hi, Joe, Big Al and Andi. The show’s really strong these days-”

Al: It wasn’t so good before.

Joe: “- just like my portfolio.” How’s your portfolio? Strong.

Al: Strong.

Joe: It’s strong. “I love listening to it each week. How can I protect my stock investments against a potential market crash?” So is that the question, Steve? “I’m a long-term buy-and-hold investor. Assume that good portfolio management practices are already in place, diversification, asset allocation, rebalancing, dollar-cost averaging. No matter how small or large your stock holdings are, they are 100% exposed to market downturn. That includes mutual funds, ETFs, individual stocks. Is there a way to protect each long-term equity position? I’ve heard of things like trailing stop losses, put options, collars, and such. The other choices seem to be either just wait it out or try to time the top and the bottom. But that’s risky. I’m looking for something in between. Appreciate your thoughts.” Of course, you can protect on the downside. You can put stop losses in. So what a stop loss is, is that I buy a stock for $10 a share and then you put a stop loss in. If it goes to $8 a share, you sell, you’re out.

Al: It automatically sells. So you’re done.

Joe: So I guess you could put it at $9- if you buy the $10 a share, you can put a $9.95 maybe. I’ve never bought a stop loss. Have you, Al?

Al: No, and this is just my opinion. My feeling on stop losses is it very often just locks in a loss.

Joe: Because you got to buy back in.

Al: Yeah. You got to buy back in at some time. And when do you buy back in?

Joe: I don’t know.

Al: It seems like- pretty much all the research I’ve seen over the last 5, 6, 7 decades will tell you that it’s almost impossible to time the market and those that do oftentimes, if not more often than not, end up in a worse case than people that just stayed in the market. So I think what you do instead, and Steve, you’ve already got an allocation between stock and bonds. So great. But maybe you need more bond allocation. Maybe if you’re very concerned about the market going down and what it’s going to do to your portfolio and it’s going to affect your spending and your goals in the future, maybe you got too much in stocks to begin with. But see, the thing is, you could have done this strategy, any of these strategies, the stop loss is one of them. You can buy options. There are things you can do. But the thing is, you could have done this in 2015. There would have been a great justification to do it. But then you would have missed 6 years of the best bull market probably in our lifetime. But even though at that time it seemed really high. So I guess what I’m saying is I wouldn’t worry too much about it, get the right allocation, rebalance as appropriate. When the stock market goes down, it allows you to buy more in stocks because your bonds will hold their value, allowing you to recover that much more quickly. And if you look at what happened during the Great Recession 2008, people that did that ended up recovering very quickly. So that’s my thought.

Joe: He doesn’t like that thought, I bet.

Al: I know.

Joe: He wants something sexy. He wants the sizzle.

Al: He wants protection. I get it.

Joe: Yeah. You want to do some collars, struts-

Al: How about this? So I’ll go another direction. What about more non-correlated assets? Like reinsurance or something weird like that.

Andi: What is reinsurance?

Joe: Liquid alts?

Al: Liquid alts, yeah. Well, how about if there’s a hurricane?

Al: Then you’re screwed. Reinsurance- it’s kind of like, how would you describe it? Is that kind of like insurance on top of insurance?

Joe: They insure the insurance companies.

Al: So something- as long as something doesn’t go terribly wrong, you make money. So it has zero correlation to the market. But if there’s a gigantic hurricane or volcanic explosion in Denver, you might not do so well with that program.

Joe: You could look at something exotic. But there are options traders that could absolutely do this for you, Steve. However, you have to look, there’s a cost of saving you on the downside, you know what I mean? Risk and expected return are related. You could get all the funny- Al and I believe in the boring stuff. So we’re probably the wrong show to answer.

Al: Yeah, probably there’s a better show than ours for this question.

Joe: They get all into the sophistication on put options and option collars. But there are strategies that you could employ for your overall portfolio. If I were to bet- if I were a betting man, you take a buy-and-hold strategy that’s super boring, that’s allocated to your specific goals and you rebalance, and you tax-manage the hell out of it and you have the right allocation and you give it 10 years versus an option strategy- I don’t know- I would be interested to see who would win.

Al: Yeah, remember, was it Warren Buffett that said ‘I betcha the hedge funds can’t beat the S&P 500- ‘

Joe: Oh, without question.

Al: ‘- for 10 years?’ And sure enough the S&P won.

Joe: But that’s also BS too, because he’s taken a hedge fund like proxy. I mean, there are some badass hedge funds out there that you and I will never even be able to sniff at.

Al: We’re not allowed.

Joe: We’re not even close to being allowed. So, yeah, there’s a lot of really interesting strategies that you could do with your money. If you want to do some stuff with options and collars, by all means, go for it, take a look at it, look at the pros and cons.

Al: I guess if you’re asking us, our opinion is it’s not worth it.

Joe: Right. Because we don’t know how the hell to do it. You ask me to put a caller on something. I don’t know. I was like, where’s your dog?

Al: Yeah, right.

Andi: Joe, do you remember Big Ern? We had him on the show?

Joe: I know Big Ern.

Andi: Karsten Jeske?

Joe: Yes, he’s really smart, right?

Andi: Yeah. And he talked a lot about doing that.

Joe: What was his website?

Andi: EarlyRetirementNow.com.

Joe: EarlyRetirementNow.com. There ya go Steve, call Big Ern.

Andi: We did an episode with him called How Much Can You Spend When You’re On FIRE? Because he was a FIRE guy.

Joe: Oh, yeah. There you go.

Al: Got it.

Joe: Big Ern can show you the way.

What’s the Safest Short-Term Note I Can Invest in to Earn 7% Yield? (Matt)

Joe: We got Matt writes in. “I have $100,000. What’s my safest short-term note for 7% yield.” OK, another one for Big Ern. What the hell are you talking about, Matt?

Al: There’s no such thing as a safe investment at 7%. So I’ll tell you what. So like a mortgage loan right now, you can get for 3% probably or under. And so and even a jumbo loan, I don’t know, what’s that going to be, 3.5%, 4%? So OK, so if someone-

Joe: – super subprime.

Al: Yeah, right.

Joe: Someone’s about to file bankruptcy. I lend him money or her money.

Al: If someone is willing to pay you 7%, there’s something going on here. There’s an issue. There’s a risk. So we talk- we just said that, risk and return are related. So you’re not going to find a safe 7% yield. But I will give you one little tip, if that wasn’t a good enough answer. If you want a 7% yield, try to make sure it’s secured by something, like real estate as opposed to like an unsecured loan. So at least if it goes bad, you’ll have something to go back on.

I’ve linked to that YMYW episode, #236 with Big ERN, Karsten Jeske, in the podcast show notes at YourMoneyYourWealth.com. So how do you avoid poor investment decisions, protect yourself from risk, and grow your investments in all market environments? Markets are bound to fluctuate, but there are 8 investing principles that will help you feel confident in your portfolio even when markets are volatile, available in the podcast show notes as well. Listen to Big ERN, read the transcript of this episode, download 8 Timeless Investing Principles, and Ask Joe and Big Al your money questions – you can do it all in the podcast show notes at YourMoneyYourWealth.com by clicking the link in the description of today’s episode in your favorite podcast app. And if you dig the show, why not tell someone about it? That’s the best way to thank Joe and Big Al for all the information, suggestions and entertainment they provide every week on YMYW. See where it says “share post” at the top of the show notes? You know what to do….

How Do You Measure CERTIFIED FINANCIAL PLANNER™ Professional Performance? (Pat, Houston, TX)

Joe: I got Pat from Houston, Texas. “Hey, Andi and those two other guys.”

Andi: Thanks, Pat.

Joe: Look at Big Pat.

Al: Yeah. We’re just a couple of guys. I like that.

Joe: That’s all right. I’m going to lose my voice here. “I love to listen to the show and appreciate your humorous and straight-shooting approach. Very informative. A recent question you guys answered reminded me of a question I have asked other CFP®s, but really never got a great answer. The question you answered was from a listener that wanted to know if he should hire a CFP®. I agree that CFP®s have value and I work with one now and plan to continue in the future. My question, how do you measure the performance of CFP®? It does not seem fair to look at portfolio performance alone as a big chunk of what the CFP® does is advising during market downturns. But seems that CFP®s or anyone managing money should be measured by some kind of performance standard against a market benchmark or my thinking about this wrong? FYI, here’s the responses I have obtained-”

Al: Oh, so Pat’s been asking this question a lot.

Joe: So far.

Al: She’s categorizing all the answers even.

Joe: Pat could be a male too.

A: Yeah, it could be.

Joe: Just like Rikki.

Al: I know. I shouldn’t say that. I should say ‘they’, shouldn’t I?

Joe: “Number 1) A list of factors that should not be used to evaluate performance. If I think I’m receiving value-” Yeah, OK, so these are the responses that he’s getting. So he’s asking the CFP®s, he’s like, hey, how do I know if you’re worth a grain of salt? And the responses- is he getting? Is this what he’s doing here?

Al: Yeah, he’s categorizing. He must have- he or she- they, they-

Joe: Pat.

Al: Pat. I’ll just say ‘Pat’. Pat has asked a number of CFP®s I’m guessing, because-

Joe: And then here’s the categories that the responses fall into.

Al: Yeah. Yeah. So we would probably have 10 or 15. So they fall into these 3. So he or she is looking for a better-

Joe: Just call it ‘Pat’.

Al: Pat. I can’t help it.

Joe: So Pat receives an answer. And it’s like a list of factors that should not be used to evaluate performance.

Al: That’s one thing.

Joe: OK, “if I think I’m receiving value.” I wonder, well Pat, do you feel like you’re receiving value? “Or a kind of vague developing a relationship based on trust? Seems like there should be more defined way to evaluate whether or not my CFP®’s performance has declined over time. So it would be interesting on your take what would be a reasonable and objective way to measure performance.”

Al: So what do you think? How would you respond to that?

Joe: That’s a really good question.

Andi: Does it fall into one of those 3 categories?

Joe: No, it doesn’t. Not at all.

Al: It’s kind of like Pat’s trying to do a quantitative analysis on a qualitative factor. How do you like that? Is that clever?

Joe: Yes, I agree with you.

Andi: You’re using big words and Joe actually understands them. That’s pretty good.

Al: It’s like, should I evaluate my spouse? How can I measure the performance over the last 33 years?

Joe: I don’t know.

Al: Let’s see, if I list the factors that I shouldn’t use or I’m receiving value-

Joe: I don’t know. Are you?

Al: I am, by the way.

Joe: So yeah. There you go. I think it- the answers are this, is if you’re hiring an advisor and if all they’re doing is managing your money and if they’re using a globally diversified portfolio, it’s really hard to measure anything else because they’re not really doing a lot for you.

Al: Yes. So that is your measure, in that case.

Joe: Right. Then you would measure that CFP® based on a certain benchmark on performance. So if they’re not doing anything else but managing your money, then for sure measure them on a benchmark. Look at what is a globally diversified? Or is it more domestic? Is it international? Or whatever, and then just gauge it on the benchmark. And if they’re outpacing the benchmark, then keep them. If they’re not outpacing the benchmark, then fire them.

Al: And if that’s all they’re doing for you and you’re the type of person that you don’t really care if the market goes up and down, you’re going to stay put, then maybe there’s not a ton of value for you, because once you’ve got the portfolio, you might just maybe once or twice a year look at the portfolio and rebalance it. But you’d be in a pretty similar situation. But for most people, they freak out when the market is going down or they get too optimistic when the market’s going up and they buy and sell at the wrong times.

Joe: And this whole thing based on trust and all that, that’s just a BS way to avoid the question ‘well do you trust me?’ But the person’s got to be somewhat smart in this industry. They have to understand tax law. They have to understand how to create income. You have to understand rebalancing, tax-loss harvesting, asset location. There are so many different things that they should be doing for you on an ongoing basis. If you call them and they don’t respond within 24 hours, then if you have an issue that they can’t explain to you in a way that you totally understand and feel comfortable with, there are all sorts of ways that you can measure this, but it really depends on what they’re doing. There’s a lot of people out there that call themselves CERTIFIED FINANCIAL PLANNER™s. No offense to any CERTIFIED FINANCIAL PLANNER™ out there, but Al and I have interviewed a lot of them and they don’t really understand financial planning. They were able to take a very difficult test, but they’re not really applying it in their day-to-day or work. It is hard to evaluate.

Al: And I’m going to add this, Joe, so we help a lot of our clients save taxes over their lifetime. But that’s very hard to compute in a percentage. Because it’s like I want you to do a Roth conversion because you’re going to save more taxes in retirement, which is like 18 years from now. So it’s like I want you to pay more taxes this year, more taxes next year. So if you just look at that, it’s like I’m actually going backward now.

Joe: I’m not- I’m losing money.

Al: I’m losing money. But if you look at over a lifetime, and that’s the best way we can think about it, is you run projections over a lifetime and look at how much better you’re in the situation. But it’s hard to put that in terms of a rate of return.

Joe: Another thing too, Al. There are ways that CERTIFIED FINANCIAL PLANNER™s or any advisor could do that going through financial planning software, let’s say. Because we’ll run through ‘what if’ scenarios. Here’s where your current situation is since today and use the same assumption as rate of return, inflation, death, blah, blah, blah. And if you follow our recommendations in regards to this for your cash flow, this for income generation, this for tax strategies and so on, pay off your mortgage, don’t pay off your mortgage, things like that. You can see a drastic change in the overall net worth of the overall client. So that’s probably one way to do it. But it’s hard to gauge that against any other advisor. If I was with a different advisor, would I be in a different situation? Here’s my answer. If you’re not with me, the answer is yes, you would be in a lot worse situation. So, Andi, then throw out our number and ask them to call us.

Andi: 888.994.6257.

Al: So here’s another little wrinkle on that. So a lot of times we’ll sit down with an individual or couple and show them that you’ve got plenty to retire, spend more. And so they spend more. So they actually end up in a worse spot, but they had a better quality of life and that’s- how do you measure that?

Joe: I think Pat has an advisor that Pat doesn’t necessarily like. And it’s like, how do I gauge this advisor? There’s got to be a matrix. How do I give this person a grade? Because we’ve been graded our whole life. ‘A’ through ‘F’. I got a ‘C’ on that one, but you know who got an ‘A’? Well, I would rather go with the person that got the ‘A’ than the ‘F’. So I guess we should start-

Al: Maybe you’re on to something. Maybe we should all have 10 advisors. Then we could grade them all ___.

Joe: Maybe.

Al: And then after 5 years, we pick the ones that get “A’s.

Joe: I guess it goes back to kind of your question, that’s why I’ve been single forever. It’s like, well, man, well, this one’s nice, but is there something better out there? Is something better out there? I don’t know.

Al: You haven’t figured out how to do that quantitative analysis yet.

Joe: I haven’t found out yet. So that’s why I have got to test it.

Al: Got it.

Is HSA Tax-Free or Not? (John, Abilene, TX)

Joe: “Hi Andi, Joe, and Grande Al.”

Al: I like it.

Joe: “I’m John from Abilene. Yes Joe, you mispronounced it the last time.”

Andi: Last time you said Abeline.

Al: But Abilene was right.

Andi: Abilene is correct.

Joe: I was perfect.

Al: You learned. You learned. You can learn.

Joe: The kid can learn. “I have a question about HSAs, Health Savings Accounts. I thought after 59 and a half that I could use my HSA just like a Roth for tax-free income. But I recently saw a post that said it was after 65 your withdrawals used for anything but medical will be taxed as ordinary income. I’m lost. Thanks. P.S. Joe, you said on episode 326 you want to start giving random life advice.”

Andi: Dear Joe.

Joe: Let’s hold on to that question.

Al: Yeah, we’ll come back to that. Let’s answer the first question.

Joe: Interesting. This could be fun. Here we go, John from Abilene. The post that you read was right. Sorry.

Al: It was right. So first of all, the only way you get money tax-free out of an HSA is to use it for medical expenses which by the way, you can do anytime throughout your life, age 30, age 50, age 70, whatever. But what you’re thinking of is if you pull money out before age 65 in an HSA and use it for something other than medical, you have to pay ordinary income taxes and a 20% penalty. Once you hit age 65, you can still do the same thing and you pay ordinary income taxes but you don’t have the 20% penalty.

Joe: So here’s the deal with HSAs, the dollars that you put in, you can put up- individuals $3500 and $7100, something like that?

Al: Yeah, somewhere in there.

Joe: Into the HSA. It’s pre-tax, it grows tax-deferred, you can pull it out tax-free. So it’s a triple tax whammy.

Al: Yeah, you get a deduction, as long as you use it for medical.

Joe: Deduction, deferral, and tax-free on the way out. So it’s pretty cool. But, if you do not use it for medical expenses, it doesn’t turn into a Roth IRA, it turns into an IRA. So the IRA, it is taxed as ordinary income because you got a tax deduction going in. So if you’re not using it for medical expenses, it will come out as ordinary income at age 65. And by the way, you cannot contribute to an HSA after age 65 or once you’re Medicare eligible.

Al: But you can almost think of it after age 65, it’s like a combination of a Roth and an IRA. Because if you pulled money out for medical, it is tax-free, just like a Roth. But if you pull it out for anything non-medical, it’s taxed just like an IRA, so it’s kind of somewhere between.

How Does Tax Loss Harvesting Work? (Will)

Joe: What the hell is this? “Hello JABA.”

Al: Oh, I guess if you read it says Joe is the man and then but it’s every line starts with ‘J’ for Joe; ‘O’ for of course; ‘E’ for ever-knowing and omnipotent.

Joe: What the hell is omnipotent again?

Al: It’s like you’re Godly.

Joe: Yeah, I like it. “In all the podcasts about money, ‘S’ is for how is always-

Al: No, “- your Show is always the best, happy people, educational and making finances fun. And now my questions. But the first letter of each line is JOE IS, Joe is, THE, the, MAN, man. Joe is the man. Very clever.

Joe: Can’t argue. Cannot argue that. Oh, we lost Andi again.

Al: Yeah. But we’re still recording.

Joe: “I have been deprived of your podcast since it’s only once a week. So I started watching the season 6 of your YouTube show.

Al: So really? Will, have you watched- have you listened to every podcast? Because we have over 300.

Joe: We have more than that.

Al: I know we do.

Joe: “On episode 2, you talked about tax loss harvesting. I get the concept or maybe not. In your example, you bought at around $30 and if you sell it at around $36, it means you have a gain of $6. But the example strategy was buy at $30, sell around $17, buy something similar at $17 and then sell at $36, creating a loss of $13 and a gain of $19, which is a total of $6 on the surface. Is that the same?”

Al: It is the same.

Joe: Yes, it is the same. So what he’s saying is that if you have a stock at $30 a share, it goes to $15. You sell, you buy something similar and then it goes back up to $30 and you sell it. There’s no gain.

Al: What was the point?

Joe: What’s the point? Why are you doing all this stupid stuff?

Al: Because most of us have more than one stock.

Joe: Yes.

Al: So you sell certain positions to create a loss so that when you pull money out of other positions that have gone up in value, you don’t have to pay tax on it.

Joe: And then you harvest the losses because- unless you only have that one security, you’re going to sell it 100%, then it doesn’t make any sense to do it and then don’t do it.

Al: And I think that’s where people get tripped up and the analysis is correct. I mean, you end up in the same spot, but what they’re forgetting is you should have more than one investment. And that’s the whole point here.

Joe: “Is the strategy being able to use the loss of $13 at full tax rate and only paying the $19 at capital gains rate?” No. The loss is a loss against capital gains. So if you have a capital loss, it will offset capital gains dollar for dollar, but a capital loss will offset ordinary income up to $3000. ” I know one of them is being able to carry over.” Yeah, capital losses will continue to carry over for the rest of your life until you utilize them. So. So, yeah. So let’s say one loses $60,000, Al. Does it matter if it’s short-term and long-term?

Al: Possibly.

Joe: Not on the loss, does it?

Al: It does. Because short-term loss nets against the short-term gain first. Long-term loss, that’s against the long-term gain first. And then if there’s still more losses for one or the other, they net against the other kind. So like, for example, if you know you have a bunch of short-term gains, you’d actually rather- and you have long-term gains, too, you’d rather have some short-term losses because that will net against the short-term gains.

Joe: I think he gets the concept.

Al: Yeah, I think so.

Joe: He was just confused, I think at first of like-

Al: Well, if you look at it in a vacuum with one position that you’re going to sell outright anyway, it doesn’t matter.

Joe: Right. It’s just like doing a Roth versus a Traditional IRA. In a vacuum, it’s always almost the same because of the math.

Al: So here’s a real life story. A friend of mine- so they sold out of a bunch of positions in March of last year when the market went way down because of Covid. And then they were able to rebalance and buy back in. Over the course of the year, their portfolio ended up much higher at year-end than it was at the beginning of the year. Yet they had all these losses and they pulled some money out for living expenses. They paid zero taxes on it because of these losses they harvested. So now you’ve got a portfolio that’s gone up. You took money out and you paid no taxes. That’s the whole point of this.

Joe: Yes. So let’s say they had $1,000,000 portfolio, it’s worth $1,300,000 at the end of the year, but they were able to harvest $200,000 worth of losses.

Al: That’s right. And they needed $100,000. They pulled it out, paid no tax.

Joe: Correct.

Al: That’s what we’re talking about.

Joe: You can’t look at any strategy in a vacuum. Well, My Money My Wealth Will is going to go back to the episode and contrast to the next guy contemplating listening to your show at half the speed just so it can last longer.

Al: Nice.

Joe: Will, stop drinking gasoline, bro.

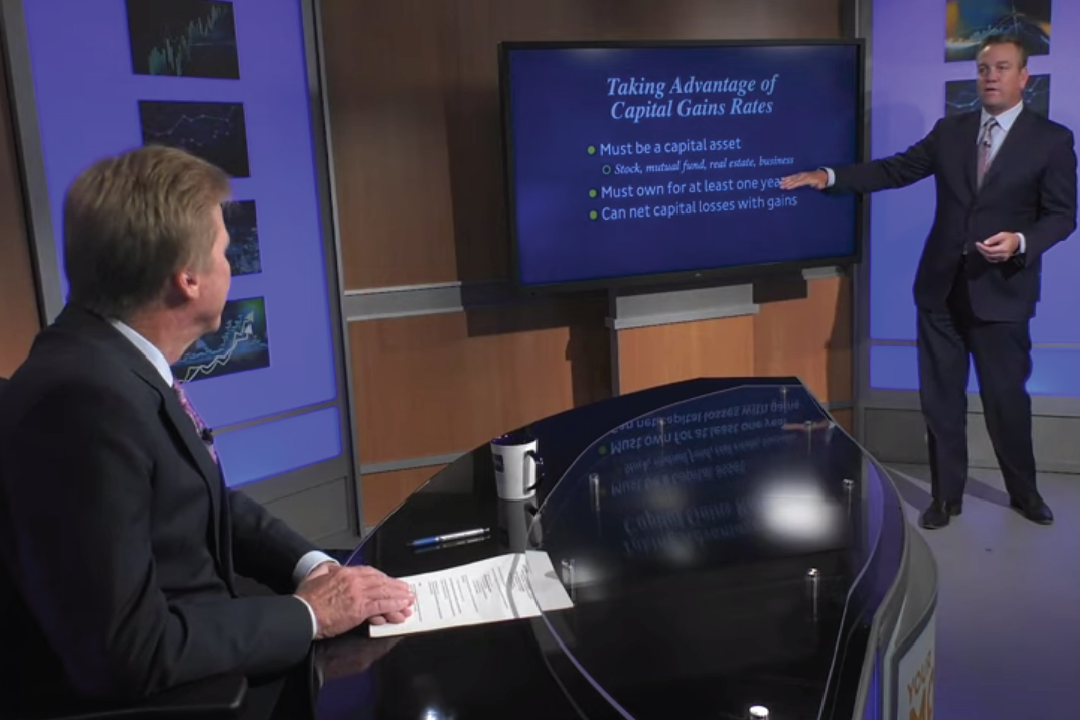

Don’t Let the Taxman Ruin Your Retirement – that’s actually the name of a recent episode of the Your Money, Your Wealth TV show, which of course I’ve posted in the podcast show notes at YourMoneyYourWealth.com. Learn about the different types of income tax, taking advantage of capital gains rates, more on this concept of tax loss harvesting, deductions, exclusions, and more. Make sure you’re subscribed to the Your Money, Your Wealth® newsletter so the latest TV and podcast episodes land right in your email inbox as soon as they’re available. Click the link in the description of today’s episode in your favorite podcast app to subscribe to the YMYW newsletter, and to take control of your taxes in retirement.

Roth Contribution Strategy with DROP and Pension (Mike, Columbus, OH)

Joe: Mike from Columbus writes in. “Hello, Andi, Joe, and Big Al. I absolutely love the show. I’m 52. My wife is 50. We would like to retire in 8 years. I’m a firefighter. My wife is an RN.” Wow. Dynamic duo there. “We’re completely debt-free and drive a 2008 Chevy Silverado and a 2006 BMW. I’ll receive a yearly pension of about $100,000 when I retire. My wife will not receive a pension. I will have approximately $1,000,000 in the DROP account once I retire. Tax-deferred. Currently we have the following assets: $200,000 in tax-free; $500,000 in tax-deferred; and $200,000 in a brokerage account. We have a combined annual income of $225,000. I am unsure if we both will be eligible to make 2021 Roth IRA contributions. However, I do not have a Traditional IRA, so I believe I can deposit the $7000 in the Traditional IRA and then use the infamous backdoor Roth.” Every damn week. “My wife won’t be able to because she has $220,000 in her Traditional and I believe the pro-rata rules apply to her.” Very good. Mike from Columbus.

Al: Yes, you are correct on both those comments.

Joe: “My wife’s employer allows her to make contributions to either 401(k), Roth 401(k), my employer only allows contributions to the Traditional 403(b), although I hear they may soon change that to the Roth 403(b). We should be able to contribute the max to these accounts, $26,000 to both and $7000 to the backdoor. Finally, my question is finding the best strategy to use these contributions. Should I pay taxes now on contributions that can be made to the tax-free options available? Or make contributions to the tax-deferred accounts? When I retire at age 60, I figure we should have approximately $2,000,000, $2,500,000 in our accounts, of this, including the $1,000,000 in the DROP plan will be in tax-deferred accounts. I plan to use my yearly pension and supplement with brokerage account and use the rest of the tax brackets to transfer from pre-tax to tax-free accounts. I hope you can follow my thought process. In the meantime, for the next 8 years, would it be better off filling the bucket with contributions going to tax-free accounts or taking advantage of tax-deferred accounts? Thank you for my question, Mike.” Mike, Roth IRA. 100% all the way.

Andi: Al, do you agree?

Al: I’m going to agree with you on that.

Andi: Oh.

Joe: Because he’s got $100,000 pension.

Al: Right. So $100,000 pension is the same as having a $2,500,000 in an IRA. Roughly, with the 4% distribution rule.

Joe: And what that means is you take 4% out of $2,500,000 is equal to $100,000. Or if you wanted to try to create $100,000 from a retirement account, you would need $2,500,000 to do it.

Al: So we’ll start with $2,500,000. So then we’ll add the $1,000,000 in the DROP, so now that’s $3,500,000, and we’ll add another $500,000 deferred. So it’s equivalent to having $4,000,000 in an IRA 401(k), which is a lot of money. You need more diversification. You’re in, let’s see, at this income level, you’re probably in-

Joe: 24%.

Al: 24%-

Joe: – barely.

Al: Maybe even 22%. You’re right around- and that’s a good rate compared to what it has been and probably what it’s going to be. So, Roth IRA.

Joe: 8 years, jam 100% Roth. I would even convert her IRA into a Roth. So you’re $225,000, let’s call it $200,000 of income and they’re married. So he’s in, what the 24%, just touched the 24% tax bracket- I believe is what, $170,000.

Al: Yeah that’s right.

Joe: OK, he’s got plenty of room in the 24% tax bracket. So over the next 8 years I would get all of that $200,000-some odd out of her IRA into a Roth. I would put 100% of my contributions into the Roth. Because the pension plus her Social Security and I believe I don’t know if firefighters will receive- So yeah, he’s got the pension. I’m not sure about Columbus’s-

Al: It depends on the county, probably.

Joe: – pension plan, but maybe Mike’s got Social Security. Let’s just assume he doesn’t. She’s going to have Social Security plus the fixed income pension. You know, they’re going to be in probably the 25% tax bracket once the tax rates revert back.

Al: And that’s if they revert back to what they were going to. Will they go higher? I mean, that’s possible too. So, yeah, I completely agree with that. And if she converts to the Roth and she can do a backdoor Roth contribution as well.

Joe: Oh yeah. We gotta do the double duty backdoor. Yeah. So much fun. Everyone’s doing the backdoor. OK, all right. Mike, let’s see. Appreciate your email. Appreciate your service too.

Do We Have to Worry About Alternative Minimum Tax When Moving Roth Funds to an Annuity? (George, Charlotte, NC)

Andi: How about George?

Joe: George. Georgy Porgy. “My wife and I have significant retirement investments in our pre-tax bucket and we’ll look to begin moving some of our assets to Roth once I retired June 2021 and my income over the next few years will be much lower. We have $300,000 in a Roth IRAs and we’re thinking about moving these funds into annuities to generate tax-free income stream in retirement. Do we need to worry about any AMT impact in doing this?”

Al: I don’t know of any AMT issue with that, so I would say no.

Joe: Yeah, but why are you going to move the money into annuities? I guess is-

Al: That’s the bigger question, right?

Joe: Yeah, I would not probably move those into annuities, but if he wants to get a guaranteed income, it’s in the Roth and it’s going to give them tax-free income for life.

Al: Guaranteed tax-free.

Joe: Guaranteed tax-free income.

Al: It’s just that with annuities, in general for downside protection, you’re giving up some rate of return and you want your highest rate of return in the Roth. So I’m not sure why you’d want to do that, but that’s just my opinion. Joe: Right, because annuity, your guaranteed income, your expected or your IRR in those are relatively low.

Al: It’s going to be lower. And you kind of want something that’s going to do well because it’s tax-free.

Joe: Right. So something that grows 6% versus 1.5%.

Al: Or whatever.

How Pacino/McConaughey Movie Two for the Money is Like Investing Behavior

Joe: David’s got a pretty long one here. I don’t know if I want to do this one.

Al: We could be able to read about half of it and take a break.

Joe: I don’t know. It’s like making my eyes like-

Al: Some of it is in italics too.

Joe: Yeah, I don’t know. Every time I see that, I just kind of go, oh God, is he referring back to something else? Underlining-

Al: Yeah, he’s quoting us from Andi’s mother’s transcript from our show.

Joe: OK, we’ll just hold off on that one, I guess.

Al: When we have more energy, next show.

Joe: He’s sourcing our answers.

Al: Yeah, that’s right.

Joe: I watched the movie last night that kind of reminded me of our listeners. It was Two For The Money.

Al: Two For The Money.

Joe: Have you heard of it?

Al: No.

Joe: Andi? Any takers there?

Andi: Nope.

Joe: No. It’s with Al Pacino and Matthew McConaughey.

Al: Oh, that would be good.

Joe: It wasn’t that great.

Al: It wasn’t that great?

Joe: No. It was like Matthew McConaughey was like college football star and then he snapped his knee. And so he couldn’t play. And then what Al Pacino is, this TV guy. He had a studio just like us. A TV studio.

Al: Got it.

Joe: But he was a better so he would like he’d call in and we’ll give you 6 picks for Sunday’s games.

Al: I thought you were going to say he was better than us. He was a better, he bets.

Joe: No, he was a gambler.

Al: Got it.

Joe: It was a gambling site or a gambling show.

Al: Got it.

Joe: Yeah. So people would- trying to make money listening to their advice. And of course, everyone made a lot of money and then everyone lost a lot of money. The point of my story, Al-

Al: OK, there’s a point?.

Joe: There is a point. Al Pacino was- he went to Gamblers-

Andi: Anonymous.

Joe: – thank you, I couldn’t say the word. He had a problem with gambling. So he was not gambling, but he ran this big gambling operation. And so Matthew McConaughey comes in and he’s picking all the winners. 13 and 0 one week, 12 and one the other week, just killing it. And of course Al Pacino is like, oh, well, now it’s hot and this guy can’t miss, he’s the Messiah of gambling. So what is Al Pacino do?

Andi: Starts gambling again?

Joe: Starts gambling.

Al: Got it.

Joe: And what does Matthew McConaughey do?

Andi: Crash.

Joe: Starts blowing up. Right. And this guy is I mean, it got. Oh, Jesus.

Andi: Doesn’t sound formulaic at all.

Joe: So, yeah, it was bad. So it reminds me, though, of how people kind of look at their investments. When the market is really hot and, you know, hey, let’s buy in now. Let’s buy bitcoin.

Al: Yeah. It’s hot.

Joe: Dogecoin. Whatever coin. We get some likes, and we get some dislikes, so I dunno, half of you like the show, half of you don’t like the show, which is all good. We don’t have egos here.

Al: Which is fine. Yeah, not really.

Joe: If you’ve got a really difficult question we send you to Big Ern anyway. We know financial planning, we know taxes, so there are some things we can help you out with. So go to YourMoneyYourWealth.com, click on Ask Joe & Al On Air. I’d like to hear your voice. If not, cool, just keep sending the emails. Send ’em our way.

Derails: Al Clopine Vs. Mike Schmidt. Dear Joe: How Do I Get My Mother-in-Law Not to Smoke in My Car? (John, Abilene, TX)

_______

Listen to the YMYW podcast:

Amazon Music

AntennaPod

Anytime Player

Apple Podcasts

Audible

Castbox

Castro

Curiocaster

Fountain

Goodpods

Google Podcasts

iHeartRadio

Apple iTunes

iVoox

Luminary

Overcast

Player FM

Pocket Casts

Podbean

Podcast Addict

Podcast Index

Podcast Guru

Podcast Republic

Podchaser

Podfriend

PodHero

Podknife

podStation

Podverse

Podvine

Radio Public

Rephonic

Sonnet

Spotify

Subscribe on Android

Subscribe by Email

RSS feed

Go to the show notes to send those questions, access the free resources, read the transcript, and share. Big Al vs. Mike Schmidt and “Dear Joe” for John in Abilene in the Derails, so stick around.

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

Your Money, Your Wealth® is presented by Pure Financial Advisors. Sign up for your free financial assessment.

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.