More Podcasts

Purefinancial

Updated for 2023: Interested in a retirement account that will expand your finances tax-free? Learn everything your need to know about Roth IRAs in this white paper. In this guide, you’ll learn… What a Roth IRA is and the benefits Differences between a Roth IRA and Traditional IRA Rules of Roth IRA contribution limits Roth […]

Are you navigating your financial future solo? When you’re single, life’s twists and turns can be more devastating than if you are building your wealth with a partner. Taking the helm solo requires special tools and strategies to help ensure you’ll reach your financial goals. Joe Anderson, CFP®, and Big Al Clopine, CPA, help to […]

When you shift from saving for retirement to spending in retirement, your financial strategies need to change… but your plan for retirement withdrawals could be full of trap doors! Do you what to look out for? Trapdoors can be hard to spot – you’re moving through life thinking you have got it handled, and then […]

Taxes are often overlooked in a financial plan, delivering a sucker punch that could cost you tens of thousands of dollars. Are you wrestling with your taxes and getting body slammed – do you even know if you are? Ignore tax strategies and you are losing money that could compound over a number of years […]

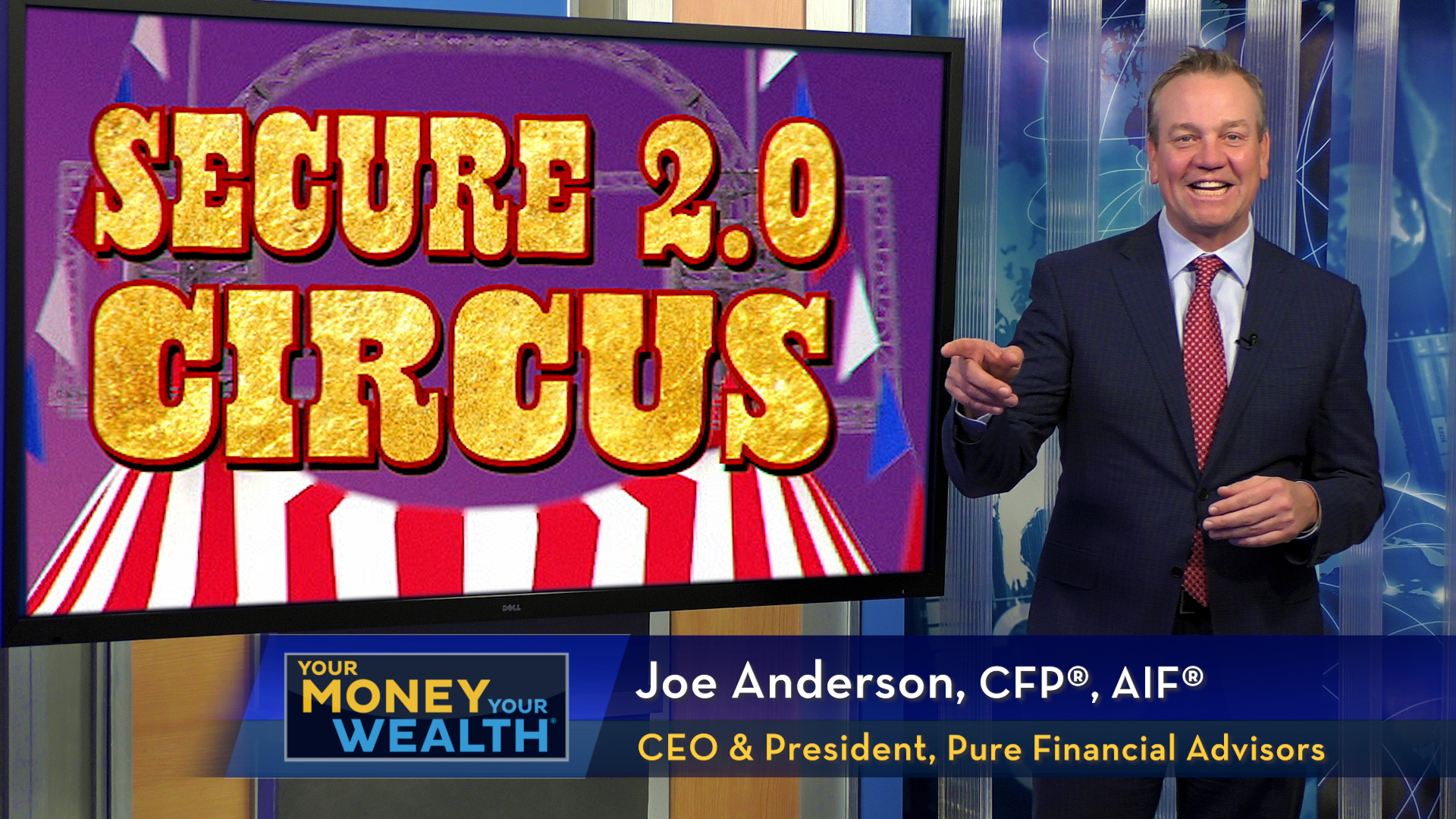

Saving for retirement can be a bit of a three-ringed circus but Joe Anderson, CFP®, and Big Al Clopine, CPA have your ticket to the show! Whether you’re retired, saving for retirement, in the military, or paying off student loans, SECURE 2.0 is a massive shift in investment policy, designed to motivate and enable people […]

The tax deadline (April 18) is quickly approaching and it’s that time of year to prepare for your tax return. Pure’s Financial Planner, Scott Huband, CFP®, AIF®, takes you through a quick checklist to make sure you have all the right documents and deductions. FREE GUIDE | 2023 Tax Planning Guide Transcript Tax season is […]

Do you understand the differences between a Traditional IRA and a Roth IRA? Pure’s Financial Planner, Nick Rose, CFP®, breaks down the tax benefits, contribution limits, and phase out ranges for both IRAs to help you determine what option might be best for your financial situation. FREE GUIDE | The Ultimate IRA Guide Transcript If […]

It’s crucial to know how the new RMD rules will impact you to properly plan your finances in the future. Jeff Brecht, CFP®, AIF®, Pure Financial Planner, Los Angeles branch, points out the new RMD changes with the passing of the SECURE 2.0. FREE GUIDE | The SECURE Act 2.0 Guide Transcript For retirees or […]

Asset location strategies, liquidity, and building up tax-free Roth IRA money when retiring early, how growth is taxed in taxable accounts, the pros and cons of rolling an employer retirement plan into a traditional IRA, how stock futures are determined and why stock price matters, and buying 8-week treasuries. And, if you’re planning to make a killing on eBay or at your next garage sale, the fellas get into the weeds on how to maximize your tax savings.

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

LISTEN on Apple Podcasts | Google Podcasts | Stitcher | Player FM

Joe and Big Al clarify once and for all those 5-year clocks for withdrawing money from your Roth accounts. How do the 5-year Roth IRA rules impact the taxation of dividend income? Do the 5-year rules impact thrift savings plan (TSP) to Roth conversions as well? Plus, why contribute to a Roth in the first place and lose today’s tax savings? Joe and Big Al rise to that challenge and they discuss Roth conversions and required minimum distributions from an inherited IRA.

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

LISTEN on Apple Podcasts | Google Podcasts | Stitcher | Player FM

Setting up your saving and investing strategies when you’re in your 30s can put you on a good path to meeting your retirement goals. Joe and Big Al revisit their financial spitballing over the last couple of years specifically for savers and investors in their 30s and even 20s, some of whom want to retire early.

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

LISTEN on Apple Podcasts | Google Podcasts | Stitcher | Player FM

Should you save for a house down payment or invest for retirement? How much long term capital gains tax do you pay on a rental property when you sell it after 20 years, and how does a 1031 exchange work? Also, opening a Roth IRA with the Backdoor Roth strategy, and the 5 year Roth withdrawal rules explained. Plus, a couple retirement spitball analyses: are you saving too aggressively for retirement? Can you avoid the Medicare IRMAA, or income related monthly adjustment amount, and high taxes from required minimum distributions?

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

LISTEN on Apple Podcasts | Google Podcasts | Stitcher | Player FM

Is there a way to get out of a bad SIMPLE IRA and stash cash in a tax-free Roth account? Can an owner of a company, that’s being sold to another company, load up a Roth account with company shares before the sale, and have a big chunk of cash happily growing tax-free? (What exactly are disqualified persons and prohibited transactions?) When designating beneficiaries of an annuity in a community property state like California, does state law or the annuity owner determine the beneficiary?

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

LISTEN on Apple Podcasts | Google Podcasts | Stitcher | Player FM