Have you ever found yourself wondering, “What is asset allocation and how do I use it in my portfolio?” Well, first let’s start at the beginning. Common investing practices usually include stock picking and attempting to time the markets in order to drive returns. This method opens investors to unnecessary risk. Alternatively, decades of time-tested financial research and performance shows that an investor’s asset allocation plays a major role in a portfolio’s performance.

What is Asset Allocation?

Asset allocation is one of the most, if not the most important decisions an investor can make. It is really the heart and soul of a well-diversified portfolio. It’s the science of combining different asset classes within your portfolio. This allows you to balance risk and return by adjusting the percentage of each asset in your portfolio accordingly. Your portfolio and corresponding asset allocation should always consider your overall long-term goals, time frame, and risk tolerance.

Asset classes can include:

- U.S. large growth stocks

- U.S. large value stocks

- Emerging stocks

- International stocks

- Corporate bonds

- Municipal bonds

- Government bonds

- Real Estate

- Natural Resources

These different combinations of asset classes are going to give you the efficiency between return and risk that is appropriate for your portfolio while aligning with your long-term goals.

How Important is Asset Allocation?

Allocating your investment portfolio is one of the most crucial decisions you can make as an investor. Asset allocation will specify which asset classes you want to invest your money in and exactly how much risk you want to be associated with your portfolio.

Everyone will have a different asset allocation strategy based on their financial situation.

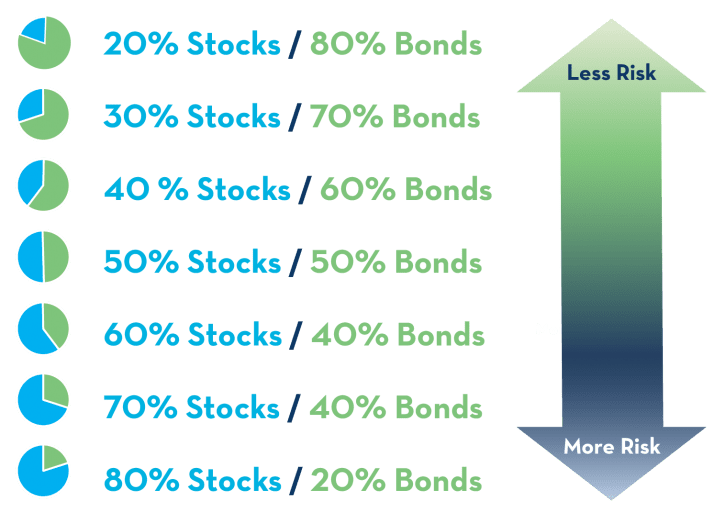

Common Asset Allocation Portfolios

Diversification

Diversification is really the result of a properly allocated portfolio. It is often described as the only free lunch in the investment game.

This just means that diversification is one of the only ways to have lower risk in your portfolio and keep the same expected return. Usually, as you add more risk, the higher chance you have of decreasing your expected return.

A lot of times we put the cart, before the horse, or as Warren Buffet once said,

“Investing is simple, not easy.”

As with any theory, in practice, it can sometimes become flawed.

Fear and greed can often dictate which individual stocks or mutual funds we include in our portfolio. When this happens we not only fail to implement a proper asset allocation strategy, we defy years of science and even logic to speculate.

We really shouldn’t speculate with something as important as our retirement. Rather than speculating, we should let the science of investing be our guide and put to good use the tools of asset allocation and diversification.

Asset Location

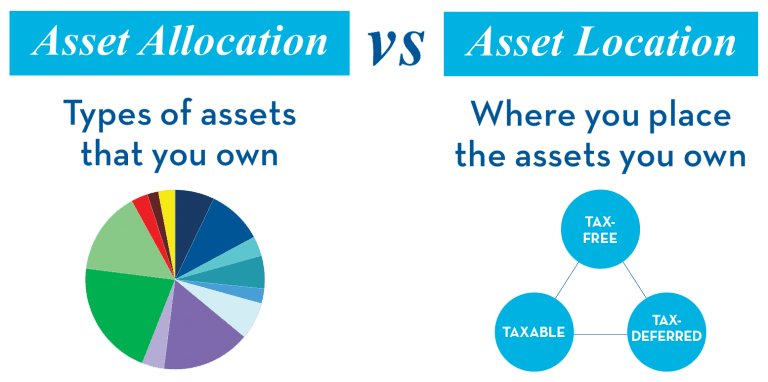

Once you have determined the best asset allocation and diversification strategy for your portfolio to reach your financial goals, the next step is determining asset location.

No that was not a typo.

Asset location and asset allocation are two different investment strategies. Asset allocation is what you own. Someone that has a 50% Stocks / 50% Bonds portfolio has a different allocation than someone who has a 70% Stocks / 30% Bonds portfolio. Asset location is where you have decided to place those assets.

After you have decided your asset allocation or risk level, asset location allows you to decide which account types work best from a tax standpoint with the assets that they hold.

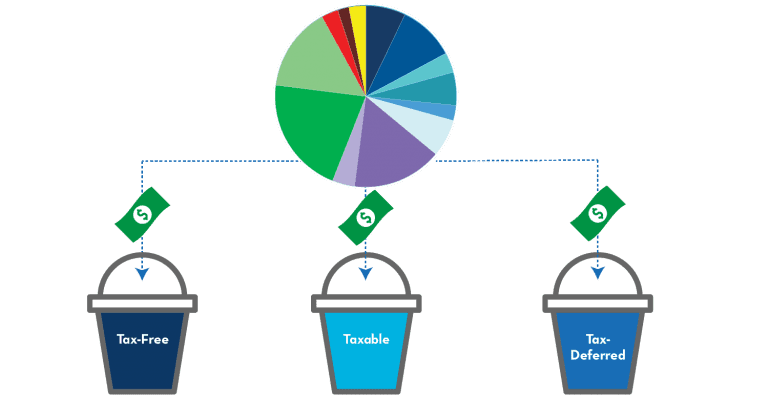

The entire reason we need to make decisions regarding asset location is that different accounts have different tax features.

An easy way to view this is as three different pools of money. For example, we have the tax-free pool of money, we have taxable money and then we have money that is in the tax-deferred pool.

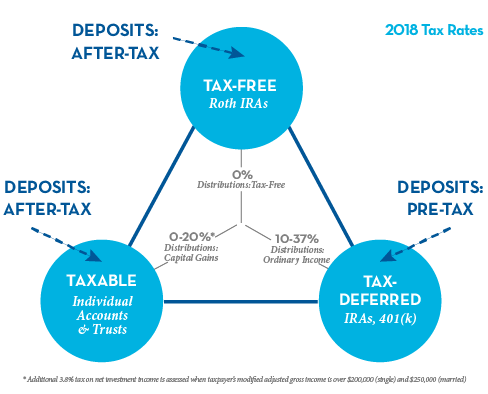

1. Tax-Free Accounts

A tax-free account means that you pay taxes on the money you put into the account, but then all future growth and withdrawals are tax-free. An example of a tax-free account would be a Roth IRA or municipal bond.

2. Taxable Accounts

Deposits are also made after-tax with taxable accounts. These accounts are your individual accounts that you hold at your brokerage firm or jointly with a spouse, trust accounts, qualified dividend, and capital gains on the sale of stocks, bonds, mutual funds, and real estate held for more than one year.

3. Tax-Deferred Accounts

Tax-Deferred accounts let you deposit money in pre-tax. In this type of account, you will eventually pay taxes on the money, and that will occur when the money is withdrawn from the account.

There may be activity inside the account beforehand, like the sale of an asset or the payment of interest that would be taxable if it were in your regular taxable account when that activity happened. But in a tax-deferred account, taxation will occur when money is withdrawn from the account. Tax-deferred accounts include IRAs, 401(k)s, 403(b)s, SIMPLE IRAs, SEP IRAs, Keoghs, and annuities.

What Type of Investments Do I Put in Each Type of Account?

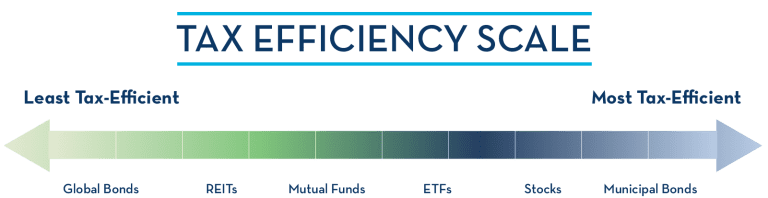

As a general principle, it is a good idea to place TAX INEFFICIENT items in tax-advantaged accounts, and TAX EFFICIENT items in taxable accounts.

We’ve discussed the tax implications of various account types, but let’s look at the investments themselves.

Stocks

Let’s start off with stocks. Most people buy stocks because they want one of two things to happen.

- The value goes up

- Get paid along the way in the form of a dividend

Fortunately, when either of these things happens, you would be taxed at a more favorable rate – investment rate. 15% for most people, as low as 0%, as high as 20%. For this reason, stocks are often a good fit to place inside taxable accounts.

Bonds

Bonds often pay taxable interest that would be taxed at your ordinary-income rate if held in a taxable account. For this reason, many individuals choose to own their bonds in a tax-deferred account.

An exception to this is a municipal bond, which often pays interest that is tax-free at the federal and state level. Let’s say you live in California and you buy a municipal bond in the state of California. When you receive an interest payment, you would not pay federal income tax or income tax to the state of California. Keep in mind that if you own municipal bonds, you may have implications that relate to the alternative minimum tax, or an increase in your Medicare Part B premium.

Mutual Funds

Mutual funds are an interesting investment for this topic because even if you hold the investment with no intention to ever sell, in non-qualified accounts, as opposed to retirement accounts, you will be taxed on the activity that happens inside the fund. This only happens in non-qualified accounts and not in retirement accounts.

Remember, you indirectly own a small piece of every investment that the fund owns. So, if there are sales or interest payments or dividend payments that happen inside that mutual fund, you would be subject to tax on those activities.

A Note on Mutual Fund Managers

For this reason, if you’re going to invest in mutual funds, you should understand that some fund managers try for the highest return possible, independent of tax considerations. While some fund managers will try to get the best tax-efficient return that they could get. You can find this information in the fund’s prospectus, and you should take it into account when deciding if the type of mutual fund that you’re considering purchasing is a good fit for the account type that you’re going to hold it in.

Exchange Traded Funds (ETFs)

Exchange traded funds, or ETFs, are an example of items that are often very tax efficient because they are passively managed. Depending on what is inside the specific ETF, it might be a good candidate to own in a taxable account. Check your specific fund before buying, of course.

Assets with High Expected Return

Assets with high expected return such as emerging market stocks or small-cap stocks should be held in a tax-free account. These high expected return assets are less efficient, so you want to place them in tax advantage accounts. This allows your investments to grow tax-free and you are not taxed on the growth with full access to your accounts with no penalties.

EXAMPLE

Let’s do a quick example. Let’s say that Jerry is a moderate investor that has $50,000 in a taxable account, and he also has $50,000 in a retirement account – an IRA. Jerry has decided that he wants a 50% Stocks/50% Bonds asset allocation.

Where should he put the stocks and where should he put the bonds?

Well, let’s consider what we’ve discussed.

We know that stocks are often taxed at a favorable rate (investment rate – which for many people is often 15% when you have a long-term capital gain) or when a dividend is paid to shareholders. This often makes stocks a good candidate to own in a taxable account.

We know that with bonds our objective is generally the payment of interest, therefore we own bonds in a taxable account. That interest would be taxed at the ordinary income rate, which is less favorable for most people than the investment rate. So, let’s put those bonds in the tax-deferred account. It’s all going to come out as ordinary income anyway, when it’s in that account type.

As a bonus, when your bonds pay interest inside the account, you don’t get taxed on that activity when it happens. It’s only when you decide to pull the money out. This allows you to control the timing of that taxation.

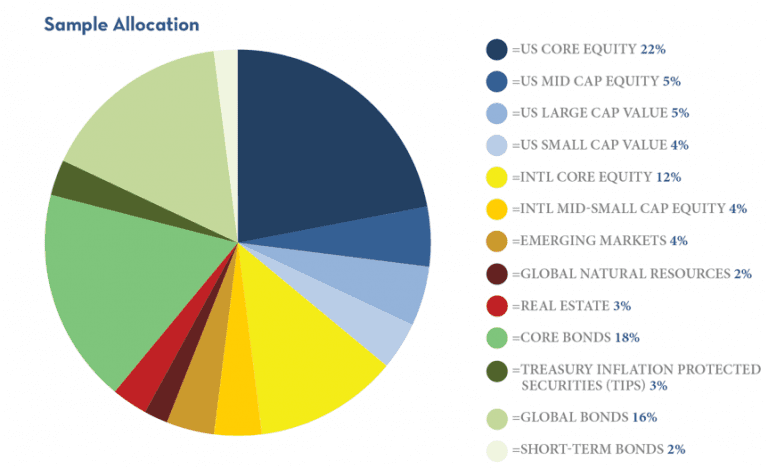

Prioritizing Assets

One strategy is to prioritize asset classes with the highest expected return, and usually the highest volatility, in tax-free accounts. This can include asset classes like small cap and value stocks, as well as emerging market securities.

You can also prioritize assets like real estate or global bonds for tax-deferred accounts. Here’s the reason: these assets, if they were held in a taxable account, would pay out and be taxed at the ordinary income rate. If they are placed in tax-deferred accounts that account type is going to be taxed anyway. Match the asset with the pool that holds it and save taxable accounts for assets that might have more favorable tax treatment when held there.

You can often round out assets in taxable accounts, like US core equities, small cap, value, and municipal bonds. If you need more bond income than you have in your tax-deferred accounts. This is because interest paid from municipal bonds is often tax-free at the federal and state level.

Summary

It’s important to make sure that your asset allocation decision is a good fit for your overall goals. Don’t let your asset location decision unduly affect those choices. Some people may only have an IRA or their 401k at work. That doesn’t mean that they should only own assets that happen to be advantageous in a tax-deferred account. They should have an allocation that works well for their goals and time horizon in general. Your asset location decision should be viewed as something separate that complements that decision, rather than something that leads and determines it.

Disclosures

Investing involves risks and some investments have more risk than others. Diversification and asset location do not assure a profit or protect against a loss in declining markets.

Intended for educational purposes only and are not intended as individualized advice or a guarantee that you will achieve a desired result. Before implementing any strategies discussed you should consult your tax and financial advisors.