During the second half of 2022, worries about a potential economic slowdown grew. Those fears seemed to dissipate as the calendar flipped to 2023, but they’ve recently begun percolating again. On April 11th, the International Monetary Fund (IMF) released a new forecast1 for short and intermediate term global economic growth, which included some of the lowest estimates in the past 30 years.

News headlines like that, combined with an aggressive Federal Reserve rate hike cycle designed to slow the economy and stamp out inflation, make this a good time to discuss recessions.

But first, two important caveats:

- Just because this article looks at recessions does not mean I am forecasting one. The truth is that at some point the economy will contract, but no one knows exactly when.

- When we do have a recession, it does not mean financial markets will collapse. Economic ups and downs are a regular part of the cycle and need to be accepted as part of the process when investing in financial markets.

What is a recession?

Let’s start by saying what a recession is not. You might have heard that a recession is two consecutive quarters of negative GDP growth. This is a common rule of thumb and is often used in media reports, but it’s incorrect.

Recessions are defined by the National Bureau of Economic Research (NBER). The NBER evaluates economic activity across a broad range of sectors and determines whether the economy has meaningfully contracted. If they determine a recession has occurred (or is occurring) the NBER assigns starting and ending dates to it. That means that in some instances, a recession may not be “officially” declared until it is well under way, or even over.

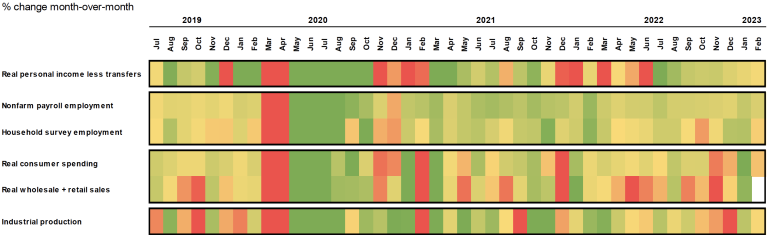

Here is a chart showing six of the major economic variables the NBER uses to evaluate the strength of the economy. This is a ‘heat map’ which means that it is color coded for strength or weakness. The deeper the green, the stronger the variable, and the deeper the red, the weaker the variable. As you can see most variables are currently yellow or ‘neutral’ indicating a relatively tepid economy but one that is not in a recession.

Variables Used by the NBER in Making Recession Determination

The heat map shading reflects 10 years of data, with green and red reflecting a range of +/- 0.5 standard deviations from a baseline of 0% monthly growth.

What does a recession mean for you?

Recessions affect different people in very different ways. For someone who loses their job, a recession can be devastating. For others, a recession might not directly impact their employment, income, or finances, though they might experience an increased sense of unease or worry about their future. And still, for other people, there might not be any impact at all. In fact, some people might even benefit during a recession – for instance, consider someone that owns a business that repossess cars.

Frequently, recessions are clustered among several industries or regions of the country. Consider the recession of the early 2000s, which disproportionately affected tech workers and the Silicon Valley area. Or the 2008-2009 recession, which saw large layoffs in industries related to housing and construction.

The bottom line is that while the thought of a recession can be frightening for many people, for those not directly impacted the results might be relatively muted.

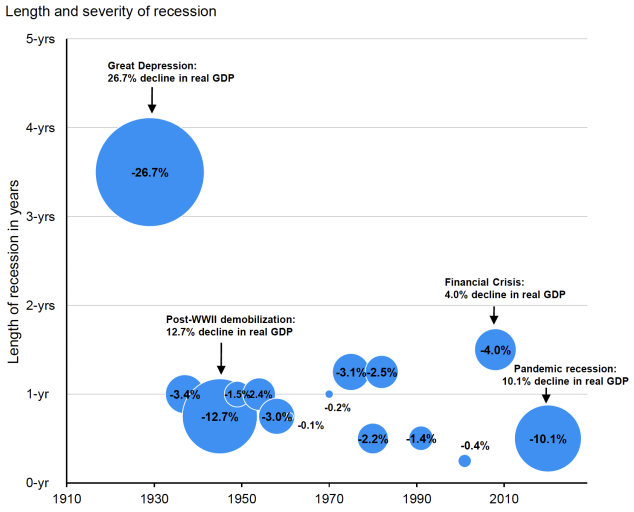

The Great Depression & Post-War Recessions

Bubble size reflects the severity of the recession, which is calculated as the decline in real GDP from the peak quarter to the trough quarter except in the case of the Great Depression, where it is calculated from the peak year (1929) to the trough year (1933), due to a lack of available quarterly data.

The chart above looks at historical recessions and the magnitude of the accompanying economic decline. As you can see, the Great Depression was an outlier in terms of severity. The declines following WWII (demobilization) and COVID (shelter in place) were also very large, though they were both caused by one-off events unlikely to be repeated. More ‘normal’ recessions have seen an average economic decline in the neighborhood of 2%-3%.

Think of what your lifestyle would look like if you cut spending by three percent. You might go out to eat one less day a month or take one less weekend trip a year. Not pleasant, to be sure, but a very different scenario to the doom and gloom you might see or hear in the media.

But what does a recession mean for markets?

The answer to the question above is: it depends. No one knows exactly when the economy will experience a recession, let alone how severe it may or may not be. Because of that, no one knows what sectors of the economy might be most impacted, nor what the effect on corporate profits will be. And because of all that, no one knows exactly how markets will react, though oftentimes high-quality bonds perform reasonably well in a recession.

The story with stocks is more nuanced. However, it is important to note that the stock market is a leading indicator. That means that in general, stocks decline ahead of a general economic slowdown. In fact, buying stocks during a recession has often been a profitable endeavor, as the market frequently begins to recover before the economy rebounds.

Nevertheless, this could be a good time to refresh your financial plan and review your asset allocation and risk exposure. Make sure you have a reasonable risk/return profile among your investments and if you are drawing income from your portfolio, check that you have sufficient ‘safe’ assets to fund your lifestyle in the event of a market downturn. Of course, if you are still working and contributing to your accounts, market downturns are your friend, since they provide an opportunity to buy more stocks ‘on sale.’ Nevertheless, it could still make sense to hold sufficient liquid reserves to cover any emergencies you may encounter, without having to resort to selling securities in a possible market downturn.

Remember, negative news headlines, whether about the economy or any other topic, are designed to cause emotional responses. That is why it is important to have a plan in place and remain committed to that plan, regardless of where we are in the economic cycle. The bottom line is that well-crafted financial plans are designed to withstand the inevitable ups and downs of the economy and financial markets, provided of course, that you stick with that plan.

1 CNBC, IMF Cuts GDP Forecasts, Says Global Economy Heading for Weakest Growth Since 1990, April 2023. https://www.cnbc.com/2023/04/11/imf-world-economic-outlook-april-2023-weak-growth-forecasts-inflation-high-until-2025.html.