Should Real Estate Investing be a part of Your Retirement Plan?

How a Reverse Mortgage Can Benefit You in Retirement

Is Downsizing Right for You?

Rental Properties

Tips for Real Estate Investing

Many people fail to give real estate the attention it deserves when planning for retirement. While traditional asset classes typically include stocks and bonds, real estate tends to fall into the “other” or “alternative” category of asset classes. However, that doesn’t mean it can’t be a lucrative tool for you to utilize. The biggest asset you own is probably your home, so wouldn’t it make sense to evaluate how to make the most of it in retirement?

Let’s dive into how to make the most of your real estate in retirement…

Should Real Estate Investing be a Part of Your Retirement Plan?

One of the most important questions you should ask yourself when developing your retirement plan is whether various investment options are appropriate for you, given your specific retirement needs. Establishing a retirement portfolio can be challenging, as there are many issues to consider. With so many investments available (stocks, bonds, mutual funds, etc.), it can be difficult to find the right mix.

During your evaluation of available investment options, be careful not to overlook real estate as a potential asset class. Real estate can offer several advantages not available in a portfolio made up exclusively of stocks and bonds. But where does rental property or your home fit in your retirement equation?

Some opportunities that draw investors to real estate are:

Diversification

Perhaps the most crucial aspect for investors who consider adding real estate to an overall retirement plan is diversification. Too many investors have investment portfolios that focus exclusively on stocks and bonds and ignore other asset classes such as real estate.

Adding real estate, either through rental properties or Real Estate Investment Trusts (REITs), can help diversify your portfolio. Diversification means owning asset classes that react differently to a varying market environment. The movement relationship between two assets is called correlation. When what’s good for one asset class is bad for another, and vice versa, this is called a negative correlation. For example, when stocks are down, bonds are often up (or at least not down as much as stocks). Real estate has a relatively low correlation to stocks and bonds.

Having a diversified portfolio of multiple asset classes (including real estate) can help smooth out your investment experience over time as the peaks and valleys offset one another. This can go a long way toward helping you reach your financial goals with less risk.

Growth and Income

Through growth (price appreciation) and income (from rent), investors can make money with real estate in more than one way. Specific properties may be more appropriate for either goal, but the prospective real estate investor has the advantage of enjoying an income stream while seeing their asset grow in value.

Those interested primarily in income could also potentially experience periodic increases in the amount of revenue their properties produce. This is a pleasant contrast to some income-producing investments (such as bonds or bank CDs) that typically pay a fixed percentage throughout the course of ownership.

Hedge Against Inflation

Real estate can be an excellent hedge against inflation. This is because the value of real estate tends to increase when inflation is high, which can limit the impact of inflation.

However, not all changes in price are due to inflation. There are many reasons why a property (or any investment) may increase or decrease in value. You should consider all factors relevant to your property when making investment decisions.

Tax Advantages

Real estate comes with many potential tax advantages. These advantages range from the deductibility of mortgage interest to the capital gains exclusion on the sale of a primary residence. Those with rental properties might be able to offset some of the taxable income received from rent using depreciation.

Recent changes in the tax code may also benefit investment property owners using a “pass-through deduction,” available under section 199a of the tax code. Assuming certain conditions are met, investors may be able to deduct up to 20% on their combined qualified Real Estate Investment Trust (REIT) dividends and publicly traded partnership income. If you own or are considering investment properties, discuss this with your financial planner or tax professional to see if it applies to your situation.

Developing a strategy for your real estate can be challenging and requires even more care when considering the place of real estate in a general retirement strategy. Working with a professional (such as a CERTIFIED FINANCIAL PLANNER™ ) can help potential or current retirees plan for retirement with an eye on how best to utilize real estate in the overall strategy.

How a Reverse Mortgage Can Benefit You in Retirement

Reverse mortgages are complex financial products that are often misunderstood. However, they can be an excellent source of retirement income for some homeowners. In this section, we answer some of the most important questions to consider if you’re considering a reverse mortgage.

What is a Reverse Mortgage?

A reverse mortgage is a type of loan against property, usually the primary residence of a senior. Unlike a standard (or “forward”) mortgage where the balance is paid off over time, a reverse mortgage allows the homeowner to access the equity in their property without making periodic payments.

How Are Funds Received?

When you apply for a reverse mortgage, you should consider various loan scenarios, similar to the way you would evaluate multiple insurance quotes. Some borrowers elect a lump sum amount, others opt for a line of credit, while still others choose periodic payments (often monthly). And some borrowers opt for a combination of these options. Regardless of your method of receipt, the amount you receive, plus origination fees and interest, will add up to the total balance owed on your loan.

What Are the Requirements?

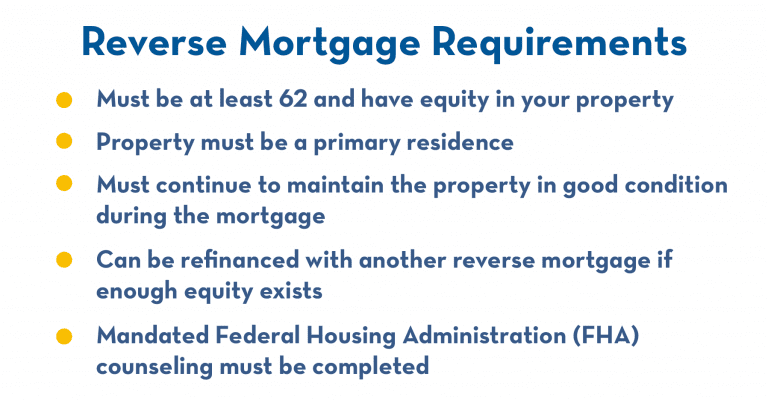

To qualify for a reverse mortgage:

- You must be 62 years old and have equity in your property.

- The amount of equity required depends on your age when you take out the loan.

- The property must be a primary residence rather than an investment property.

- You must continue to maintain the property in good condition during the mortgage and remain current on insurance and property taxes.

- Reverse mortgages can be refinanced with another reverse mortgage if enough equity exists.

- They can also be used to purchase a home rather than access the equity of a home currently owned.

- A mandated Federal Housing Administration (FHA) counseling must be completed.

- This is usually done in person, although many counselors also offer remote options.

When Does the Loan End?

The loan will need to be repaid when the property is sold (typically after the owner dies) or when the property is no longer used as a primary residence. Don’t confuse this with many forward loans that can still be retained if a residential property is later used as an investment property.

The loan can also be terminated if the borrower is no longer meeting their requirements of maintaining the property, keeping it insured, or paying property taxes. The borrower can also pay off the loan voluntarily or refinance it into another reverse mortgage or forward mortgage.

Will I Still Own My Home?

As with a forward mortgage, you remain the owner of the property with a right to sell when you wish and can still determine who will inherit the property. However, the loan will need to be satisfied when those events occur.

How Is It Taxed?

Because reverse mortgages are considered loans, not income earned, the payments received are not taxable to the recipient. This is the case for funds received in a lump sum, line of credit, or periodic payments.

However, unlike a forward mortgage, you won’t be able to deduct the interest on your reverse mortgage when filing your taxes each year. This is because you aren’t paying the interest year-by-year, only letting it accrue and increasing the existing balance over time. When the loan is paid off, the interest can be deducted, but the deduction may be subject to the limit on home equity debt (depending on the type of reverse mortgage).

What happens when you die?

According to your state’s laws, or those designated in your trust, the heirs who inherit the property will do so like a regular mortgage. They will not be able to assume your reverse mortgage. Meaning, the loan will either need to be refinanced, or the property will need to be sold, leaving the heirs with the leftover equity.

The balance of the reverse mortgage will be the amount loaned, plus interest and fees, throughout the life of the loan. If this balance is higher than the value of the property at the time of the homeowner’s death, the estate of the deceased is not responsible for the negative balance.

The decision to consider a reverse mortgage can be complicated. It often makes sense to explore your various options with a professional. For a free assessment with a CERTIFIED FINANCIAL PLANNER™ that addresses these and other retirement considerations, contact Pure Financial Advisors.

Is Downsizing Right for You?

Some retirees, who currently maintain a large residence choose to downsize in retirement. There are many factors that may lead you to this decision. Maybe you don’t need as much room now that your kids are grown and have moved out. Or maybe cost is a concern, and a smaller residence makes better sense for your budget. Or perhaps, you want to simplify your life and maintaining your property is too much work.

Let’s look at each of these reasons to downsize and examine the pros and cons of each to determine if downsizing is right for you.

The Right Space and Accessibility

It may seem obvious, but opting for a smaller home often makes sense when fewer people are using it. Maybe downsizing looks like moving from a bigger house to a condo or maybe it looks like a house with fewer bedrooms.

Also, since size and accessibility are often related, a larger home (especially one with more than one floor) can lead to challenges as mobility decreases.

Downsizing to a smaller, single-story residence may be an appropriate solution for those who either no longer need the extra room, or prefer the practicalities available with a smaller property, or both.

Cost

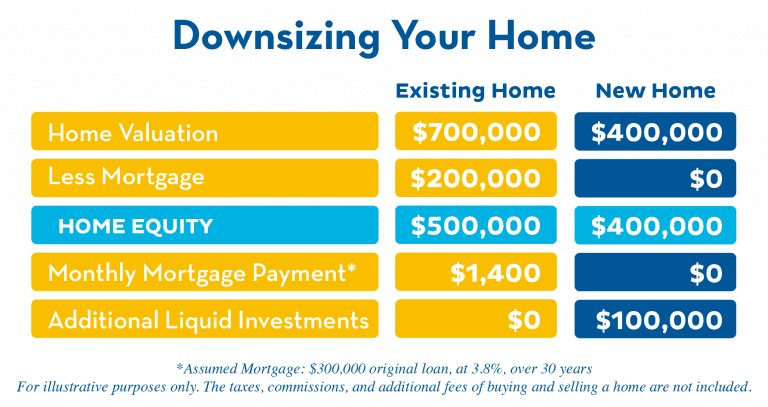

Cost can also be a significant factor for those choosing to downsize. This can be the case for both those who have their properties paid off and those who maintain a mortgage balance in retirement. Downsizing as a financial strategy can allow you to unlock the equity you have built in your property by selling your current property and purchasing a property. When a mortgage exists on the current property, downsizing may help eliminate the balance and thus free up cash flow. When there is no mortgage on the current property, the difference between the price of the old property and the new property can represent a meaningful increase to your retirement nest egg.

Here’s an example, let’s say you own a $700,000 home with a $200,000 mortgage and a monthly payment of $1,400. Perhaps you decide to downsize and purchase a new home for $400,000. Now you’ve eliminated your mortgage, freed up $1,400 a month, and added $100,000 to your retirement nest egg. Using the “4%” safe-withdrawal rule, that $100,000 could generate another $4,000 of income each year.

When evaluating the cost savings available through downsizing, there are a couple of potential issues to consider. The first consideration pertains to taxes on the appreciated value of the home. If certain conditions are met, you may be able to exclude up to $250,000 in capital gains (for single filers), or up to $500,000 (for married filers). Those with substantial appreciation in their property may wish to consider other strategies as well. You should discuss your unique situation with your financial planner and tax professional.

The next thing to consider is your current property tax rate compared to the rate you will pay for your next property. This is important, not only because property tax rates can vary in general by location, but also because you may live in an area that has limited the amount your tax can increase over time. In certain circumstances, and when certain conditions are met, you may be able to transfer your property tax assessment to a new home. Paying more in property taxes after downsizing is entirely possible, so be sure to do your research and talk to a professional beforehand.

Simplification

The last reason to downsize we’ll look at is simplifying your life and eliminating commitments that come with owning a more substantial residence. Do you use the pool enough to deal with periodic cleanings and maintenance? Does cleaning the house or mowing the lawn take longer than you’d like? In general, does your property now seem to be more of a chore than necessary?

You might find that downsizing to a smaller property, owned or rented, can afford you more time to actually enjoy your retirement.

Like any major decision with financial implications, it often makes sense to discuss your choices with a professional. A consultation with a CERTIFIED FINANCIAL PLANNER™ at Pure Financial Advisors can help you evaluate your downsizing options along with numerous other areas of your financial life.

Rental Properties

Your retirement income might come from multiple sources. It may come from social security, a pension, an IRA, or other retirement accounts. Some retirees also use rental properties as an income source. While many people have had success with rental properties, there are several key areas to consider before taking the plunge. Let’s look at a few of them…

Active Management

One of the first issues any potential investment property owner should consider is the degree to which they wish to be actively involved with their investments. The question you should ask yourself is, “do I want to be a landlord in retirement?” While you can certainly use a property manager for rent collection and to coordinate maintenance, you may still need to be involved in certain decisions. Many believe that you either manage properties or manage managers, but real estate owned in your name is never entirely “passive.”

You might decide you want to maintain your properties yourself, delegate tasks to a property manager, or even forego direct ownership and consider Real Estate Investment Trusts (REITs) for your exposure to real estate.

Income

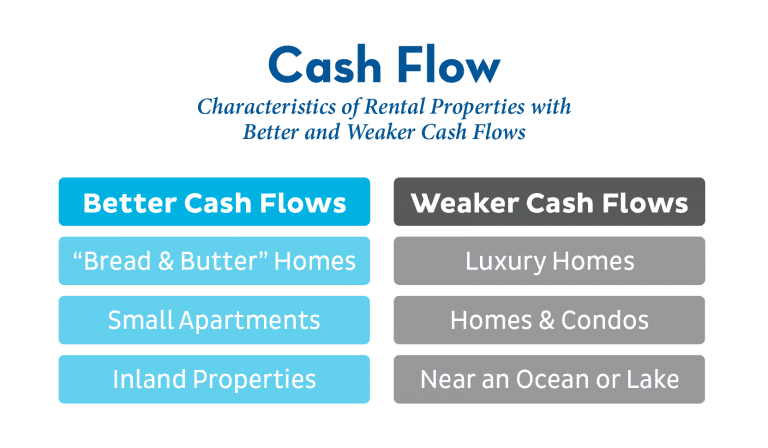

When it comes to rental income, you need to find out if it has good appreciation potential. Such as, how successfully will you be able to increase the rent over time? Or where is the property located? How’s the local economy? How’s the neighborhood doing? What’s the condition of the property? Does the cash flow (income minus expenses) make sense?

For example, let’s say you have a rental property, and you’re getting $2,000 per month in rent. That may sound good, but you need to remember that you have expenses that come with rental properties. Maybe you have a mortgage on it, or repairs and upgrades are required, or perhaps you have to pay a property manager. All those things will cost you money and need to be accounted for as expenses. Make sure you budget appropriately for them.

Continuing the example, if the property has $19,000 in expenses, you’re net income would be $5,000 annually. Now let’s say you have $100,000 of equity in the property. $5,000 of income on $100,000 of equity would be a 5% cash-on-cash return, which would generally be considered a good return for a rental.

A good rule of thumb to follow is to look for properties where the monthly rent is at least 1% of the total purchase price. For example, a property that costs $100,000 should rent for at least $1,000 per month, a property that costs $200,000 should rent for at least $2,000 per month, etc. Note, this is only a rule of thumb, and it may be more realistic in certain markets than others.

Holding Periods

Real estate investors should strongly consider their liquidity needs before entering into transactions. Investors should have a primary long-term objective for income and be willing to hold the property for an extended time or indefinitely to meet this objective.

Those without the ability or willingness to hold properties long-term may wish to examine other income investments outside of direct ownership of real estate.

Tax Considerations

Rental properties can have substantial tax advantages. Although income earned from rent is taxable income, there are often many expenses such as mortgage interest and maintenance that can offset how much is ultimately taxed. Owners may also take advantage of depreciation. New for 2018 is the Section 199a “pass-through” deduction (that we discussed earlier) that may be available for some direct real estate owners who meet specific requirements.

If you already own investment properties or are considering doing so, you should address this with your tax professional and financial planner. While this is a potentially substantial advantage for real estate investors, as well as certain taxpayers in other industries, it is a complex topic that is misunderstood with no shortage of confusing or inaccurate information online.

Significant Regional Differences

Real estate investment opportunities can vary substantially by geographic region. Many say the best real estate investments are the ones in an area you know. You might find what appears to be a diamond in the rough in an area that you’re moderately familiar. You might find a property that yields more in your immediate geographic vicinity, but upon further inspection, there are local regulations that might substantially impact your investment. These might include limitations on further development or repair, unfavorable local tax treatment, or unusually tenant friendly policies that might make ownership more difficult than expected.

One overall issue that you should consider is the degree to which the market you are examining is favorable for the ownership of rental properties. When looking for a property to buy, you might’ve heard the phrase, “location, location, location,” but sometimes a “hot real estate market” doesn’t necessarily translate to a good market for a real estate investor seeking income. You will ideally want to invest in properties that are reasonably priced relative to the amount of rent they are currently receiving or likely to receive.

Some markets are more favorable for investors interested in a short or intermediate term appreciation, not necessarily long-term income. A booming coastal city might be an excellent pick for an investor interested in appreciation. Whereas, a rural city in the Midwest might have more favorable opportunities for an income investor. In either case, a market in which you are familiar with the region, professionals you’re likely to work with, and local regulations can be a much better opportunity than one you are less familiar with.

Work with a Professional

Real estate can be a powerful tool to produce income in retirement, but for most investors, it’s one of many sources including their retirement accounts, pensions, Social Security, other investments, or part-time employment. Investors can benefit from taking a “big picture view” of how all their retirement income sources work together and how this may affect other aspects of their finances.

A financial planner may be able to help you view the many areas of your investments in context and make decisions that consider all your needs, including those for retirement income. Contact us for a free assessment with a CERTIFIED FINANCIAL PLANNER™ at Pure Financial Advisors.

Tips for Real Estate Investing

Many investors choose to invest in real estate as part of their retirement. While this can be a good fit for some, there are potential downsides as well. We’ll look at some tips you can use to try to maximize the likelihood of success for your own real estate investments during retirement.

Things to Consider Before Investing in Real Estate

Real estate is like a business – it’s not like the late-night ads that make it sound effortless. The reality is you will need to find and evict tenants, find properties, collect rent, and fix toilets, among other things.

Be realistic about what your skill set is. Do you have the skills and time needed to do the necessary repairs? Before buying a “fixer-upper,” take a step back, and you might find yourself asking yourself if you can honestly handle the repairs given your abilities. If you’re not as handy when it comes to making repairs, you might want to take a more conservative approach.

Don’t get stuck in an unrealistic budget and timeframe. If you do, you could be stuck with a cash black hole that’s just eating up money every month and getting exponentially worse. Also, something to think about, it is very competitive to find a great crew who will actually do what you want, on time and on budget.

Once you catch the real estate bug, it can be easy to get carried away, especially when financing your transactions. Make sure your real estate holdings don’t represent a more significant percentage of your investments than appropriate for your level of risk tolerance and avoid the temptation to take on too much leverage.

View Real Estate in Context and Know Why You’re Investing

Real estate can be a great asset class to invest in. As with any asset, a piece of real estate should be viewed not in isolation, but in context with your overall investment portfolio. How does it contribute to your overall retirement goal? Is it serving that purpose better than other options? Is your desired level of risk tolerance maintained? Designing a good portfolio is a complex subject, but these are a few of the critical questions you should ask regarding real estate or any other asset you are considering.

Real estate can be a great investment to build net worth or to create cash flow. Very often, it’s not the same in different areas of the country. In Texas, you make your money in cash flow. Historically, the “Lone Star State” has not appreciated very much, but the cash flow on rental properties has been decent. In California, you make money in appreciation. In the “Golden State,” the cash flow has been abysmal, but the properties have gone up in value.

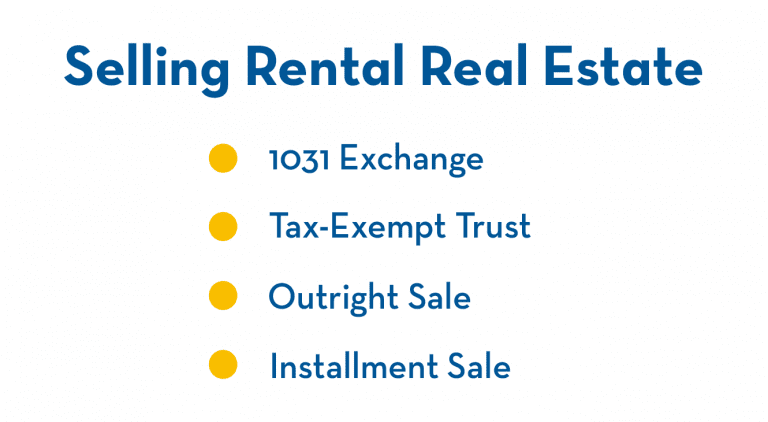

Keep in mind, you might be selling your California style properties when you retire. Selling the properties may be the best way to access that equity without borrowing against it. When you sell properties, you have options. You can do an outright sale, an installment sale, a 1031 exchange into a property that has a better cash flow, or you can do a tax-exempt trust (or Charitable Remainder Trust). Consider all of your options and make the best choice for your situation.

Understand the Finances of Real Estate (Cash-on-Cash) & Review Your Financing Periodically

Real Estate is less liquid than many asset classes. It can take months or longer to complete a real estate transaction. Be sure your liquidity needs are in line with your likely holding period of any properties you are considering. Whatever you do with your investments, make sure you always maintain a reasonable emergency fund in cash or similar assets for easy access.

Make sure you understand the finances of real estate because ultimately, you are here to make money on your investment. The first thing you should calculate is the cash-on-cash percentage.

Cash-on-cash is your net profits divided by your equity.

For example, assume you have $100,000 of equity in your property. Your profits after all expenses (even the mortgage payment) are $3,000. Take $3,000 divided by $100,000, and that equals a 3% cash-on-cash percentage.

Different areas of the country have different ratios. Texas might be around 10% cash-on-cash, but in California, you’d be lucky to break even out the gate.

Once you’ve done all the work to select a property and get financing, you’re done, right? Not necessarily. You’ll want to keep an eye on the financing of your properties to make sure they’re still a good fit for your needs.

As interest rates change, you may be able to get lower rates. Even if rates are similar, some investors wish to lower their payment to increase their net cash flow from the property by extending the term of the loan they have. Be sure to consider any pre-payment penalties to leave one loan or origination fees to enter into the next.

It’s tempting to “mentally spend” the income your property will generate after the “known” expenses of your mortgage, insurance, and property tax. In an ideal world, all investment properties would remain fully occupied with quality tenants and require no maintenance. In the real world, some units will be vacant, and repairs will be needed. Make sure your budget considers maintenance and vacancies.

Buy a Rental Property for the Cash Flow – Not the Flair

The most conservative way to invest in real estate is to buy something for cash and to collect cash flow. If you introduce leverage acquiring a mortgage, or if you are counting on appreciation and speculation to be your return, you’re taking on more risk. In a booming market, you can make more money that way, but in a market that’s down, you can also lose a lot of money.

It really comes down to this – for every dollar invested in the property, how many dollars are going to come out (regarding income) after all expenses?

As you go up the ladder regarding price point, you don’t necessarily see a corresponding increase in the rental rate. Now there can be certain nuances to that, depending on which market you’re in and where the demand is. If you live in a place where there’s a prominent tourist attraction, or if it’s right on the water where you always have a high demand for short-term high-dollar vacation rentals, that can be a bit of an exception. If you’re looking for a tenant who will be there for a few years and will be a steady source of cash flow, you’d typically do better with the more modestly priced homes. Keep in mind that the million-dollar home isn’t necessarily going to have 10 times the rent of the $100,000 house.

Using Vacation Rentals to Generate Income – Risks and Rewards

If you’re looking to build up a portfolio and receive passive income for the rest of your life, you may be looking to use real estate to try and boost that passive income. You might try and expand that portfolio by utilizing vacation rental and travel websites like Airbnb and VRBO, instead of standard rentals.

Although a vacation rental requires more work on your part, the income potential is generally more significant.

Ask yourself if your property would be a good candidate for a vacation rental. Would others want to visit your town and community?

Another factor is in areas where tourism is part of the base, and there is always the chance for new regulations. One of the “gotchas” among rental properties that have emerged in recent years is that homeowner’s association and county boards across the country are less than thrilled with the coming and going of vacation home renters.

Many people might be on borrowed time with the ability to rent out for a couple of days. We might be penned into weeklong stays soon, which could potentially cut into profits. New laws and regulation regarding rental properties are a significant risk and are becoming more and more commonplace.

Leverage – Plan Strategically

If you want to get started in real estate, use other people’s money to increase your returns when buying rental real estate. Consider this; if you use all cash, then if the property goes up 5% in value, you made 5%. However, if you put 10% down and it goes up 5%, now it’s as if you made 50% because you have less invested and are now the equity owner.

The problem is if the property goes down 10%, now you’ve lost 100% of your investment. That’s why you have to be careful with leverage.

For example, let’s say you buy a $100,000 property with 10% down ($10,000) and $90,000 borrowed. If the property goes down 10% and is now worth $90,000, you’ve lost 100% of your original investment.

Here is another consideration, in markets where real estate prices are falling, rental rates tend to fall as well. High leverage can be risky because reduced values and rental rates could mean you can’t sell because there is no equity, and you can cover your rental expenses because your rental income is lower.

Moral of the story: leverage can definitely work for you, but it can also work against you in weak markets.

Weigh the Pros and Cons Before Buying Real Estate in an IRA

You have the option to buy real estate in your IRA, but you have to set up a self-directed IRA. You cannot set up a self-directed IRA with a traditional custodian such as Charles Schwab or T.D. Ameritrade; you have to go to a special custodian that will hold real estate. While you can buy real estate in an IRA, it is essential to know both the pros and cons.

PROS

The best advantage of using IRA funds to purchase real estate for most investors is the availability of the funds. If you want to be a real estate investor, your IRA may be your only source of investment capital.

CONS

Owning real estate in an IRA often lacks some of the advantages that direct ownership in an individual’s trust or entity name may provide. Some cons include:

- You generally must pay all cash for a property (no financing allowed)

- Annual income is taxed at ordinary income rates when withdrawn from your IRA rather than potentially tax-free (with depreciation)

- Profits on sale are taxed at ordinary income rates when withdrawn from your IRA rather than at capital gain rates

- There is no step-up in basis upon passing of taxpayer

- Required minimum distributions are still required each year at 70½

- Repairs must be paid out of the IRA’s cash balance

- You are not allowed to repair the property yourself

- No personal use is allowed for you or your family members

Consider Taxes

There are many tax advantages to real estate ownership in addition to the many opportunities for mistakes that you can make. You can increase the likelihood that your real estate decisions make sense with your tax situation by discussing your holding and any decisions related to them with your accountant and financial planner. The 2018 tax legislation has a few changes that affect real estate ownership, so make sure you check to see if any of these changes are relevant to your situation.

Minimize Taxes Through Real Estate Investments as a Real Estate Professional

Real estate can be a significant investment and a great write off, but only if your income is below $150,000 or you (or your spouse) qualify as a “real estate professional.”

If your income is $100,000 or less that year, you can deduct up to $25,000 in excess rental losses. If you make between $100,000 and $150,000, then you can only use part of your losses to offset your other income. There are no real estate losses allowed when your income is above $150,000. These losses are referred to as “passive losses,” and any unused losses will be suspended or carried forward until your property generates positive income or you sell the property.

To qualify as a “real estate professional,” you must work at least 750 hours a year doing your real estate investments – management, buying properties, etc. You also need to have spent more than half of your total professional time that year in real property trades or businesses. And you need to participate in the management of the property materially. If you meet these requirements, you will be able to write off your passive income losses against other income.

Ready to Sell? Consider These Ways to Sell

1031 Exchange

If you sold a rental property for $150,000 and purchased a new property for $300,000, how could you defer capital gains tax? Consider a 1031 exchange.

A 1031 exchange is when you sell an investment property (a rental property) and buy another rental property – within the following timeframes and parameters.

- When you sell the property, your money must go to a qualified third-party intermediary or exchange accommodator

- After the escrow closes, you have 45 days to identify up to 3 properties that you might want to buy

- Then you have six months from the close of escrow to buy one of those 3 properties you listed

If you do all of those things, and the rental property that you purchase is the same price or more expensive than the property that you sell, then you defer the gain – but you don’t eliminate the gain entirely (it will eventually need to be realized).

Note that if the new rental property purchase price is lower, there is “boot.” Meaning there’s a tax event on the difference. So, if you walk away from a transaction with cash in your pocket or less debt, either of those things are considered boot, and it’s taxable.

But it’s not pro-rata. This means that if you have a gain of $100,000 and you get boot (cash of $80,000) the entire $80,000 is gain. You still have another deferred gain of $20,000 that goes into the new property. When you sell the new property, you’ll pay the tax on that $20,000 gain in the future.

Tax-Exempt Trust

We already mentioned 1031 Exchanges as a tax-favorable option when selling rental property, but there is also another option: a Tax-Exempt Trust (also known as a charitable remainder trust).

Maybe you don’t want to exchange the property at all. You have decided you are done with real estate and just want to sell it to have more liquidity and income. This is where a tax-exempt trust comes into play.

You have to set up a tax-exempt trust and contribute the property over to the trust so that the trust now owns it. When the trust sells it, there is no tax to pay because it is a tax-exempt trust. You can have the entire proceeds to invest without taxation.

What you get is a lifetime earnings stream. Year after year, you get payouts from this trust, and the payouts are part income, and part capital gains of the trust. These payouts are taxable in the year received. At the end of your life, charities of your choice receive the remaining balance of the trust. That is the reason there is no up-front taxation on the sale.

Outright Sale

When you sell a rental property at a gain, you have to pay all kinds of capital gains taxes, and it gets worse than that. You also have to pay depreciation recapture because when you buy a residential property, the IRS lets you depreciate or deduct it over 27 ½ years. If you have owned that property for 10 years, you have taken a lot of depreciation. You received some tax benefits, but now you need to pay those tax benefits back.

Installment Sale

An installment sale means you sell the property, but instead of receiving all the cash now you receive it in installments over time. You become the bank as you are making a loan to the buyer. So, whomever you sell it to, the buyer makes monthly payments to you. As they make principal payments, you pay a percentage of the gain. However, this process has its drawbacks. For example, if the buyer stops making payments, then you have to foreclose on the property to get the property back, and a lot of people don’t necessarily want to do that.

Direct Ownership Isn’t the Only Option

Many owners enjoy the direct ownership of properties, although this is indeed not the only way to gain exposure to real estate. Some may wish to avoid the responsibilities of direct ownership, while others may want more diversification within the asset class of real estate. Whatever your reason, you may want to consider options for indirect ownership including, Real Estate Investment Trusts (REITs) or other investment vehicles.

Delegate when Possible – Contacts are Key!

For those who do decide to own directly, it will be essential to determine which tasks to perform and which to delegate. Does your attorney have real estate experience? The person who represents you in one area may not be the best fit for your real estate needs. Choosing appropriate agents, property manager, attorneys, and accountants with real estate experience can make your life as a real estate investor easier and potentially more successful.

Many real estate investors who have prepared their own taxes in the past find their entry into real estate to be a good point to transition to professional assistance for their preparation. Make sure you are addressing the financial implications of your decisions with your financial planner as well since choices in one area may affect other planning decisions.

If you plan to purchase rental properties out of town, make sure you have local contacts to help you. Rental properties can be rewarding and profitable, but it takes work, and there will be surprises. How do you manage everything with property managers, repair people, and things that need to be done to the unit when you live away from the property?

Know How to Leave Property to Your Heirs

It would help if you understood how your property would pass to your heirs. You may be able to meet your wishes by owning in joint tenancy, but many owners like to hold their properties in a trust or other entity such as an LLC or S Corporation. There may be tax ramifications in addition to estate planning issues involved with this decision, so be sure your estate planning attorney, tax advisor, and financial planner are consulted.

These are only a few of the things you should consider when investing in real estate for retirement income. If you’d like to see how this fits into your overall retirement goals, consider an assessment with a CERTIFIED FINANCIAL PLANNER™ at Pure Financial Advisors.