We hear it all the time – markets are at an all-time high, a “bubble” is surely on the horizon. There are a few problems with that comment as I see it.

First, markets reaching all-time highs are what markets are supposed to do.

That’s the whole point of capital markets. Reaching all-time highs is simply not an indication of an imminent market decline. We would expect assets with a positive expected return to go up more often than down. Of course, we never know for certain how markets will move over short time periods. This is why your asset allocation is so important and is ultimately a reflection of the entire financial planning process.

Second, and this might just be a matter of semantics, market “bubbles” are not truly bubbles if you can’t take advantage of them.

In an efficient market, share prices reflect all available public information. We know this hypothesis holds water as Professor Eugene Fama won his Noble Prize in 2013 for his work in this field. If that’s the case, then market fluctuations aren’t bubbles correcting previous errors, but rather the market taking into account new information. A bubble is only a bubble and useful to an investor if you can see it coming. Since new information is by definition unknown, it is extremely difficult to predict where markets will go tomorrow. There are mountains of academic evidence to support this point. Consequently, as investors, the question ‘is this the right time to invest?’ is probably not the best way to think about your portfolio. Since on average markets tend to go up, your probability is better by investing today, rather than tomorrow. I’m sure this is a hard pill for some folks to swallow as the wounds of 2008 are still somewhat fresh. Remember though, hindsight is always 20/20.

Don’t take my word for it. Here are a few examples to help illustrate the point. A personal favorite was retired Federal Reserve Chairman Alan Greenspan’s famous irrational exuberance speech made on December 5, 1996. During that time, The S&P 500 was already trading well above its historical P/E ratio. This ratio, amongst others, is a fundamental measure that supposedly helps investors identify if markets are too pricey. Yet over the subsequent handful of years, the S&P 500 continued to climb at roughly 20% a year.

Those were returns investors should have captured by maintaining their discipline and understanding that markets don’t move based on simple historical price ratios. If investing were only that simple. Now I’m sure some of you are thinking that the market did eventually crash during the tech downturn. I’m not arguing that markets don’t dip, all I’m saying is it’s unpredictable and therefore a pointless exercise to try and leverage. More importantly, a globally diversified portfolio provided positive returns during the 2000-2002 US market downturn. Countless studies show that most investors don’t even capture standard market rates of return because they are participating in the age-old game of market timing.

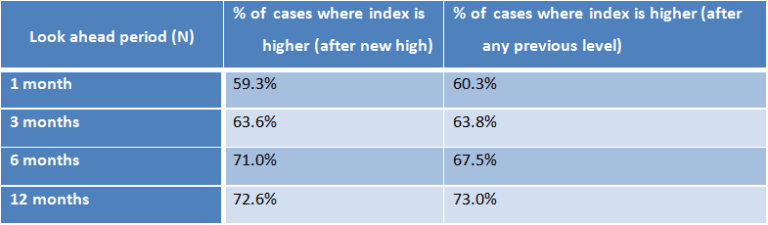

To further illustrate this argument, I pulled daily closing S&P 500 index prices (The S&P data are provided by Standard & Poor’s Index Services Group, start time: 7/2/1962), and looked at what has occurred subsequent to each time the index level has reached a new all-time high. The findings are summarized in the table below. After each new high, I looked ahead in the data at horizons of 1, 3, 6, and 12 months out and tabulated the percentage of the time that the index level was at or above the level it had reached when it had set the new high.

These numbers would indicate that a new high doesn’t really tell us much about where the market will be in the future.

Free markets work because the price system is a powerful mechanism for absorbing and interpreting information. As F.A. Hayek pointed out in his Nobel laureate lecture, “We are only beginning to understand how subtle and efficient is the communication mechanism we call the market. It garners, comprehends and disseminates widely dispersed information better and faster than any system man has deliberately designed.”* If it was really as easy as looking at a few charts or ratios, there would be a lot more millionaires walking around.

So what does this mean for you, the investor?

Simply put, prices are fair. The market mechanism aggregates all the available information which is then reflected in a stock’s current price. This price is our best estimate of fair value. How should you behave in the realm of fiercely competitive capital markets? Regardless of how the media and Wall Street tries to sell ‘investment advice,’ competition among profit-seeking investors causes prices to change very quickly in response to new information and therefore neither the buyer nor the seller of a publicly traded security has a systematic advantage. For every person that sells a stock share, someone else is buying. That means for every person that thinks a stock is a dog, someone else thinks it’s a winner. Therefore, trying to time markets or pick stocks is simply a mug’s game.

When it comes to capturing a successful investment experience, it’s the simple things that get you to your goal. While I say simple, these ideas are actually based on 50+ years of rigorous academic research.

By following a few basic principles, you can greatly improve your odds of achieving your financial/retirement goals.

- Planning – having a set financial plan is the most integral part of the process. This determines your cash flows, tax strategies, investment goals, and needs, etc.

- Diversification – “The only thing we know for certain about investing is that diversification is your buddy.” Merton Miller, Nobel Laureate.

- Fund Fees – keep unnecessary investment fees as low as possible. Expensive investments don’t add any value in your ability to capture market rates of returns. In fact, those fees dramatically reduce your ability to experience those returns.

- Taxes –Pay attention to taxes!

- Discipline – all the previous points hinge on investor discipline. Stay seated as markets go up and down. In capital markets, there is a positive expected return on your investments. If you subscribe to picking stocks and timing markets…well…good luck.

*1. Friedrich August von Hayek, “The Pretence of Knowledge” (lecture to the memory of Alfred Nobel, December 11, 1974)