Throughout the investment community, gold is one of those alternative asset classes that many seem to keep near and dear to their heart. Usually this sentiment is the result of short–term market turbulence and recent performance. The media perpetuates this mentality by hyping a variety of seemingly spectacular benefits from holding gold. Most notably, we are told that gold is a great hedge against inflation. Other’s focus on the correlation benefits of adding gold to a portfolio and finally we often hear that gold is a safe harbor from shaky capital markets and economic catastrophe.

Can investors reliably protect themselves from risk and still capture capital market rates of return?

As most of us know by now, on planet earth there really is no free lunch. Before we get into the data, lets take a step back and view gold through the lens of financial theory. By this I mean as investors, we should have reasons for our investment decisions – reasons rooted in economic logic and portfolio theory. Modern finance teaches us that components of a portfolio should have an expected return. Since gold is simply a metal, it has no projected earnings and therefore no expected return. Therefore, the only source of price appreciation is based on demand – someone has to want it. This characteristic of gold makes it a speculative asset, like currencies or collectibles. While such assets fluctuate in price over time, there is no economic reason to expect them to be worth more tomorrow than they are today. At the end of the day, these items are worthless without a social contract – people have to agree it’s worth something.

Fortunately, modern finance provides us with a guiding compass to help lead us through our investment decisions, especially in times of uncertainty. Asset pricing has illustrated that there are some risks worth taking – risks that come with an expected return. When we invest in companies (whether stocks or bonds), we are fueling a capital economy. Such enterprises generate growth and productivity – earning an expected return. Speculative assets like gold do not generate economic growth and therefore there is no definitive reason to expect the price will go up.

Renowned investor Warren Buffet has shared a variety of notable gold quotes over the years. Here are a couple of my favorites –

“The problem with gold is that you are betting on what someone else will pay you for it in six months. The commodity itself isn’t going to do anything for you…it is an entirely different game to buy a lump of something and hope that somebody else pays you more for that lump two years from now than it is to buy something that you expect to produce income for you over time.”

9 Investment Pitfalls All Investors Should Avoid – Download the Free White Paper

“Gold, however, has two significant shortcomings, being neither of much use nor procreative. If you own one ounce of gold for an eternity, you will still own one ounce at its end.”

In other words, gold is not a suitable investment to produce income over time. You can’t guarantee the demand, which is what gives gold its value.

Frequent claims we hear in respect to holding gold

1) Gold is a hedge against inflation

– there is no doubt that there have been inflation concerns in recent years. By definition, to “hedge” means making an investment to reduce the risk of adverse price movements in an asset. If we are trying to hedge inflation risk, as measured by CPI (Consumer Price Index), gold seems to be a poor choice.

Here’s why:

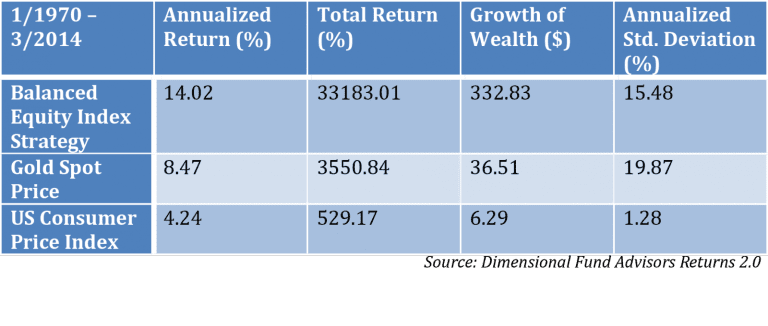

The annualized standard deviation* (volatility) of gold since Jan 1970 (inception of Bloomberg’s index) is 19.87%. CPI on the other hand has had an annualized standard deviation of 1.28%. By definition alone gold does not make a good “hedge” as the magnitude of price fluctuations is over 15 times that of CPI. This would seem to add to uncertainty as opposed to reducing it. A more appropriate hedge to look at is an asset class such as TIPS (Treasury Inflation Protected Securities) or ultra–short term, high quality bonds.

2) Gold offers correlation benefits when added into a portfolio

– without getting too far into the weeds, let me briefly explain what this means. Correlation measures how closely two assets move in tandem relative to one another. Perfect positive correlation implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. Alternatively, perfect negative correlation means that if one security moves in either direction the security that is perfectly negatively correlated will move in the opposite direction.

Why is this concept important?

Modern portfolio theory illustrates that by adding assets with low correlations, we can minimize portfolio volatility and therefore increase compound returns. Well in this case, we have already noted the relatively high volatility of gold as an asset. Gold as an investment can make a portfolio considerably more volatile, which may offset the potential benefits of low correlations. Furthermore, correlations themselves don’t tell us everything we need to know. Correlations don’t tell us anything about expected returns. As we discussed above, since gold does not produce anything there is no expected return. Such an addition to a portfolio can drag down the overall average return.

Show me the money!

As the data clearly illustrates, gold as an investment long term drastically underperforms a simple low cost, globally diversified portfolio and does so with greater volatility. I’ll assume at this point some readers will argue that they don’t invest in gold for the long run – only in times where it makes sense. This leads us to the topic of market timing, which there is very little evidence to support and a discussion of its own for an entirely different blog.

With all this said, I don’t think there is anything inherently wrong with having a small portion of your asset allocation invested in a well–diversified commodities portfolio as long as it’s an informed decision and not in reaction to recent market uncertainty. This is why at Pure Financial we put planning before investments. The investment plan is a reflection of the various circumstances specific to each investor’s situation – risk tolerance, expected return needs, taxes, goals, etc. First and foremost, the plan should determine an investor’s asset allocation!

*Standard Deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is calculated as the square root of variance. In finance, standard deviation is applied to the annual rate of return of an investment to measure the investment’s volatility. (Source: Investopedia)

1Source: Data provided by Dimensional Fund Advisors Returns 2.0